475

475 22

22Top features:

Top features:

Bonus:

125% up to $3,125 475

475 22

22

312

312 23

23Top features:

Top features:

Bonus:

50% up to $1,000 312

312 23

23

112

112 21

21Top features:

Top features:

Bonus:

50% up to $250 112

112 21

21We have reviewed dozens of real money betting sites in Colorado and shortlisted these three as the best Colorado online sportsbooks based on the best bonuses and market coverage.

BetUS, a sportsbook owned by Firepower Trading Ltd, has been in the sports betting industry since 1994. This offshore sportsbook, licensed in Curacao, further ensures its reliability and safety for Colorado bettors.

This top Colorado betting site covers everything from major US sports like the NFL, NBA, MLB, and NHL to college sports events. In addition to these popular sports, BetUS also offers betting options on niche events like golf, soccer, and international games such as the English Premier League.

Unique Feature

BetUS Sportsbook is renowned for its impressive Loyalty Program, designed to reward its dedicated players. This program is structured around six distinct tiers, starting with Blue and going all the way up to Black.

Earn points on every real money wager to climb these tiers. The higher your tier, the more exclusive your rewards are. These include up to $500 Free Play every time you ascend to a new level. Once you reach one of the top three levels, you’ll enjoy a 10% bonus on each deposit.

Best Welcome Bonus in Colorado

BetUS Sportsbook also offers a generous sports Welcome Bonus. Colorado sports bettors can start their online betting journey with a free play thanks to a 100% up to $2,500 welcome bonus.Remember to clear the 10x wagering requirements in 14 days. Make at least a $100 deposit using credit cards such as Visa and Mastercard, or wire transfer. Use the JOIN125 code to extract the most thrilling sportsbook bonus in Colorado.

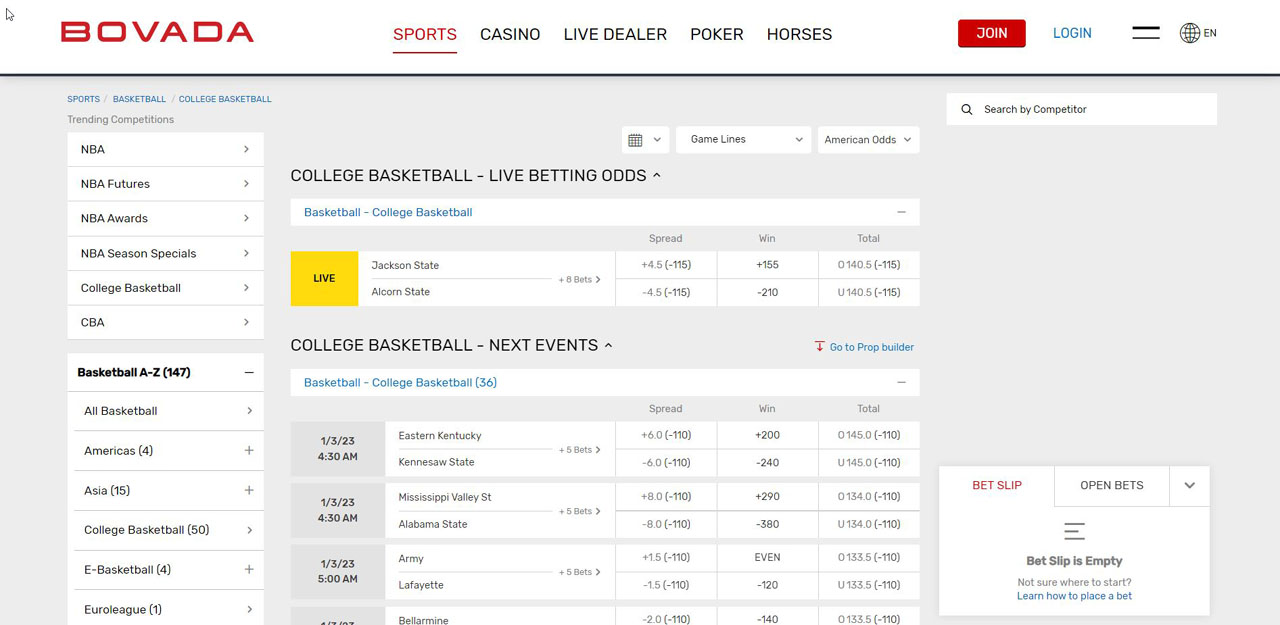

Bovada is the best mobile sportsbook for Colorado fans, who prefer mobile wagering over in-person sports betting. This top Colorado site is licensed by Curacao and has been operational in the state since 2011 – nearly a decade before legal applications like Caesars sportsbook appeared in the sports betting market in Colorado.

From NFL betting, NBA betting, MLB betting, NHL betting, or international games like cricket and snooker, Bovada has you covered. We particularly recommend Bovada as the best online sportsbook for college basketball betting.

Bovada provides a decent set of banking options ranging from major credit cards to a handful of cryptocurrencies. However, the inclusion of MatchPay is one of the standout features at Bovada.

MatchPay is an umbrella platform that includes various e-wallet services like PayPal. All you need to do is create a MatchPay account and connect to one of the preferred e-wallet services.

Bovada features the best crypto sports welcome bonus, thanks to its 75% up to $750 to bet online. Colorado players can claim this one-time offer by using the code BTCSWB750. Bitcoin, Bitcoin Cash, Bitcoin SV Deposit, Litecoin, and USDT qualify for this bonus. This top-notch crypto offer has a fair 5x rollover.

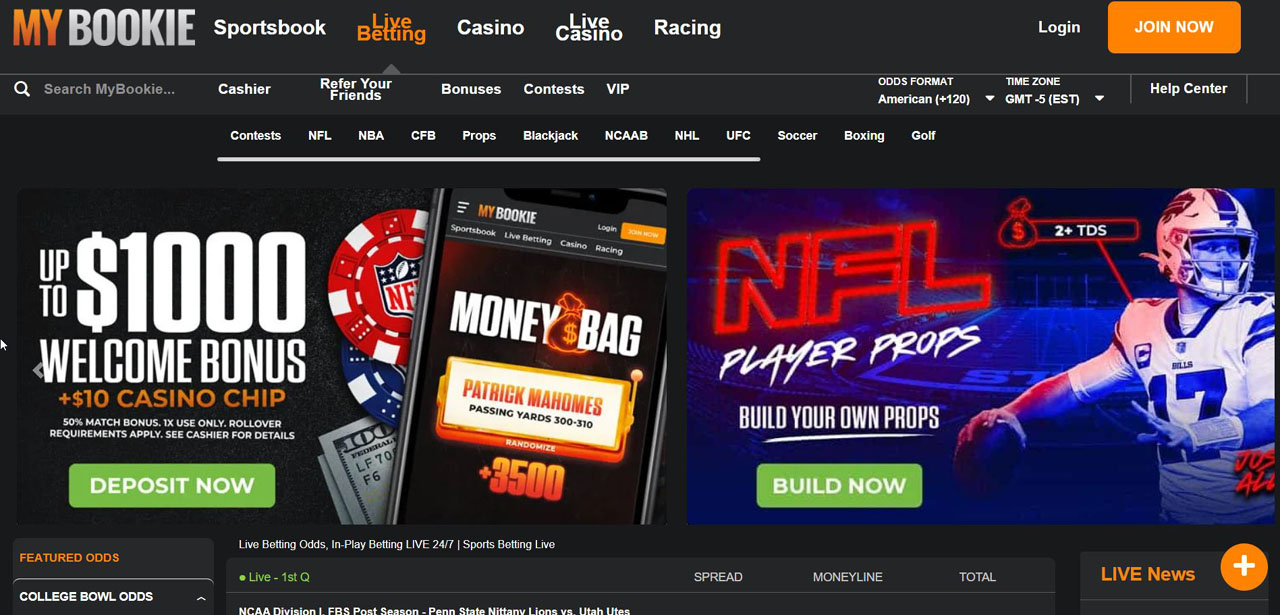

MyBookie, also licensed by Curacao, is one of the newer online sportsbooks that went live in 2014. This Colorado site features a clean user interface, allowing you to see what bets are live, most popular, or upcoming.

You will find betting lines on all major sporting events and leagues, including professional events like American Football (NFL) to college sports (NCAA). You will also find odds on Canadian Football (CFL) and other international events.

Live betting, frequent promotions, and sports betting contests are among the various unique features on MyBookie. Colorado bettors can win up to $350,000 by showcasing their sports gambling expertise on this site. You can find these sports betting contests on “Contests” in MyBookie’s menu.

MyBookie sportsbook competes with its more formidable competitor, BetOnline, when it comes to bonuses. New Colorado players can get a 50% Deposit Match up to $1,000 on their first deposit at MyBookie sportsbook. This bonus has a 10x rollover requirement.

MyBookie allows 14 deposit options, including Mastercard, Visa, Moneygram, Bitcoin, Ethereum, and several other cryptocurrencies. However, you can withdraw using only four methods – Bitcoin, e-checks, bank wire, and Moneygram.

MyBookie is one of the best credit card betting options, thanks to a lower deposit fee of 6%. BetOnline has a 9.75%, and Bovada has 15.9% credit card fees.

| Sportsbook | Welcome bonus | Playthrough | Valid for | Min. deposit |

|---|---|---|---|---|

| Bovada | 75% up to $750 | 5x | doesn’t expire | $20 |

| MyBookie | 50% Up to $1,000 | 10x | 30 days | $50 |

You can now navigate the site to pick your preferred sport, choose the bet amount, and bet online for real money in Colorado.

Whether a sportsbook is safe depends on the offshore sportsbook you choose. We have found some offshore sportsbooks operating under dubious circumstances. However, shady sites have short life spans because word spreads faster than the speed of light among sports bettors.

For secure online wagering in Colorado, you must stick to the sportsbooks we have suggested. The top Colorado sites offer exciting bonuses and competitive odds and ensure quick withdrawals.

All our suggested Colorado sites have been operating successfully in the Centennial State. For instance, BetOnline began accepting online sports bets in 2001.

Colorado was the 19th state to legalize sports bets in 2019. It came a year after the US Supreme Court annulled the PASPA, paving the way for the states to regulate their sports gambling rules independently.

The sports betting law in Colorado allows bets on almost every sporting event, including the major American professional associations – the NFL, NBA, MLB, and NHL. In addition, major Colorado casinos and operators allow residents to place bets on national and international competitions. However, each operator offers its unique list of sports.

However, the best Colorado sportsbook apps like DraftKings sportsbook cannot provide a more expansive market coverage than our recommended sportsbook sites like BetOnline and Bovada. For instance, no legal sports betting site in Colorado offers odds on high school sports, prop bets on college sports, and US elections. Luckily, BetOnline and Bovada offer odds on all these prohibited bets.

Yes, online sports wagering is legal following voters’ approval in November 2019. However, legal online wagering was launched only on May 1, 2020. BetRivers, BetMGM, DraftKings, and FanDuel were the first legal sports betting sites to go live on the launch day.

As of December 2022, 26 legal sports betting sites are live in the Centennial State, besides many leading offshore sportsbook giants like BetOnline, Bovada, and MyBookie.

The sports betting law in Colorado states that residents must be over 21 to place an online bet on sports. However, our leading offshore sites like BetOnline and Bovada accept Colorado players who are over 18 years of age.

The Colorado Division of Gaming regulates all gambling laws in Colorado, including Colorado Casinos and legal sports betting sites. The regulatory body is a part of the Enforcement Division of the Department of Revenue, which is responsible for collecting most types of taxes and enforcing Colorado gaming laws.

Colorado lawmakers introduced a sports betting bill in April 2019, less than a year after the annulment of PASPA in May 2018. In May, the state legislature approved House Bill 19-1327 and sent the measure to the governor.

Although Gov. Jared Polis signed off the bill, the measure still required voters’ approval to become a law. That approval came in November 2019.

HB19-1327 would establish the Colorado Gaming Control Commission to regulate the sports betting industry, imposing a 10% gross revenue tax on the operators.

While no sports betting license fee was specified, the bill said any license or renewal fee must not exceed $125,000. The bill created three types of licenses:

The master license to operate sports betting would be valid for two years. Each master licensee was allowed to contract with one sportsbook operator license holder for land-based sports betting and one online operator licensee. Like the master license, these two license types were also renewable after two years.

After Polis approved HB19-1327, which had bipartisan support, the bill would require Colorado voters’ ratification. That happened in November 2019 when the state held a general election.

On Nov. 5, 2019, Colorado became the 19th US State to legalize sports betting following a close vote. More than 1.3 million residents voted on Proposition DD – a legal sports betting measure to fund a state water conservation plan.

Despite lawmakers’ confidence in the proposal, whose 10% tax revenue would go toward the resource-hungry Colorado Water Conservation Board, Proposition DD passed with a narrow majority of 51% to 49%. The state’s TABOR (Taxpayer’s Bill of Rights) laws required the measure to gain voters’ approval in a general election because TABOR requires public approval of any measure involving new taxes or tax increases.

However, it was good enough to bring retail and online sports betting to Colorado the following year in May 2020.

Democratic House Majority Leader Alec Garnett – a co-sponsor of the bill – and Republican House Minority Leader Patrick Neville cited multiple reasons for the close vote. According to them, one of the significant reasons was voters’ rejection of another tax measure that would have enabled the state to keep revenue that it was obliged to refund to taxpayers. According to Garnett, the betting ballot language, which included the conservation plan, did not help either.

Initially, the Colorado State would expect to raise up to $29 million a year from the sports betting tax.

Many lawmakers hailed this bi-partisan legislative effort, with Sen. Kerry Donovan calling Proposition DD an investment in the state’s water future.

“With the growth of the Front Range, and climate change shifting us to a more arid future, today marks a critical step for the future of agriculture and the quality of life for all of us who call Colorado home,” Donovan said.

However, some lawmakers opposed CO sports betting on moral grounds. For instance, Sen. Larry Crowder did not think bringing mobile sports betting to the people of Colorado was a good idea:

“People get into gambling to make a profit, but why would you want to make people that much poorer? To make this so convenient that it’s on a telephone that is in your possession at all times? I don’t think that’s a good idea….”

Colorado eventually rolled out legal sports betting online in the summer of 2020 despite the absence of several professional sports leagues and closures of casinos amid the peak of Covid-19.

BetRiver became the first online sportsbook to go live in the state on the launch day on May 1, 2020. It came after JP McGill’s Hotel & Casino, located in Cripple Creek, partnered with the Rush Street-owned sportsbook to bring online sports betting to the Centennial State.

FanDuel sportsbook, DraftKings sportsbook, and BetMGM also became operational on the launch day.

As we write this review in January 2023, there are 26 legal online sportsbook sites in a market that could have up to 33. Each of the 33 casinos could have one mobile skin.

Here is the list of all the legal Colorado online sports betting sites and their land-based partners:

In November 2022, MaximBet shocked its Colorado customers when it announced quitting online sports betting operations. In an email sent out to its customers, the sportsbook application told customers withdrawals would be available until Dec. 15, 2022, after which balances would be mailed.

It came months after another legal online sportsbook in Colorado – TwinSpires – revealed it would be exiting the online sports betting space over six months. The Churchill Downs-owned online sportsbook could not float in increasingly competitive marketplaces like Colorado, as CEO Bill Carstanjen admitted on the company’s quarterly earnings.

All these bet types are available to players on our top online sportsbook sites in Colorado:

A Risk-Free Bet allows bettors to get refunded for their initial bet if they lose it. This promotion is usually capped at a certain number. For instance, BetOnline currently offers a $250 Risk-Free Bet if you bet on the NBA this weekend. According to this promotion, you can bet $10 or more on any NBA game between now and Sunday night. If your initial wager loses, BetOnline will refund you up to $250. A Risk-Free Bet tends to change frequently as new sporting events arise.

A Deposit Match – or Welcome Bonus – is where a CO sportsbook site will match a percentage or portion of the amount you deposit with bonus funds. Some sites will even match your initial deposit on a 100 percent basis. However, it usually happens when the maximum bonus is up to $250 or $500.

Interestingly, most legal Colorado sportsbook sites combine a risk-free bet and deposit match. However, the best sports betting sites make a clear difference between a Risk-Free Bet and a Deposit Bonus. BetOnline’s 50% Sports Welcome Bonus enables Colorado fans to grab up to $1,000 on their first-ever BetOnline deposit.

Leading Colorado sports betting sites find pretexts to reward their existing customers. You can even get free money if you tell your friends about the CO sportsbook application you’re wagering on. For instance, Bovada offers you up to $275 if you refer friends. All you need to do is to get your friend to sign up using the link sent by you or mention your email to claim the Referral Bonus.

In this unique promotional offer, the Colorado sports betting site raises the odds on a certain event/game to incentivize customers. For instance, BetOnline’s Odds Boosters will boost the odds for various sports betting markets every day. The odds will work in your favor, no matter what sport or bet type.

Parlay Insurance is a way some CO sites encourage their players to participate in Parlay betting. Considering the complicated nature of Parlay, where you must win all the legs to win the whole Parlay, many players prefer straightforward bet types like Moneyline or Totals. However, Parlay Insurance works so that if you miss one of the legs of your Parlay, you get a refund.

Some sportsbooks will still allow you to place bets without depositing into your account. A No Deposit sports betting bonus is usually offered when new players sign up on a site. Currently, none of our top Colorado sites offer a No-Deposit bonus.

More than 80% of Colorado players prefer making online bets. Most of them do so using their smartphones. BetOnline, Bovada, and MyBookie have specifically optimized their sports betting sites for mobile devices. These top Colorado sportsbooks are 100% mobile-friendly for iOS and Android users. Since these sites don’t have downloadable mobile applications, Colorado players can bet directly from their mobile browsers. Bovada is one of the best online sportsbooks in Colorado.

Offshore sportsbooks provide an experience that no legal sportsbook in Colorado can rival. For instance, BetOnline has been operating for nearly 25 years, that’s nearly two decades before the first legal sportsbooks appeared in the regulated market of Colorado.

Other areas where offshore sportsbooks remain unrivaled are bonuses and market coverage. For instance, we have yet to see any Colorado sites offer more promotions than BetOnline. Particularly, their 50% up to $1,000 Welcome Bonus is the best.

You will explore the widest sporting events to bet on using our suggested Colorado sites like Bovada and BetOnline. You can even bet on politics and unorthodox odds like religion and the weather when betting on offshore sites like XBet.

Another key advantage of joining an offshore site in Colorado is that you can also enjoy other gambling options. For instance, Colorado online poker and real money online casinos in CO are currently unregulated. However, the best offshore sports betting sites accept Colorado bettors for real-money poker and casino gambling.

Sports bettors in Colorado love professional and college football. For instance, NFL betting attracted over $171.6 million of the $526.6 million handle for October 2022. College football took in a $50.4 million handle.

While residents have dozens of options to bet on their favorite sports, many bettors are unsure about which Colorado sportsbook to choose for the best NFL betting odds. Try Bovada.

Whether you’re a casual Colorado bettor placing a wager on your favorite NFL team for fun or a more experienced bettor willing to put down some serious cash, Bovada has you covered. You can place NFL sports bets using simple wager types like Moneyline or Totals. However, Bovada’s prop builder tool is ideal for advanced players looking for NFL betting in Colorado.

LetsGambleUSA prioritizes reliability, so we only recommend Colorado sportsbooks that have provided stable online sports betting. Unfortunately, many legal operators have crumbled in the ever-increasing competitive sports betting market in Colorado. We have seen MaximBet and TwinSpires exiting the market recently. Many more are likely to follow.

So, when we say new online bookmakers in Colorado, we are comparing offshore sportsbooks. XBet and MyBookie are newer online sports betting sites in Colorado. These sites were established in 2013 and 2014, respectively.

Horse racing in Colorado has been legal since 1950, when pari-mutuel wagering was first legalized. Online horse race betting is also legal in Colorado, and you can use offshore sites such as BetOnline and Bovada to place online wagers statewide. Luckily, all our recommended Colorado sports betting sites serve as full-fledged racebooks.

Although sports betting is legal in Colorado, legal operators like FanDuel sportsbook cannot offer odds on many bets because they are prohibited. Election betting is one of those. However, luckily, you can still find competitive election betting odds across all our top three recommended CO sportsbook sites.

For instance, Bovada is ideal if you’re looking to bet on “who will be the next US President”? Currently, the Bovada site offers -165 odds for Joe Biden winning the US Presidential Election 2024. While BetOnline also offers exciting odds for betting on US elections, it is the best option if you’re looking to bet on global politics.

All the following online sports betting options are available on the best online sportsbooks in Colorado:

Moneyline is the simplest bet type in which you choose the winner. It usually involves two teams or players, leaving you the simple alternative of picking either of the two.

Parlay bets combine two or more wagers and tie them together into one bet. Each individual wager in Parlay betting is called a ‘leg’. You must win each leg of your Parlay to win and cash out. Although Parlay bets are riskier, it allows Colorado players to win a large payout for a small amount.

A Ttotal – also known as an over/under – bet allows you to predict the score/points both teams will combine to score in a game. Your prediction must be over or under the betting lines set by your sportsbook operator. You don’t have to predict the exact score or points.

Betting on the Point Spread is when you wager on how many points a team or player will win or lose by. It is a bet on the margin of victory in a contest and is particularly popular when betting on football and basketball.

Futures bets are placed on an event – a series, award, or election – that will be decided in the future. As a result, you may have to wait for months or years to see the outcome of your wager. For example, you can bet on “who will be the next Super Bowl champion?” or “who will win the next US Presidential Election?”.

Prop Bets – short for proposition bets – are side wagers not directly linked to the final score or outcome of the game. These bets may be placed during any time of the game and could be specific to the game or an individual player. A simple example is “how many goals a player will score” or “who will make the next touchdown” in a game.

Live betting – or in-game betting – refers to online wagering after a game has kicked off. The ability to wager on a game already underway has spiced up the level of sports betting over the last decade. All our top sportsbooks in Colorado offer Live sports betting and attract the largest portion of their revenue through this wager type.

All those online wagers that the law does not allow fall under the category of ‘prohibited bets.’ For instance, state law does not allow political bets. It means no legal online sportsbooks will offer odds on elections. However, our recommended Colorado sportsbook sites offer exciting odds for global politics, including US elections.

Look for the following aspects when choosing the best Colorado betting site:

Always read reviews from independent sites that employ experts to review major Colorado sportsbook sites. After reading reviews from different sportsbook sites, you can judge whether or not a CO sportsbook is worth considering. By reading customer reviews, you can also complement your search for the best online sportsbooks in Colorado.

Only join a licensed Colorado sportsbook. If a Colorado site is licensed from a recognized jurisdiction, it is safe to play. Panama Gambling Commission and Curacao Gambling Commission are some of the leading jurisdictions.

Promotions are one of the major reasons most people prefer online wagering. So, check the available bonuses and promotions before signing up for a Colorado online sportsbook. Often, only the bigger operators can afford to dish out huge bonuses.

All the leading Colorado betting sites have a common feature: they are accessible to all kinds of players. What we mean by accessibility is that no matter where you are, the best online sportsbooks in Colorado have perfectly optimized mobile betting features besides a desktop version.

Make sure that the online bookmaker you want to join in Colorado provides extensive market coverage and all the major bet types. Moneyline, Totals, Point Spread, Futures, Parlays, Props, and Live betting are some famous bet types.

You must join multiple Colorado sites to compare the odds pricing. The term refers to how much it will cost you to make a particular bet. The top mobile sportsbooks in Colorado consistently provide better odds, making them stand out in the market.

The available banking options are another make-or-break point when joining an online sportsbook in Colorado. More expansive banking methods for deposits and withdrawals are desirable and reflect the site’s credibility, fewer banking options can limit your choices, especially when cashing out your winnings.

Most new sports bettors make the common mistake of ignoring an online bookmaker’s customer support aspect. Don’t be one of them. A good customer support feature enables you to contact your CO sportsbook’s representatives instantly. Email, phone, and live chat are the major communication channels used by most leading legal online sports betting sites in Colorado.

Colorado has five professional sports leagues/teams, each with its own loyal fanbase. You can bet on all these sports leagues using our recommended Colorado sports betting sites:

According to the Colorado Department of Revenue, the state reported $526.6 million in sports betting handle for October 2022. This was the second time the Centennial State crossed the half-billion dollar since May 2020, when the state launched online wagering. Earlier, in January 2022, $573.7 million in handle was seen – the highest ever total in the 30 months of legal wagering.

The latest CO sportsbook revenue report represents a giant leap of a market that saw a total of $25.6 million sports betting handle in its launch month.

Colorado sportsbook sites posted $36.5 million in gross revenue for October 2022, and the state collected around $2.3 million from the adjusted revenue of $21.1 million. October 2022 marked the first time the tax receipts totaled north of $2 million in two consecutive months.

Colorado generated $29.2 million in sports betting taxes between May 2020 and October 2022.

All the top Colorado sports betting sites allow all of these deposit and withdrawal methods:

Credit cards are the most common banking option available across every major Colorado site. For instance, Bovada and BetOnline include four credit cards: Mastercard, Visa, AMEX, and Discover.

Bank direct transfer is also available across our top Colorado sportsbooks. However, look at the minimum deposit and maximum withdrawal limits available on the site you want to join. For instance, Bovada allows a minimum deposit limit of $50 via bank transfers compared to BetOnline’s $1,000 minimum deposit limit.

Although offshore sites don’t offer e-wallet options to US-based customers, Coloradans can still use PayPal and other e-wallet deposits and withdrawals when depositing with Bovada. Currently, only Bovada offers MatchPay – an umbrella platform with various e-wallet options, including PayPal, Venmo, Zelle, and more. You must create a MatchPay account to use Bovada’s e-wallet services.

Most experienced Colorado bettors prefer Bitcoin deposits and withdrawals to traditional banking options. Unfortunately, no regulated sportsbooks include Bitcoin deposits. Fortunately, our three recommended CO operators offer Bitcoin deposits and withdrawals and offer boosted promotions and faster withdrawals if you use the top digital coin.

Like Bitcoin, our recommended Colorado sportsbooks also offer other cryptocurrencies called altcoins. With 17 deposits and 13 withdrawals, BetOnline is one of the best altcoin online sportsbooks.

These are the most popular Colorado sports teams you can bet on using our recommended sites:

Yes, online sports betting is legal in Colorado, with dozens of local and offshore online sportsbook sites operational.

You must be 21 years of age or above to engage in legal sports betting via Colorado’s legal sites like DraftKings sportsbook. However, our top Colorado sports betting sites, like BetOnline, accept Colorado bettors aged 18 or above.

Gov. Jared Polis signed the Colorado internet sports betting bill in May 2019, and the measures came into effect following voters’ approval in November of that year.

Yes, all the leading offshore online sportsbooks dish out enticing bonuses for US-based customers. For instance, BetOnline’s 50% up to $1,000 bonus is among the best online sportsbook bonuses in Centennial State.

The Colorado Limited Gaming Control and the Colorado Division of Gaming regulate and oversee legal sports betting within the state.

You can either be a resident or visit Colorado to bet on sports using top Colorado online sportsbooks.

Yes, you can play daily fantasy sports in Colorado using DraftKings and FanDuel.

Whether Colorado betting sites are safe depends on the site you choose. For secure online sports betting, stick to the recommended CO sites.

DraftKings has been legal in Colorado following the regulation of daily fantasy sports in 2016.

FanDuel is also legal as a DFS and sports betting operator in the Centennial State.

Bovada has been running legal operations in Colorado, thanks to its Curacao license that enables this sportsbook to operate across most US states.

BetOnline also legally operates in Colorado and is licensed by Panama Gaming Commission.

BetUS is one of the first online sportsbooks that began operations in Colorado in 1994. It is operated on a Curacao license.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.