475

475 23

23Summary:

Summary:

Bonus:

125% up to $3,125 475

475 23

23

315

315 35

35Summary:

Summary:

Bonus:

50% up to $1,000 315

315 35

35

112

112 29

29Summary:

Summary:

Bonus:

50% up to $250 112

112 29

29If you’re not feeling our top-rated sportsbooks, browse the list below for alternative options. These are all the offshore betting sites currently accepting American players – even if sports betting isn’t legal in your state. Our experts update this list regularly as new sportsbooks enter and leave the market.

We have also provided a ranking next to each platform to help to identify trusted sites from blacklisted providers. These scores are frequently updated as we perform our monthly online sportsbook reviews, helping you find the best online sportsbooks in the US to start betting with.

| ONLINE BETTING SITE | RATING | STATE RESTRICTIONS |

|---|---|---|

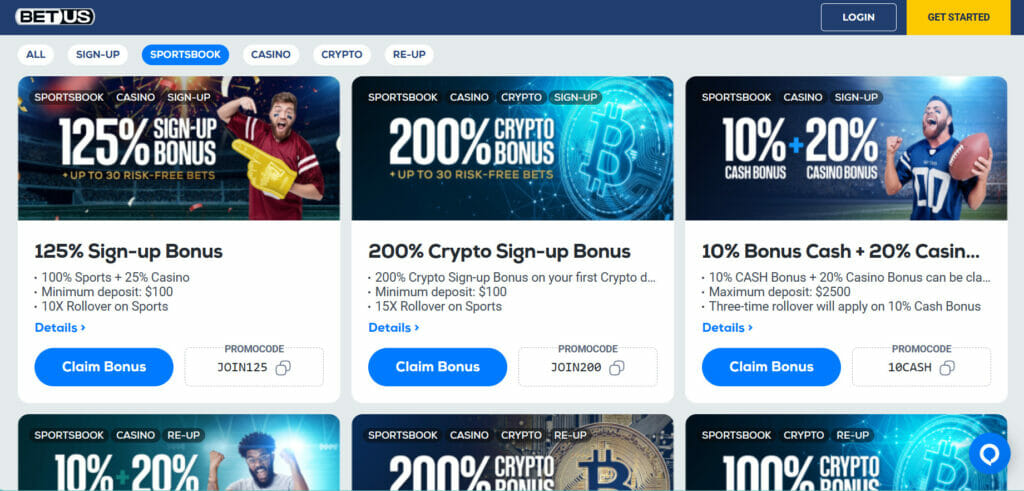

| BetUS | 4.8 | Available in all US states |

| BetOnline | 4.6 | Available in all US states |

| Bovada | 4.5 | Unavailable in Delaware, Maryland, New Jersey, Nevada and New York |

| MyBookie | 4.2 | Available in all US states |

| EveryGame | 4.2 | Available in all US states* |

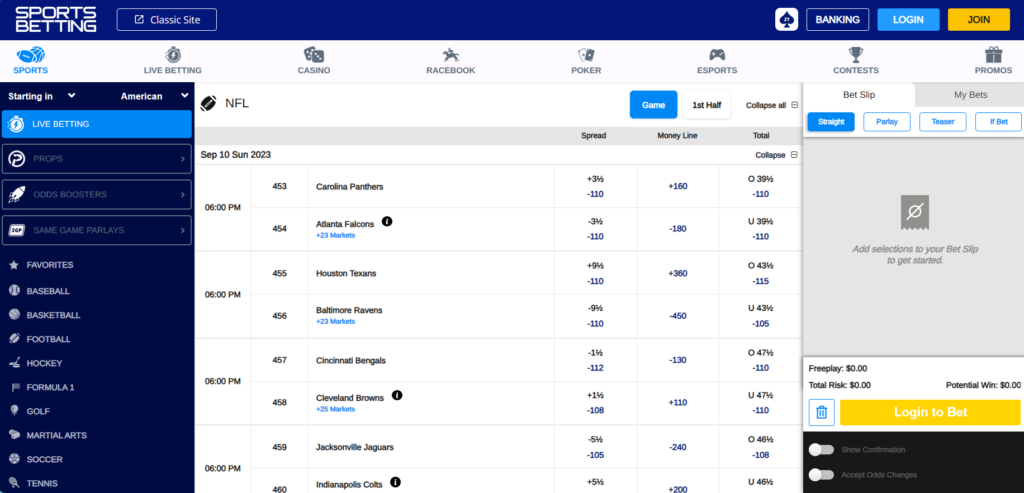

| SportsBetting.ag | 4.0 | Available in all US states |

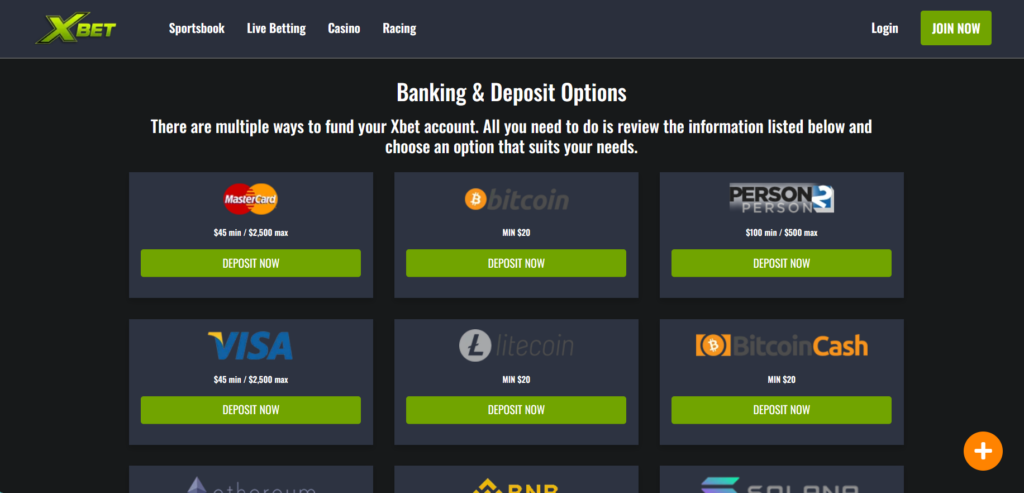

| XBet | 3.9 | Available in all US states |

| BetNow | 3.9 | Unavailable in New Jersey and New York |

| GT Bets | 3.8 | Unavailable in Arizona, Arkansas, Colorado, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, Mississippi, Missouri, Montana, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oregon, Pennsylvania, Rhode Island, Tennessee, Virginia, Washington, West Virginia, Wisconsin and Wyoming |

| FortuneJack Sportsbook | 3.7 | Available in all US states |

| BetDSI | 3.7 | Available in all US states |

| Heritage Sportsbook | 3.6 | Available in all US states |

| BUSR | 3.5 | Available in all US states |

| Jazz Sportsbook | 3.4 | Available in all US states |

| TopBet | 3.4 | Available in all US states |

| YouWager | 3.4 | Available in all US states |

| Achau Bet | 3.3 | Available in all US states |

| BetPop | 3.1 | Available in all US states |

| Horizon Sports | 3.0 | Available in all US states |

| HR Wager | 3.0 | Available in all US states |

| InfinitySports.AI | 3.0 | Available in all US states with legal sports betting |

| Lucky99 | 3.0 | Unavailable in Nevada |

| Sportsbook.ag | 3.0 | Available in all US states with legal sports betting |

| All Sports 247 | 3.0 | Available in all US states |

| Americas Bookie | 3.0 | Available in all US states |

| Bet33 | 2.9 | Available in all US states |

| 1Vice | 2.9 | Available in all US states |

| BetMania | 2.9 | Available in all US states |

| Galaxy Sports | 2.7 | Available in all US states |

| GetaBet | 2.7 | Available in all US states |

| Just Bet | 2.6 | Available in all US states |

| Looselines | 2.5 | Available in all US states |

| SportBet.one | 2.5 | Available in all US states |

| WagerWeb | 2.4 | Available in all US states |

| YouBetOnIt | 2.3 | Available in all US states |

| SportsBettingOnline | 2.3 | Available in all US states |

| Bookmaker | 2.0 | Available in all US states |

| ABC Islands | 2.0 | Available in all US states |

| BetPhoenix | 2.0 | Available in all US states |

| Cash Bet | 1.9 | Available in all US states |

| Oddsmakers | 1.7 | Available in all US states |

| US Dice | 1.7 | Available in all US states |

| CRSportsBet | 1.6 | Available in all US states |

| FastWager | 1.5 | Available in all US states |

| BetPlatinum | 1.2 | Available in all US states |

| Wager7 | 1.0 | Available in all US states |

| 724Sports | 1.0 | Available in all US states |

| BetOWI | 0.8 | Available in all US states |

| Bookie Barn | 0.5 | Available in all US states |

| BigBetBiz.ag | 0.5 | Available in all US states |

| BetVegas777 | 0.5 | Available in all US states |

| Ace Sportsbook | 0.5 | Available in all US states |

| MySportsbook | N/A | Rebranded to Sportsbook.ag |

| Intertops | N/A | Rebranded to EveryGame |

| Globet | N/A | Currently unavailable; returning soon |

| 5Dimes | N/A | US players NOT accepted |

| BetAnySports | N/A | US players NOT accepted |

| BetCris | N/A | US players NOT accepted |

| BetOBet | N/A | US players NOT accepted |

| BetOnSports | N/A | US players NOT accepted |

| BetShop | N/A | US players NOT accepted |

| BetVictor | N/A | US players NOT accepted |

| Betzone | N/A | US players NOT accepted |

| Bodog | N/A | US players NOT accepted |

| Cloudbet | N/A | US players NOT accepted |

| CyberBet Sportsbook | N/A | US players NOT accepted |

| Hollywood | N/A | US players NOT accepted |

| Instant Action Sports (BetIAS.com) | N/A | US players NOT accepted |

| Interwetten | N/A | US players NOT accepted |

| Ladbrokes | N/A | US players NOT accepted |

| Legend Play | N/A | US players NOT accepted |

| LSBet | N/A | US players NOT accepted |

| Matchbook | N/A | US players NOT accepted |

| MarathonBet | N/A | US players NOT accepted |

| MegaDice | N/A | US players NOT accepted |

| Nordic Bet | N/A | US players NOT accepted |

| Paddy Power | N/A | US players NOT accepted |

| Pinnacle Sportsbook | N/A | US players NOT accepted |

| SBG Global | N/A | US players NOT accepted |

| SkyBet | N/A | US players NOT accepted |

| Skybook | N/A | US players NOT accepted |

| SportsBet | N/A | US players NOT accepted |

| Sportingbet | N/A | US players NOT accepted |

| Sporting Index | N/A | US players NOT accepted |

| Sports Interaction | N/A | US players NOT accepted |

| TAB Sportsbet | N/A | US players NOT accepted |

| Total Bets | N/A | US players NOT accepted |

| VietBet | N/A | US players NOT accepted |

| WinABet365 | N/A | US players NOT accepted |

* Reserves the right to refuse new registrations from the United States.

Note: Not all online betting sites accept players from every US state. Please refer to the table and check the iGaming laws in your jurisdiction before registering for an account.

If your state has legal sports betting, you can alternatively choose from US-licensed betting sites. Below is a complete list of all US-related online betting apps and their available states. We update this list regularly as new sportsbooks enter the ever-growing iGaming market.

| ONLINE BETTING SITE | RATING | AVAILABLE STATES |

|---|---|---|

| DraftKings Sportsbook | 4.3 | Arizona, Colorado, Connecticut, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, Tennessee, Virginia, Washington, West Virginia and Wyoming |

| FanDuel Sportsbook | 4.2 | Arizona, Colorado, Connecticut, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Michigan, New Jersey, New York, Ohio, Pennsylvania, Tennessee, Virginia, Washington DC, West Virginia and Wyoming |

| BetRivers Sportsbook | 4.0 | Arizona, Colorado, Illinois, Indiana, Iowa, Louisiana, Maryland, Michigan, New Jersey, New York, Ohio, Pennsylvania, Virginia and West Virginia |

| BetMGM Sportsbook | 3.8 | Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, Massachusetts, Michigan, Mississippi, Nevada, New Jersey, New York, Oregon, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, Washington DC and Wyoming |

| Caesars Sportsbook | 3.8 | Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, Massachusetts, Michigan, Nevada, New Jersey, New York, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia and Wyoming |

| Golden Nugget Sports | 3.8 | Arizona, Michigan, New Jersey and West Virginia |

| Unibet Sportsbook | 3.7 | Arizona, Indiana, Iowa, New Jersey, Pennsylvania and Virginia |

| Pointsbet | 3.6 | Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, Michigan, New Jersey, New York, Ohio, Pennsylvania, Virginia and West Virginia |

| William Hill | 3.6 | Nevada |

| Tipico Sportsbook | 3.6 | Colorado, Iowa, New Jersey and Ohio |

| Barstool Sports | 3.5 | Arizona, Colorado, Illinois, Indiana, Iowa, Kansas, Louisiana, Maryland, Massachusetts, Michigan, New Jersey, Ohio, Pennsylvania, Tennessee, Virginia and West Virginia |

| Hard Rock Bet | 3.5 | Arizona, Indiana, Iowa, New Jersey, Ohio, Tennessee and Virginia |

| SuperBook Sportsbook | 3.5 | Arizona, Colorado, Iowa, Maryland, Nevada, New Jersey, Ohio and Tennessee |

| BetPARX | 3.5 | Maryland, Michigan, New Jersey, Ohio and Pennsylvania |

| WynnBET Sportsbook | 3.5 | Massachusetts, Michigan and New York |

| ClutchBet | 3.5 | Colorado and Iowa |

| Sporttrade | 3.4 | Colorado and New Jersey |

| Prophet Betting Exchange | 3.3 | New Jersey |

| Borgata Online Sports | 3.3 | New Jersey |

| Bet365 Sportsbook | 3.2 | Colorado, Iowa, Kentucky, New Jersey, Ohio and Virginia |

| Betfred | 3.2 | Arizona, Colorado, Iowa, Maryland, Ohio, Pennsylvania and Virginia |

| Betr Sportsbook | 3.1 | Ohio and Virginia |

| Betway Sportsbook | 3.0 | Arizona, Colorado, Indiana, Iowa, New Jersey, Ohio, Pennsylvania and Virginia |

| Elite Sportsbook | 3.0 | Colorado (previously Iowa but has ceased operations) |

| Resorts Casino Sportsbook | 3.0 | New Jersey |

| BetJack | 3.0 | Ohio |

| SI Sportsbook | 3.0 | Colorado, Michigan and Virginia |

| SBK Sportsbook | 3.0 | Colorado and Indiana |

| Bally Bet | 2.8 | Arizona, Colorado, Indiana, Iowa, New York, Ohio and Virginia |

| DRF Sportsbook | 2.7 | Iowa |

| Eagle Casino & Sports | 2.5 | Michigan |

| Resorts World Bet | 2.5 | New York |

| Sky Ute Sportsbook | 2.5 | Colorado |

| Betly | 2.5 | Arkansas, Ohio, Tennessee and West Virginia |

| FireKeepers Sportsbook | 2.5 | Michigan |

| PlaySugarhouse | 2.5 | Connecticut and Pennsylvania |

| Fanatics | 2.4 | Tennessee, Ohio, Maryland, and Massachusetts |

| Q Sportsbook | 2.4 | Iowa |

| Sahara Bets | 2.4 | Arizona |

| MVGBet | 2.3 | Ohio |

| BetSafe Sportsbook | 2.3 | Colorado |

| BetMonarch | 2.2 | Colorado |

| Desert Diamond Sports | 2.0 | Arizona |

| Action 24/7 Sportsbook | 2.0 | Tennessee |

| Oaklawn Sports | 2.0 | Arkansas |

| BetSaracen | 2.0 | Arkansas |

| BetWildwood | 2.0 | Colorado |

| TwinSpires Sportsbook* | 2.0 | Arizona |

| Maverick Sports | 2.0 | Colorado |

| Four Winds Sportsbook | 1.8 | Michigan |

| GambetDC | 1.5 | Washington DC |

| Circa Sports | 1.5 | Colorado, Iowa and Nevada |

| Wagr Sportsbook | N/A | Acquired by Yahoo and currently offline (previously available in Tennessee) |

| 888 Sports | N/A | Shut down (previously available in New Jersey) |

| Bet America | N/A | Rebranded to TwinSpires Sportsbook |

| BetLucky | N/A | Shut down (previously available in West Virginia) |

| FOXBet | N/A | Shut down (previously available in Colorado, Michigan, New Jersey and Pennsylvania) |

| Fubo Sportsbook | N/A | Shut down (previously available in Arizona, Iowa and New Jersey) |

| MaximBet | N/A | Shut down (previously available in Colorado) |

| PlayUp | N/A | Shut down (previously available in New Jersey and Colorado) |

| TheScore Sportsbook | N/A | Shut down (previously available in Colorado, Indiana, New Jersey and Iowa) |

| TwinSpires Sportsbook* | N/A | Shut down (previously available in Michigan, Tennessee, Indiana, Pennsylvania, Colorado, New Jersey and Louisiana) |

* TwinSpires have ceased their sports wagering operations everywhere but Arizona. However, they continue to offer horse betting in the following states: AL, AZ, AR, CA, CO, CT, DE, FL, ID, IN, IA, KS, LA, MA, MD, MI, MN, MO, MT, NE, NH, NM, NY, ND, OH, OK, OR, PA, RI, SD, TN, VA, VT, WA, WI, WV and WY.

You can find a complete list of all US online betting sites further down this page, but we know you’re probably only interested in the top options. So, here are the best sportsbooks for Americans and the reason our experts love them:

There used to be a blanket ban on sports betting in the US due to a federal law called the Professional and Amateur Sports Protection Act, or PASPA. This law was established in 1992 and restricted all but a handful of states from legalizing sports betting.

This all changed in 2018—PASPA was overturned on the basis of violating state rights, paving the way for each state to pass its own sports betting legislation. Many states quickly jumped on the opportunity to legalize betting, whereas more conservative jurisdictions have opposed the industry.

This has caused a complicated picture for the online betting industry, with the laws on and availability of sportsbooks varying dramatically across the United States. And to further confuse the situation, new regulations on sports betting are constantly passed. We’ve summarized the key points in the table below, which is updated regularly as new legislation is signed into law:

| STATE | ONLINE SPORTS BETTING (Y/N) | RETAIL SPORTS BETTING (Y/N) | LEGAL AGE FOR SPORTS BETTING | ONLINE HORSE RACE BETTING (Y/N) | LEGAL AGE FOR HORSE BETTING |

|---|---|---|---|---|---|

| Alabama | N | N | - | Y | 19 |

| Alaska | N | N | - | N | - |

| Arizona | Y | Y | 21 | Y | 21 |

| Arkansas | Y | Y | 21 | Y | 21 |

| California | N | N | - | Y | 18 |

| Colorado | Y | Y | 21 | Y | 18 |

| Connecticut | Y | Y | 21 | Y | 18 |

| Delaware | Y* | Y | 21 | Y | 18 |

| Florida | Y* | Y* | 21 | Y | 18 |

| Georgia | N | N | - | N | - |

| Hawaii | N | N | - | N | - |

| Idaho | N | N | - | Y | 18 |

| Illinois | Y | Y | 21 | Y | 18 |

| Indiana | Y | Y | 21 | Y | 18 |

| Iowa | Y | Y | 21 | Y | 21 |

| Kansas | Y | Y | 21 | Y | 18 |

| Kentucky | Y* | Y* | 18 | Y | 18 |

| Louisiana | Y | Y | 21 | Y | 18 |

| Maine | Y* | Y* | 21 | Y | 18 |

| Maryland | Y | Y | 21 | Y | 18 |

| Massachusetts | Y | Y | 21 | Y | 18 |

| Michigan | Y | Y | 21 | Y | 18 |

| Minnesota | N | N | - | Y | 18 |

| Mississippi | Yˠ | Y | 21 | N | - |

| Missouri | N | N | - | Y | 18 |

| Montana | Yˠ | Y | 18 | Y | 18 |

| Nebraska | N | Y | 21 | N | 18 |

| Nevada | Y | Y | 21 | Y | 21 |

| New Hampshire | Y | Y | 18 | Y | 18 |

| New Jersey | Y | Y | 21 | Y | 18 |

| New Mexico | N | Y | 21 | Y | 18 |

| New York | Y | Y | 21 | Y | 18 |

| North Carolina | Y* | Y | 21 | Y* | 21 |

| North Dakota | N | Y | 21 | Y | 18 |

| Ohio | Y | Y | 21 | Y | 18 |

| Oklahoma | N | N | - | Y | 18 |

| Oregon | Y | Y | 21 | Y | 18 |

| Pennsylvania | Y | Y | 21 | Y | 18 |

| Rhode Island | Y | Y | 18 | Y | 18 |

| South Carolina | N | N | - | N | - |

| South Dakota | N | Y | 21 | Y | 18 |

| Tennessee | Y | N | 21 | Y | 18 |

| Texas | N | N | - | N | - |

| Utah | N | N | - | N | - |

| Vermont | Y* | N | 21 | Y | 18 |

| Virginia | Y | Y | 21 | Y | 18 |

| Washington | N | Y | 18 | Y | 18 |

| Washington DC | Y | Y | 18 | Y | 18 |

| West Virginia | Y | Y | 21 | Y | 18 |

| Wisconsin | N | Y | 21 | Y | 18 |

| Wyoming | Y | N | 18 | Y | 18 |

* Legal but currently unavailable/yet to launch in the state.

ˠ Only permitted to place mobile wagers while physically located at authorized sports betting locations in the state.

~ No dedicated online racebooks; Online horse race betting only available at online sportsbooks.

Although 33 states have legalized online sports betting, state-licensed sportsbooks have yet to launch in Delaware, Maine, North Carolina, and Vermont. Therefore, online betting apps are only available in 29 states as follows:

Most states allow for state-wide mobile wagering from personal computers, smartphones, and tablets. However, Montana and Mississippi only let you place mobile wagers while physically located at authorized sports betting facilities. You can access other areas of your account remotely, but betting must be done at licensed venues.

All states with legal online betting have also legalized retail sportsbooks, aside from Tennessee, Wyoming, and Vermont—these three jurisdictions have opted for an online-only industry. Some states have taken the opposite approach, legalizing retail-only sportsbooks.

Below is a list of the states that have exclusively legalized in-person sports betting:

If you don’t see your state listed above, don’t worry. There are legal options for sports wagering online, regardless of the state regulations on sports wagering. This is all thanks to offshore sportsbook that are licensed overseas and don’t have to abide by US law.

As US sports betting regulations don’t restrict them, offshore bookmakers typically accept all American players of legal gambling age. Fewer restrictions mean they also offer a more extensive selection of betting types, a wider range of sports markets, and bigger bonuses and promotions. They also support cryptocurrencies and may offer gambling tax advantages.

Check the directory at the top of the page for all available offshore betting platforms, or click the links below for the best real-money betting sites in your state.

Our online sportsbook rankings are the easiest way to choose a reputable betting site. Our highly rated platforms have licenses from offshore regulators, generous promotions, extensive coverage, exciting wagering options, friendly customer support, and secure payment options.

However, the best sportsbook for you depends on your priorities. For example, all bettors have their favorite sports, safety concerns, and payment preferences. Use the guide below to help you figure out precisely what you want from an online sportsbook so that you can choose the right sportsbook for you. Our online sportsbook comparisons are useful if you need more help and advice.

Any online sportsbook you sign up for needs to be safe and secure. If safety is your top priority, choosing a US-licensed platform is the easiest way to ensure you play at a trusted site. However, you can still find legitimate sportsbooks based overseas. The safest online sportsbooks:

The best online sportsbooks have extensive market coverage, offering bets on everything from football to baseball, tennis, hockey, and boxing. We recommend signing up for a betting site that provides a wide range of markets—no matter the season or your favorite sports, broad coverage ensures there is always something exciting to bet on.

However, if there are specific markets you know you’re interested in, check these are available before creating an account. This is especially true for bets on international events, college sports, eSports, and non-sporting wagers, which are typically restricted at US-licensed sites.

It’s not only the sports coverage you need to check, but also the types of wagers available for each. The broadest selection of betting markets can always be found at offshore betting sites. You can place everything from straightforward moneylines to niche props, parleys, teasers, and more.

Live betting is another increasingly popular type of online wagering. Most sportsbooks allow you to place live bets on in-play events. However, some offer additional functions, such as in-game streaming or early cash-out options. If these are important to you, check that they’re available.

Odds are a way of quantifying the likelihood of an event happening and are used in sports betting to determine the maximum possible payout on a wager. In the US, three formats are commonly used: American, decimal, and fractional, with American odds being the most prevalent.

Always compare the sports betting odds at different sportsbooks and prioritize finding a betting site with competitive odds for your preferred types of events. Also, we recommend looking for reduced juice betting sites. These online sportsbooks take a lower percentage of your wagers as commission, meaning you get better returns if your bets win.

If you want to claim the biggest bonuses, offshore online sportsbooks are the place to go. Our recommended sites have massive deposit bonuses, risk-free bets, and other rewards to boost your bankroll which only customers can enjoy. Compare the offers before registering for an account, checking for things like:

Make sure you consider these terms in relation to your betting habits. For example, a soccer bonus is brilliant for soccer fans but not great for tennis enthusiasts. Likewise, cautious bettors might prefer risk-free bets, whereas matched bonuses are more useful for high rollers depositing large amounts.

If you’re new to online betting, more information on the types of bonuses and promotions available to US bettors can be found further down the page.

The availability of payment methods varies between sites. Generally, offshore sportsbooks accept cryptocurrencies but don’t allow Americans to use eWallets. Conversely, US-licensed bookmakers generally support eWallets but cannot accept crypto under US law. Credit and debit cards are accepted at US and offshore bookies.

Always check that the sportsbook supports a banking option that you’re comfortable using. You should also look at the specific options available under each payment category. For example, some crypto sportsbooks only take Bitcoin, whereas others accept ETH, LTC, USDT, and more.

You need to consider three essential payment terms before registering for an account: processing fees, transaction times, and payment limits.

Most online betting sites nowadays are compatible with mobile devices, allowing you to place sports bets on the go. Using the latest sports betting apps, you can also claim bonuses, withdraw winnings, or even stream and wager on live events from your smartphone or tablet.

US-licensed sites typically list mobile apps on the relevant online store, such as Google Play or the App Store. Offshore betting platforms tend to offer browser-based mobile betting instead, allowing instant wagering across a range of iOS and Android devices.

We prefer the latter – you don’t need the latest system updates or device storage for web-based betting – but you might prefer a downloadable app. Consider this before registering for an account, and remember to check the compatibility with your device.

Customer support is often overlooked, but online betting sites must offer high-end service to their bettors. We suggest looking for a betting platform that offers 24/7 support across multiple support channels, such as telephone, email, live chat, and social media.

One thing to consider is that US-licensed sportsbooks are often flooded with queries at peak times, which can hinder the customer service experience. As offshore sites operate globally, their support channels tend to be more easily accessible at all times. We test the support channels of all sites we recommend, ensuring you receive quick and comprehensive help and advice.

Don’t rule offshore betting platforms out if you’re in a state with legal and regulated online sportsbooks. They’re superior in many ways, with bigger bonuses, more extensive coverage, and access to free and fast payments using crypto.

The table below summarizes the difference between the two:

| OFFSHORE BETTING SITES | US-LICENSED ONLINE SPORTSBOOKS |

|---|---|

| Available throughout the US, even in jurisdictions without legal online sports betting. Most can be accessed from all states. | Only available in specific states. The operator must be licensed in each state for it to legally be permitted to enter their market. |

| Licensed in overseas countries such as Curacao and Panama. These authorities are not as strict as US gambling commissions. | Fully licensed and regulated in the United States, offering an additional layer of safety and security. |

| Quick and simple registration process. Less information is required for added privacy. | More invasive registration process and ID verification checks, giving less privacy over your betting. |

| Wider market coverage, including as wagers on college sports, eSports, and non-sports bets (politics, entertainment, etc.). | Limited markets depending on individual state laws. Common restrictions include wagering on collegiate sports and eSports. |

| Covers an extensive range of American and international sporting events, such as soccer, golf, tennis, and more. | Market coverage focuses on American sports and leagues (NFL, MBA, MLB, NHA, etc.). |

| Bigger welcome bonuses and ongoing promotions that are not location-dependent. | Smaller welcome bonuses and ongoing promotions. Offers also vary depending on which state you live in due to different state restrictions. |

| Credit card payments might be blocked and there are no options for eWallets. Cryptocurrency is supported and offers free and fast payouts. | No option to use cryptocurrencies at US-licensed sites. Payment options are limited to credit cards, bank transfers, and eWallets. |

| If not researched properly, you could risk joining an unregulated scam betting site. | Have passed stringent tests and regulation requirements, giving assurance you won't be scammed. |

All online betting sites offer an extensive range of betting types to keep the experience as enjoyable as possible. Offshore online sportsbooks generally have more options. They don’t need to abide by the more stringent state restrictions, allowing for more flexible wagers.

Below are the core betting markets you can expect to find at our recommendations. For a more detailed breakdown, check our guide on how to bet on sports:

US betting platforms offer extensive coverage of popular American leagues, such as the NFL, MLB, NBA, and NHL. Below is a closer look at these primary markets and other sought-after options for US players. These can be found at most top sites, including US-licensed and offshore platforms.

American football – especially the NFL – is a popular sport for online sports betting in the USA. Sports betting sites offer a variety of markets for NFL wagering, including moneylines, point spreads, totals, and futures. Prop bets are particularly exciting for this sport, from predicting which player will have the most passing yards to which player will win the Super Bowl MVP award.

Basketball is another prevalent sport in the betting world, with various betting lines available for the NBA and other leagues. These can include point spreads, moneylines, and totals. Additionally, basketball betting sites offer numerous prop bets, such as the total number of rebounds or points a specific player will score.

Hockey is a popular sport among online sports bettors in the US. The NHL season is a significant event, and hockey betting sites offer several betting options, including moneylines and various proposition bets. Examples include the first player to score a goal or the total number of goals scored in an ice hockey game.

Baseball is another common American sport for online betting, particularly during the MLB season. Some of the typical betting lines at baseball sportsbooks include moneylines, totals, and a variety of props. For instance, you might find wagers on which player will hit the most home runs or have the most strikeouts in a game.

Golf tournaments such as the Masters, US Open, PGA Championship, and Ryder Cup are relatively popular at US sportsbooks. When it comes to wagering on golf, you can bet on the spread, moneyline, totals, and various prop bets. Other popular betting markets include futures on upcoming events and head-to-head wagers against two players.

Tennis is a sought-after sport for betting, especially during major tournaments like the US Open and Wimbledon. However, it can be enjoyed year-round—legal sites offer coverage of all major tennis organizations, such as the ATP, WTA, ITF, and even the Olympics. You can wager on the moneyline, spread, and various props, such as which player will win the first set.

Soccer, also known as “football” in many parts of the world, is widely available to wager on at betting platforms. When betting at soccer sportsbooks, you can make use of the moneyline, spread, and various types of props. For instance, betting on which player will score the first goal or the total number of goals in a game. Soccer is also an excellent option for in-play betting.

Offshore sportsbooks are not restricted by state gambling laws. Therefore, they offer a range of niche and novelty betting markets in addition to the top sports leagues listed above that would be considered illegal at US-licensed sites. These additional markets set apart offshore betting platforms, so let’s take a closer look:

All online sportsbooks run exciting bonuses for new and existing players, such as:

A matched bonus is where a percentage of your deposit is matched with site credits up to a set limit. As your deposit is matched by a percentage, you get more credits with bigger deposits. The bigger the match rate and the higher the bonus ceiling, the better the offer.

BetOnline is currently giving all new sportsbook users a 50% up to $1,000 bonus on their first deposit. This means that a $100 deposit would qualify for $50 in bonus credits. To claim the full $1,000 bonus, a deposit of $2,000 is required.

Risk-free bets are a type of insurance you get when betting at an online sportsbook. If your bet comes in, you get your winnings like usual. But if you wager loses, the operator refunds the cost of the bet to you as site credits. You can use these to place (and hopefully win) future bets.

The best thing about risk-free bets is that you can place “risker” wagers with higher potential payouts, knowing you will get a refund if the bet loses. However, the drawback is that you only get a reward if you lose. They minimize your losses rather than grow your bankroll.

A free bet bonus allows you to place a wager without putting any of your own money on the line. Some free bet bonuses must be used in full on a single wager, whereas others allow you to split the promotional credits between several smaller bets.

These incentives are frequently offered as a reward for fulfilling requirements, including placing a qualifying wager or depositing a set amount. Many sites also provide event-specific free bets, such as a free stake for NFL futures or a bonus that can only be spent on basketball parlays.

Online sports betting platforms often offer welcome bonuses to entice new players to register and make an initial deposit. These bonuses usually come in the form of one of the three promotions we’ve already mentioned: matched deposit bonuses, risk-free bets, or free bets.

Offshore betting sites have the biggest welcome bonuses, often rolling several promotions into one. For example, BetUS currently gives a 150% up to $3,750 sports bonus and 30 risk-free bets with your first crypto deposit. Plus, you get an extra 50% up to $1,250 to spend in their online casino.

Boosted odds are when a sportsbook increases the odds on a specific bet. This gives you better odds than you’d otherwise get, increasing the potential payout if your wager comes in. When used in the right way, they’re a fantastic way to make more money betting on sports.

Odds boosts are constantly changing as they’re for particular wagers and events, so you’ll need to check the promotions page of the sportsbook to see their current offers. However, all our top sportsbooks provide boosted odds, especially on major US leagues like the NFL, MLB, and NHL.

Like risk-free bets, parlay insurance is a bonus that helps recover your losses. If your parlay wager loses by only one option, you get your money back. For instance, if you placed a parlay wager on three games and two of them won, but one of them lost, you’ll get a refund.

By combining multiple wagers into one, parlay bets are a great way to secure big payouts—but they come with added risk. Parlay insurance reduces this risk and is a valuable bonus if you know you’re interested in placing parlays. BetOnline, Bovada, and many other top sportsbooks all run this offer.

A refer-a-friend bonus rewards you for bringing new customers to the sportsbook. They might offer a fixed referral bonus or a matched bonus on your friend’s initial deposit. The prize is credited to your betting account after your friend signs up and funds their sportsbook account.

For example, Bovada Sportsbook offers a generous friend referral promotion. You can receive a 200% referral match bonus up to $200 when your friend makes their first deposit and an additional $75 bonus when they use one of the supported cryptocurrencies.

US betting sites support several payment options, meaning there’s something to suit all players. You can find sites accepting credit cards, cryptocurrencies, bank transfers, eWallets, and more.

However, the Unlawful Internet Gaming Enforcement Act (UIGEA) was passed in 2006. This law punishes financial companies for accepting money from gambling sites that aren’t licensed in the US. This has created a lack of FIAT payment options at offshore online sportsbooks, which are licensed overseas rather than in the United States.

A closer look at the availability of popular banking options is explained below:

Some sportsbooks also accept bank transfers, voucher payments, player-to-player transfers, and courier checks. Check our page on how to deposit money for gambling for more information.

PASPA stands for the Professional and Amateur Sports Protection Act. It was a federal law that restricted all but a few states from legalizing sports betting. It was overturned in 2018, paving the way for legal sports betting throughout the USA.

Yes, online sportsbooks are legal in the US. However, betting laws are location-dependent and vary between states. Some states have their own US-regulated sportsbook apps, whereas others only permit offshore sites to operate in a “grey area” of the law.

The minimum age for online betting in most US states is 21. However, players from Kentucky, Montana, Nevada, Rhode Island, Washington DC, and Wyoming can legally bet at 18. North Dakota allows 19-year-olds to bet on sports, but as it stands, their industry is retail-only at tribal casinos.

Currently, 33 states have legalized online sports betting. These states are as follows: AZ, AR, CO, CT, DE, FL, IL, IN, IA, KS, KY, LA, ME, MD, MA, MI, MS, MT, NV, NH, NJ, NY, NC, OH, OR, PA, RI, TN, VT, VA, DC, WV and WY. Some of these states have yet to launch their legal mobile apps.

Nebraska, New Mexico, North Dakota, South Dakota, Washington, and Wisconsin have embraced sports betting but have a retail-only industry. On the converse, Tennessee, Wyoming, and Vermont have adopted an online-only industry—you won’t find any physical sportsbooks in these states.

Online betting sites know your location by tracking your IP address using software like GeoComply. This prevents bettors from restricted countries or jurisdictions from accessing the platforms illegally. You might still be able to access some restricted offshore sites using a VPN.

US-licensed betting sites are regulated under state law. They’re incredibly safe and subject to stringent gaming enforcement regulations, but their availability is limited. Offshore betting sites are regulated by overseas governments. They’re available throughout the US and offer bigger bonuses, more markets, broader wagering options, and crypto payments.

Since PASPA was abolished, most states have amended their gambling laws in some capacity to allow for sports betting. This caused some offshore bookmakers to withdraw from the USA completely, whereas others have restricted access on a state-by-state basis according to the laws.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.