475

475 21

21Top features:

Top features:

Bonus:

125% up to $3,125 475

475 21

21

312

312 23

23Top features:

Top features:

Bonus:

50% up to $1,000 312

312 23

23

112

112 15

15Top features:

Top features:

Bonus:

50% up to $250 112

112 15

15Our experts have reviewed dozens of real money betting sites that operate from Alabama. They have picked these three brands as the most trusted and reliable offshore sportsbooks that accept Alabama sports bettors. Many Alabama residents have used these platforms for the state’s best online betting experience.

BetUS is a remarkable choice for sports betting enthusiasts, particularly those based in Alabama. Established in 1994, BetUS is a reliable platform for players. It operates under a license granted by the Curacao Internet Gaming Association to Firepower Trading Limited, ensuring a secure and regulated betting environment.

We have ranked BetUS as the best AL sportsbook for its exciting bonuses and promotions for new and existing players.

Best Loyalty Program for AL Bettors

The BetUS Loyalty Program enhances your sports betting experience, allowing you to unlock new rewards such as free payouts, bigger bonuses, welcome free play, exclusive invitations to monthly tournaments, and a toll-free number.

This six-tier VIP program comprises Blue, Silver, Gold, Platinum, Diamond, and Black. Every real-money wager on this top Alabama sportsbook will earn you points to move up these tiers.

You will get up to a $500 Free Play every time you move up to a new level. Once you reach one of the top three levels, you will get an extra 10% bonus on every deposit.

Best Sports Welcome Bonus in AL

BetUS Sportsbook offers one of the best welcome bonuses – a 125% up to $3,125. This bonus contains a 100% Sports Bonus up to $2,500.New AL bettors looking to bet on NBA, MLB, NHL, or any other league can grab this thrilling sign-up bonus by making a minimum deposit of $100. This bonus, which expires in 14 days, has a 10x rollover. Use the promo code JOIN125.

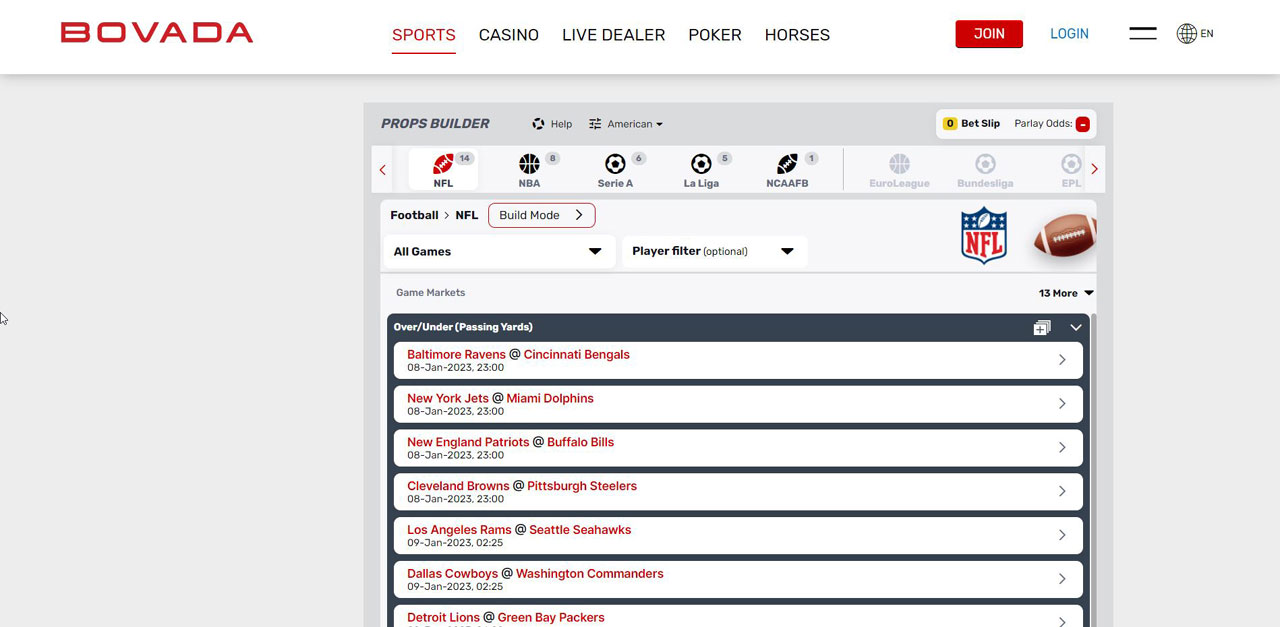

Bovada has become the most popular online gambling option in Alabama since it was launched in 2011. The Canada-based site received an operating license from Curacao – one of the most recognized regulatory authorities in the online gambling world. So, Bovada remains unaffected by gambling laws in Alabama.

Bovada is specifically known for its premium sportsbook, clean user interface, and highly user-friendly mobile betting platform. We particularly liked Bovada’s live betting section.

Bovada is ideal for both college and professional sports teams. So, whether you’re a Super Bowl or March Madness fan or looking to bet on college football, this top Alabama betting site has you covered. In addition, Bovada features all NCAA Division 1 matches across the main sports legally. Prop bets for college football and other sports is another standout feature we liked about this site.

Bovada offers the best crypto sports welcome bonus, allowing Alabama bettors to grab up to $750 to bet on sports. Use bonus code BTCSWB750 to instantly claim this 75% bonus after you make an initial deposit. This bonus has a fair 5x wagering requirement. Bitcoin, Litecoin, Bitcoin Cash, Bitcoin SV Deposit, and USDT qualify for this bonus.

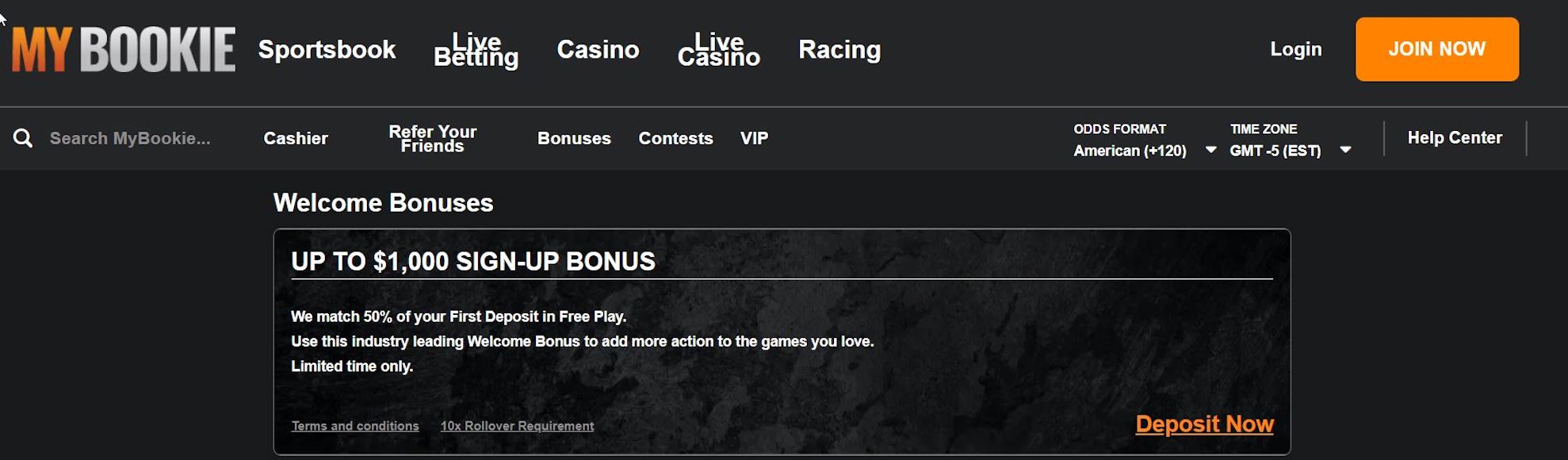

MyBookie is a top-ranking Alabama sportsbook, launched in 2014, that has rapidly gained popularity among sports betting enthusiasts. It operates under a license issued by the Curacao Internet Gaming Association, ensuring high professionalism and trustworthiness.

Exciting Contests for Major Sports

This prestigious AL site is famous for its exciting contests and easy bonuses. This Duranbah Limited-owned sportsbook offers an exclusive contest, ‘Squares,’ allowing you to pick your NFL or NCAAF squares on the game board and win real prizes every quarter.

Usually, you will find two or three contests on the page depending on the sports season. Read the terms and conditions to see the general rules of each game on offer.

Easy Bonuses for AL Bettors

Whether you want an attractive welcome bonus or are looking for decent ongoing promotions, MyBookie has you covered. With two welcome bonuses, this top Alabama site gives away up to a $1,000 Sign-Up Bonus and a 10% Cash Bonus Up to $200.

Besides their top 50% up to $1,000, which has a minimum deposit requirement of $50 and a 10x rollover, you can claim up to $1,000 in sports reload bonus. Their $200 Referral Bonus is a cherry on top, enabling you to get a 200% bonus every time you successfully invite a friend to this site. All these bonuses are easy to find with reasonable playthrough requirements.

| Sportsbook | Welcome bonus | Playthrough | Valid for | Min. deposit |

|---|---|---|---|---|

| BetUS | 100% Up to $2500 | 10x | 14 days | $100 |

| Bovada | 75% up to $750 | 5x | doesn’t expire | $20 |

| MyBookie | 50% Up to $1000 | 10x | 30 days | $50 |

| XBet | 50% Up to $500 | 7x | 15 days | $45 |

It depends on the online sportsbook you choose. Currently, dozens of online sportsbooks are accepting players from Alabama. However, for the safest online betting experience, we recommend you use the suggested ones. These top AL sites ensure a one-of-a-kind online wagering experience with quick withdrawals, exciting bonuses, and competitive odds.

Alabama remains one of the few state without a regulated sports betting market in the USA. As of Dec. 2022, Alabama has no state-licensed sportsbooks – either online or in-person. The most recent attempt was in 2022j when the state lawmakers failed to pass sports betting legislation before adjourning the session for the year.

State lawmakers have been trying to legalize sports betting since 2019 without success. Alabama will again see renewed legislative efforts to regulate and legalize sports betting in 2023. Although four horse racing tracks exist, none is operational.

Daily fantasy sports sites and horse racing betting are Alabama’s only legal online gambling options.

Tribal casinos in Alabama offer slot and bingo-style games but no table games or sports betting. Alabama is also one of the few states without a state lottery.

Meanwhile, the only available options for AL sports bettors are offshore legal online sportsbooks. All our recommended offshore online sportsbooks cover almost every sport and gaming event anywhere across the globe. Luckily, no law outrightly bans you from betting online using offshore online sportsbooks in Alabama.

Lawmakers have failed to legalize Alabama sports betting every year since 2018 when the US Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA). In 2019, HB 315 would have created legalized and regulated sports betting markets in Alabama. Since 2020, four Alabama sports betting bills have been presented. However, none made it to the finishing line.

The 2021 bill was a complete gambling package covering sports betting, casinos, and an Alabama lottery. However, although it cleared the senate, the house did not agree to making sports betting legal.

In April 2022, the possibility of legalizing sports betting was renewed with SB 294 and HB 405. Both Alabama sports betting bills received favor in their respective committees – the Senate Tourism Committee and House Economic Development and Tourism Committee. However, neither sports betting bill received the floor vote.

State Sen. Greg Albritton introduced the 2022 legislation seeking to create an Alabama Lottery and five tribal and commercial casinos.

Alabama is only one of five states without a state lottery and has no commercial casinos. Tribal casinos in Alabama can only provide Class II gaming, such as bingo-based gaming. There are no traditional slot machines, table games, or sports betting in the Yellowhammer State.

But Albritton and other like-minded lawmakers want to change the existing gambling laws. Following another failed attempt this year, Albritton said he would bring up the gaming effort again when the Alabama legislature convenes in March 2023.

“I think there’s a recognition that there’s a need that Alabama take control of this (gambling) industry. The requirement that the Yellowhammer State needs to benefit from the gaming that’s already going on,” Albritton said.

The electronic bingo halls that operate across the Yellowhammer State are against a legalized sports betting bill.

Currently, no legal body exists in Alabama to oversee sports betting in the state. However, a few active bills are seeking to regulate online sports wagering in Alabama, possibly in 2023, if the state lawmakers agree to the gambling expansion. Keep updated on LetsGambleUSA to receive the latest updates regarding legal sports betting in Alabama.

Meanwhile, you can enjoy online betting on your favorite sport using one of the best Alabama sports betting sites.

Since Alabama has yet to legalize the sports betting market, no legal gambling age for participating in online betting platforms has been technically defined.

However, you must be 18 years of age to participate in pari-mutuel horse racing, 19 to use daily fantasy sports sites, and 21 to participate at Alabama casinos or play at online poker sites in Alabama. In addition, AL sports fans can join legal online sportsbooks listed on this page if they are 18 or older.

Alabama sports fans can avail themselves of plenty of exciting bonuses and promotions. All the leading AL sports betting sites extend a warm welcome with their initial bonus called the sports Welcome Bonus. The following are some of the most common promotions to consider when joining an AL sports betting site.

A Risk-Free bet is a great way to get something back even if you lose your wager. This promotion is the ideal way for customers to get their initial stake besides their winnings on winning wagers. BetOnline provides the best Alabama sports betting site because when it comes to horse racing betting, it offers customers a $25 Risk-Free bet.

BetOnline also features a $25 Risk-Free Player Props Wager. If you win, you will keep all the winnings. However, even if you lose, your bet up to a maximum of $25 will be returned to you!

Most legal Alabama sports betting apps feature a Deposit Match or Welcome Bonus for their new customers. Deposit Match bonuses are the most popular promotions offered by gambling sites. The best deposit match bonuses are available at BetUS.

Tip: Use cryptocurrencies to get a boosted Welcome Deposit bonus.

Most leading AL online sportsbooks regularly gift their regular players with lavish bonuses. Sites like Bovada even reward their existing players if they get others to sign up and play on their platform. You can earn up to $200 for each friend that joins Bovada on your recommendation.

In addition, you will get another $75 if your friend uses Bitcoin. You have to share your code and get them to join the site. The Bovada’s referral bonus has a fair 5x wagering requirement for sports betting.

This promotion helps Alabama bettors to get better odds than usual. Legal Alabama sports betting sites like BetOnline often give up their entire house edge to move the odds in customers’ favor.

Our experts found BetOnline sportsbook’s Odds Boosters the best odds boost in Alabama.

Parlay insurance is an exciting promotion that all the leading AL sports betting operators offer. In this promotion, if all legs of parlay hit except for one, you will receive a refund.

Even if you don’t deposit into your AL sports betting account, you can still bet on your favorite sport thanks to free cash called No Deposit bonus. You need to register with a top AL online sportsbook to claim the No Deposit bonus, which doesn’t require any deposit.

All the leading offshore sportsbooks, like BetOnline and Bovada, offer no-deposit sports betting bonuses.

Alabama bettors can find offshore legal sports betting sites without downloading additional software from the iOS or AOS store. Instead, you can directly enjoy fully legal sports betting options from your smartphone and make deposits, claim bonuses, place bets, and request payouts.

The following smartphones are the ideal options for legal sports betting on a mobile in Alabama:

Apple iPhone – We recommend iOS as the most trusted operating system to access online sportsbooks from the Safari browser or similar browsers downloaded from the online store.

Samsung (Android) – Our experts also find the Android system – especially Samsung Galaxy – perfectly safe for sports betting. AL bettors can legally place a wager on their favorite sports from the Google browser, using one of the leading offshore sites. Google Pixel is also a secure option for mobile sports betting in Alabama.

Although there are no professional teams, Alabama boasts some of the best collegiate teams in the nation. As a result, Alabama bettors can bet on great college teams that perform remarkably well in NCAAF football and NCAA basketball.

Overall, the Yellowhammer State has 19 different collegiate athletic programs, including Alabama Crimson Tide, Auburn Tigers, and Alabama State Hornets.

The following are some most popular Alabama teams.

All our top 3 Alabama sportsbooks are the most trusted brands. While BetOnline has been operational since 2001, Bovada entered the Alabama sports betting market in 2011. Most Alabama bettors use either of the two operators for the best online wagering experience. However, XBet is one of the new online sportsbooks in Alabama and has attracted a fan base in Alabama for its unique betting options, including religion and the weather.

Betting on horse racing in Alabama is one of the oldest gambling traditions in the state. Luckily, our top 2 Alabama mobile sportsbooks also serve as full-fledged Racebooks. These online horse racing betting sites take bets on all the major horse racing events. So, whether you’re a Kentucky Derby or Dubai World Cup fan, our recommended AL sites for sports bets have you covered.

Alabamans looking for political betting lines must try BetOnline, which offers vast options. However, if you’re to bet on the Presidential Election in 2024, Bovada is our top pick.

Bovada provides actionable lines on many presidential election categories besides midterm elections.

All these online wagers are available on our three top Alabama sportsbooks.

Moneyline is the simplest wager in sports betting, involving a bet with two or three outcomes in most cases. For instance, bettors can choose one player or team to win when two players or teams are playing.

In Parlay betting, you can make multiple bets and tie them together into one bet. It is an ideal betting option for advanced AL bettors looking for higher payoffs than placing each bet separately. However, you must win all the bets in the Parlay to win an entire parlay.

A Total bet – also called an over/under bet – is a single wager on whether or not the combined point or score total of a single game will be over or under what the bookmaker sets before the game or event.

Points spread is the most popular betting option in basketball and football. The favorite team must win by a certain margin – points, runs, or goals – for you to receive your payout.

Future betting allows sports gamblers to apply their expertise to specific sports or markets. The goal is to extract the best price possible.

A Prop (or proposition) bet is a type of wager that is not directly related to the final outcome of the game or event. For instance, betting on who will score the first goal or coin toss are some examples. Alabama bettors are encouraged to try BetOnline sportsbook’s Prop Builder tool to extract the most profitable Prop bets.

Live betting or in-play betting allows players to place wagers while the game or event is underway. Both BetOnline and Bovada offer the best live sports betting action. In addition, Alabama bettors can enjoy in-game betting on their PC or mobile devices.

When joining a betting site in Alabama, look for the following things.

Currently, dozens of sports betting sites are operating in Alabama. Not all of them are safe. We suggest you read reviews from trusted sites. LetsGambleUSA provides unbiased reviews and encourages you to make informed decisions after reading multiple reviews from different sites and experienced gamblers.

Before joining an online sportsbook in Alabama, make sure it operates legitimately. Luckily, all our suggested brands are licensed by legitimate jurisdictions like Panama and Curacao.

Bonuses and promotions are the biggest attractions, and its best you pay attention to them when joining Alabama online wagering. For instance, BetOnline’s $1,000 sports welcome bonus is the best in Alabama.

When joining an online wagering site, make sure it is accessible on desktop and mobile devices. Considering that most AL bettors prefer mobile betting sites, the top betting sites like Bovada and BetOnline feature the best mobile wagering platforms.

It’s also best to look for those AL online bookmakers that cover the most significant number of sports. Luckily, our top Alabama operators support all kinds of sports, from major events like NFL and NBA to smaller events like table tennis.

Before joining a sports betting site, always consider whether it provides the banking options that suit your specific needs. Luckily, BetOnline allows up to 25 deposit options and 18 withdrawal options.

Avoid underestimating the significance of customer support. Always prefer those AL betting sites that make it easier for you to communicate in case you need help. The major communication channels are email, phone support, and live chat.

Leading online sportsbooks allow many banking options to have you come on board. The following are the most common deposit and withdrawal methods available in Alabama.

Visa and Mastercard are the most common credit card options. However, BetOnline also allows Amex and Discover and charges a 9.75% processing fee compared to Bovada, which incurs a 15.9% fee on credit cards. In contrast, MyBookie – a sister site of XBet – charges a 6% fee.

Bank transfers are also common among the top Alabama betting sites. Although BetOnline and Bovada allow bank transfers, XBet does not currently include this banking option. However, the minimum deposit at Bovada is $50, and $1000 at BetOnline.

Although the offshore sites don’t offer e-wallet options to US-based customers, Alabama residents who which to bet can still use PayPal through Bovada. You must create a MatchPay account to use e-wallet services.

Bitcoin is the most popular banking option that you will find across almost all the AL betting sites, including our top 3. Most online betting sites encourage their players to use Bitcoin and offer boosted deposit offers. Almost all Bitcoin deposits are free, and Bitcoin withdrawal is often the fastest.

Most AL sites allow other cryptocurrencies – or altcoins – for deposits and withdrawals. For example, Bovada and XBet feature a handful of cryptocurrencies like Bitcoin Cash and Litecoin. However, with 17 deposit and 13 withdrawal options, BetOnline is one of the best altcoins online sports betting sites.

Is online Alabama sports betting legal?

Currently, Alabama State gambling laws are on the back burner, so online Alabama sports betting is not regulated, meaning it is neither legal nor illegal. However, residents can join one of the offshore sites to place bets on their favorite sports in Alabama.

How old do you have to be to bet on sports online in Alabama?

While Alabama remains an unregulated sports betting market, there are no formal age restrictions. That said, all the top offshore sites like Bovada accept Alabama residents who are 18 years of age or older.

Can Alabama-based players claim bonuses at offshore online sportsbooks?

Yes, our top-rated offshore sportsbooks provide the best bonus packages. For instance, BetOnline sportsbook features a 50% deposit match up to $1,000. Besides Welcome bonus packages, AL players will find numerous bonuses and promotions like Risk-Free bets, Odds Boosts, etc. To find complete bonus details, read our mini-reviews of the AL online sports betting sites above.

Who regulates online sports betting in Alabama?

Currently, no regulatory body exists to oversee online sports betting in Alabama. However, Alabama lawmakers plan to regulate the online sports betting industry and create the Alabama Sports Wagering Commission to oversee the regulated market, possibly in 2023.

Do I have to be an Alabama resident to bet online in the state?

No, anyone who is a resident or visiting the Yellowhammer State can join legal sportsbooks like Bovada and BetOnline from any part of the state.

Can I play daily fantasy sports in Alabama?

Yes, daily fantasy sports (DFS) has been legal in Alabama since 2019. Legalizing DFS represents a giant leap toward regulated online sports betting in the Yellowhammer State, which already allows online horse racing betting.

Are Alabama betting sites safe?

Online sports betting is safe in Alabama if you use secure platforms. All our recommended AL sports betting sites are the safest online sportsbooks with solid reputations for paying out winnings in a timely fashion.

Is DraftKings legal in Alabama?

Yes, since 2019, DraftKings has been legal as a daily fantasy sports provider in Alabama. However, the site cannot accept sports bets in the Yellowhammer State.

Is FanDuel legal in Alabama?

FanDuel is also restricted to DFS contests in Alabama. So, if you’re looking to bet on sports, the only viable option is offshore sports bookmakers like Bovada or XBet.

Is Bovada legal in Alabama?

Yes, Bovada can offer odds in Alabama, thanks to the free trade agreement. The Curacao-licensed site remains unaffected by local laws, which currently don’t exist. So, it means Bovada can legally accept players from Alabama.

Is BetOnline legal in Alabama?

BetOnline sportsbook is also licensed by a recognized authority like the Panama Gaming Commission. So, BetOnline is a legal betting option for sports, allowing bets from players worldwide, including Alabama.

Is Mybookie legal in Alabama?

Yes, Mybookie has obtained a Curacao license to run legal sports betting operations across all the US states, including Alabama.

Is BetUS legal in Alabama?

BetUS has been operational since 1994 and has a license from Curacao to accept US players, including Alabaman residents.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.