475

475 19

19Top features:

Top features:

Bonus:

125% up to $3,125 475

475 19

19

312

312 25

25Top features:

Top features:

Bonus:

50% up to $1,000 312

312 25

25

112

112 15

15Top features:

Top features:

Bonus:

50% up to $250 112

112 15

15Our experts chose these top three Michigan online sports betting sites based on the best bonuses, competitive odds, broader market coverage, expansive banking options, and fast payouts.

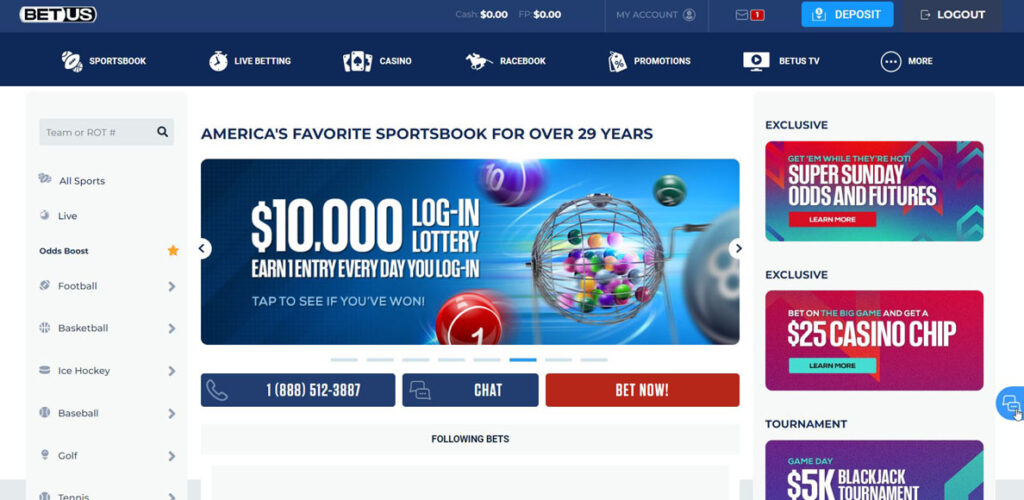

The BetUS sportsbook has dominated Michigan sports betting since 1994, the year of its digital launch. This top-notch sportsbook is owned by Firepower Trading Ltd. and holds a license from the Curacao eGaming Authority to operate in Michigan.

Top Feature

The BetUS loyalty program is a one-of-a-kind feature for Michigan sports bettors. They can earn points to move through this six-tier VIP program, starting at Blue Tier and going all the way up to Black.

Free payouts, loyalty program casino tournaments, welcome free play, and extra deposit bonuses are some of the benefits of joining this exclusive BetUS loyalty program. VIP members even get an exclusive toll-free number for early updates regarding exclusive offers.

Welcome Promotions

BetUS dishes out a 100% match up to $2,500 – the best sports welcome bonus in Michigan. New bettors can grab this exciting offer by making a minimum deposit of $100. This bonus carries a 10x rollover and expires after 14 days. Use promo code JOIN125 to qualify for this bonus.

Other Promotions

Other BetUS promotions include a 150% casino bonus of up to $3,000 on your first-ever deposit. Crypto depositors in Michigan can also grab a 200% crypto bonus, which is divided into a 150% sports bonus up to $3,750 and a 50% casino bonus up to $1,250.

Sports Betting Markets

BetUS covers all major professional and college sports betting action. Whether you’re a professional football, basketball, or baseball fan or more into March Madness betting, BetUS has you covered.

Other popular sports on this site include ice hockey, golf, tennis, martial arts, boxing, NASCAR, motorsports, and more.

Banking Methods

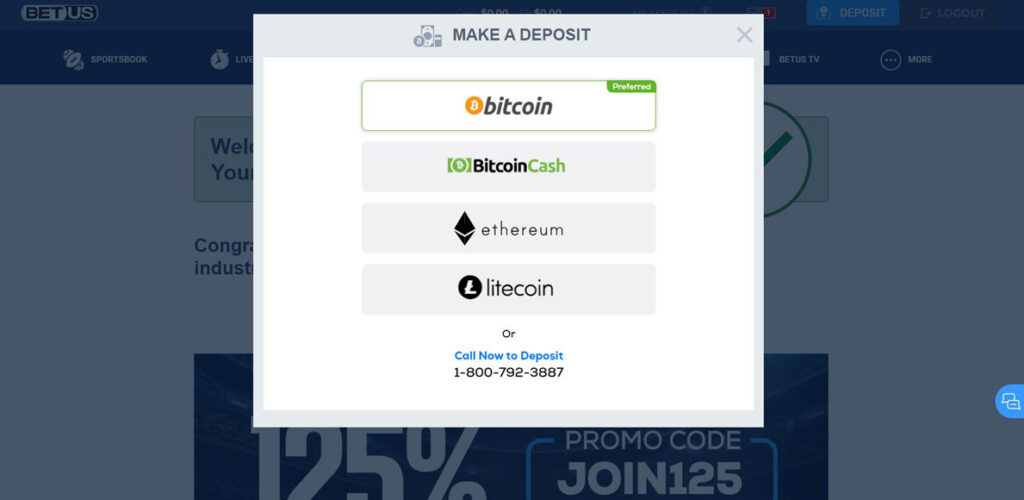

BetUS accepts various banking methods, giving you 10 deposit options, including Visa, Mastercard, American Express, wire transfer, Google Pay, Apple Pay, and some cryptocurrencies. However, Bitcoin, Bitcoin Cash, Ethereum, and Litecoin are the only crypto withdrawal methods available at BetUS.

The minimum deposit requirement on this site is $10, and you can deposit up to $50,000 using cryptocurrencies. The site doesn’t charge any fee on crypto deposits.

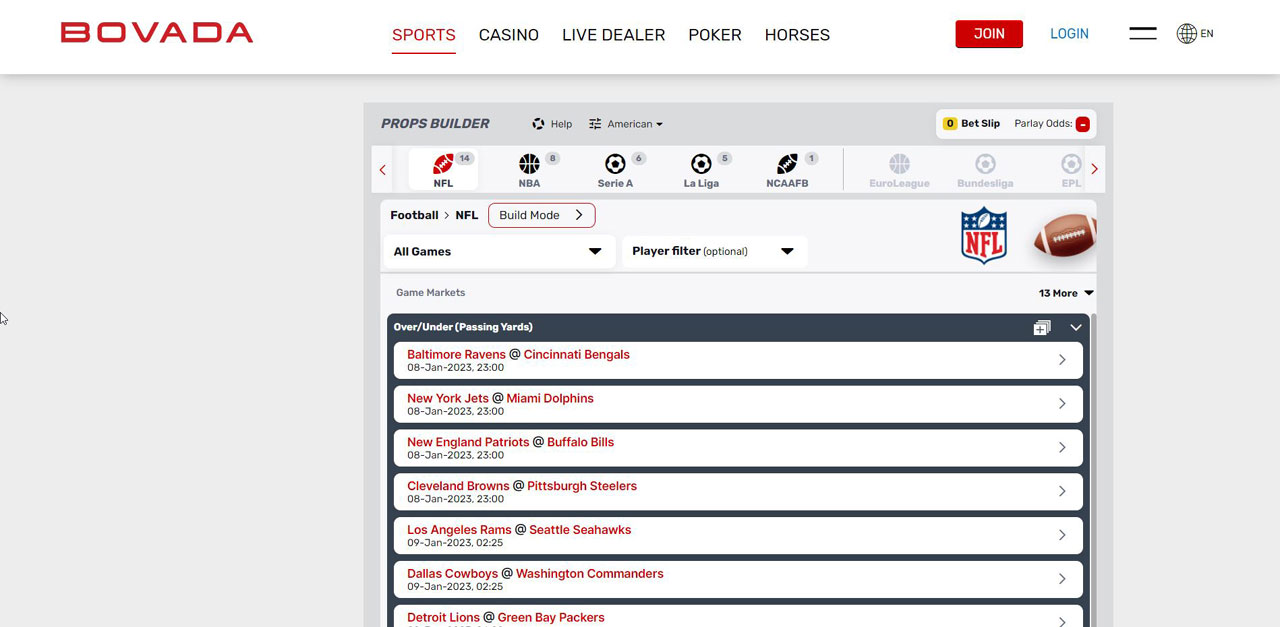

Bovada has earned the reputation for the best NFL betting odds over the years. This top Michigan site was launched in 2011 by the Mohawk Morris Gaming Group (MMGG). This site is licensed by the Curacao government to operate in Michigan and 44 other American states.

Top Feature

Bovada’s prop builder tool for NFL betting is what we like best about this site. Launched in 2020, it has become a signature feature of this site. This tool allows Michigan bettors to call audibles for every NFL game on the daily lineup. With the thousand additional customized wagers for each contest, you have a chance at the biggest possible payouts in Michigan sports betting.

Welcome Promotions

Bovada offers a modest sports welcome bonus of up to $250. You can qualify for this 50% bonus by putting up at least $20 for your first-ever deposit. This bonus carries a 5x rollover.

However, a more exciting bonus opportunity is reserved for Michigan crypto players, who can grab a 75% match up to $750 in a sports welcome bonus at Bovada. This thrilling offer is valid with the available crypto deposit options – Bitcoin, Bitcoin Cash, Bitcoin SV Deposit, Litecoin, and USDT. Use bonus code BTCSWB750 and clear the bonus terms with a fair 5x rollover requirement.

Other Promotions

Other bonus bets and promotions at Bovada include a $3,000 casino welcome bonus and a 100% poker welcome bonus of up to $500. Another excellent option is the crypto welcome bonus of up to $3,750.

Sports Betting Markets

Bovada offers comprehensive betting market coverage. If a sport/event of any significance is taking place in any part of the state and the nation, Bovada will most likely cover it. You can bet on the big four, college sports, or any sporting event in the world on this top sports betting app.

Specifically, Bovada offers a significant range of betting markets for the NFL. In addition, Michigan’s NFL bettors will find exclusive offers and betting odds to choose from. Whether you want traditional fixed odds or live betting, you’ll never run short of NFL betting options, including for the fan-favorite Detroit Lions, on this top Michigan site.

Banking Methods

Bovada offers eight deposit and seven withdrawal methods, including Visa, Mastercard, and several cryptocurrencies. However, the inclusion of MatchPay is a standout feature at this top Michigan site, allowing bettors to deposit and withdraw using e-wallets.

Michigan bettors must create a MatchPay account to use popular e-wallets like PayPal, Apple Pay, Venmo, CashApp, and Zelle at Bovada.

The only thing we didn’t like about Bovada is the charge of 15.9% on credit card deposits. However, the best thing is that crypto deposits are free.

MyBookie is a highly respected platform for US bettors, including those in Michigan. This Duranbah Limited-owned online bookmaker, launched in 2014, holds a Curacao license to offer US-facing betting services in a regulated environment.

Top Feature

MyBookie offers an exciting betting experience for Michigan players, featuring one of the best contests, ‘Squares.’ This competition allows you to play the given sport and win frequent real money prizes.

Welcome Promotions

MyBookie provides an enticing welcome bonus – a 50% match up to a maximum of $1,000. However, this bonus expires in 30 days, and you must clear a 10x wagering requirement during this period.

Remember, the minimum deposit to claim this bonus is $50, and you’ll need to use the promo code MYB50.

Other Promotions

This top Michigan sportsbook offers a 25% up to $1,000 reload bonus for existing customers. It also provides a 200% up to $200 referral bonus, rewarding existing players who introduce new Michigan customers to the platform.

Sports Betting Markets

MyBookie covers extensive sports betting markets, including every significant sport in Michigan, the US, or any part of the world. Whether you’re an NFL or NBA player, like esports, or want to bet on the English Premier League, this top Michigan site has you covered. The platform’s diverse offerings make it an ideal choice for casual and experienced bettors.

Banking Methods

The leading offshore sportsbook provides a wide range of 13 deposit methods to cater to the diverse needs of its users. Standard banking options include credit cards and Moneygram to fund your account.

MyBookie also embraces the digital age by accepting ten cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Tether, Solana, Cardano, Dogecoin, Shiba Inu, and Binance Coin. The platform allows a minimum deposit of $20 when using these coins, making it accessible for every Michigan sports bettor.

Leading online mobile sports betting sites in Michigan attract players with better promotional offers. Here are some of the best sports betting bonuses you can expect from top Michigan sportsbooks.

A risk-free bet is a second chance on your first bet if it loses. For example, BetUS currently offers up to $500 in risk-free bets. If you lose your first bet, you must contact the site, and they will credit back the amount in free bets or site credits up to $500.

A deposit match bonus is where a Michigan sports betting site offers free bets, matching a percentage of the amount you make on your first-ever deposit with the site. This percentage usually ranges from 50% to 100% with traditional deposits and can go up to 150% to 200% with crypto deposits.

For example, the BetUS sportsbook offers a 100% deposit match up to $2,500. So, if you deposit $2,500 on this site, you will get an additional $2,500 in free bets totaling your Michigan sports betting account balance to $5,000.

Odds Boosts is a promotion where your online sportsbook offers better odds on wager types than you would have gotten without this promotion.

For example, with the normal odds, BetOnline offers a +500 on the Atlanta Braves winning the World Series. With Odds Boosts, Michigan bettors will get +800 on the MLB team to win the annual championship series of Major League Baseball.

Parlay insurance is an exciting promotion for parlay betting fans in Michigan. This bonus allows you to get a refund if one of your parlay legs misses. In a standard parlay, you must hit each leg to cash your bet.

A referral bonus is how leading Michigan mobile sports betting sites reward customers who promote their brands. It’s an ideal way to earn free bets with the refer-a-friend bonus. All you need is to tell your friends about the site you use to bet on sports and get them to join it.

For example, the BetUS sportsbook will reward you with a 100% refer-a-friend bonus up to $2,000 if you refer your friends to BetUS.com.pa. Once they make their first deposit on the site, you will get your referral bonus in free bets.

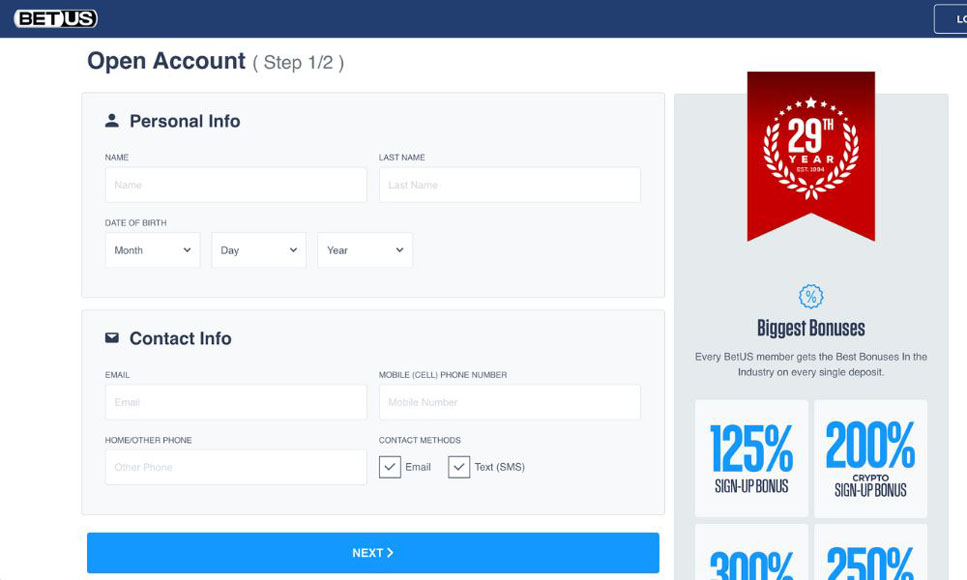

Following this three-step guide, you can join the best Michigan sports betting sites in the next few minutes. We will use BetUS as an example to show how you can do this from the comfort of your home in the Wolverine State, no visit to a retail sportsbook required.

Go to the BetUS sports betting site and click the ‘Join‘ icon on the top right corner. Then follow the on-page prompts to fill out the registration page. It will require your personal information, such as name, address, email, etc.

Once your account is created, your screen will show the ‘Deposit‘ option. Click on it and choose from the available deposit methods. Use code Join125 to grab a 100% sports welcome bonus.

After making an initial deposit, you’re good to go. Now, click on ‘Sportsbook‘ on your top-left, pick your favorite sport, choose a bet amount on the bet slip, and place online sports bets for real money in Michigan.

Yes, online sports betting is legal and has been operational in Michigan since January 2021. There are currently 15 legal sports betting applications, including the FanDuel sportsbook, available to Michigan bettors.

Legal sports betting kicked off at retail locations first in March 2020, just months after Gov. Gretchen Whitmer signed sports betting into law in December 2019.

Michigan’s online sports betting law allows wagering on almost every event besides professional and college sports betting. However, college player props are prohibited.

Here are some key points of Michigan sports betting law:

Michigan sports betting was part of a comprehensive iGaming package in late 2019. In December 2019, Gov. Gretchen Whitmer signed three iGaming bills – HB 4311, HB 4916, and HB 4308 – legalizing online casinos, online poker, daily fantasy sports, and sports betting in the state.

Money raised through online gambling and sports betting would support the School Aid Fund and First Responder Presumed Coverage Fund, the latter of which funds cancer treatment for firefighters.

“My top priority in signing this legislation was protecting and investing in the School Aid Fund because our students deserve leaders who put their education first,” Whitmer said.

The Democratic Governor hailed the passage of the legislation as a real bipartisan win for the state. She said the ability to offer online sports betting, among other forms of gambling, would put more money in state classrooms and increase funding for firefighters battling cancers.

The comprehensive iGaming package allowed tribal casinos to offer online gambling and sports wagering on an equal footing with the Detroit casinos. Those casinos had to obtain a license from Michigan Gaming Control Board to launch in the Wolverine State.

The initial hope was to launch legal sports betting by the Super Bowl that year, but Sen. Curtis Hertel Jr. said the NCAA basketball tournament would be a more realistic goal.

The Three Michigan Bills

While House Bill 4916 created the Lawful Sports Betting Act, two other measures complemented online wagering in Michigan. This bill legalized wagering in casinos, online and mobile.

HB 4311 created the Lawful Internet Gaming Act, enabling the Michigan Gaming Control Board to issue licenses for online casinos via licensed Detroit or tribal casinos. The bill allowed for all existing forms of casino gaming to be offered via the internet.

Another bill – HB 4308 – created the Fantasy Contests Consumer Protection Act. The act allowed for both paid daily fantasy contests at a commercial level and private contests within specified criteria to be legal in the Wolverine State.

Michigan sports betting was another last-minute piece of legislation made on what would be the last day of the state’s legislative session. The iGaming package received Senate approval by a 35-3 vote two months after the House passed the measure with a 63-45 vote. The divided vote indicated that the House measure lacked the governor’s support.

Although the bills moved to the upper chamber, it was feared they would meet the same fate as they did the previous year – a gubernatorial veto.

In December 2018, outgoing Gov. Rick Snyder vetoed the package of iGaming bills with just 48 hours remaining in his term. However, unlike her predecessor, Whitmer was not opposed to gambling. Rather her opposition to the House version was about how sports wagering and iGaming would affect the state’s School Aid Fund.

The Senate Regulatory Reform Committee amended HB 4916, and the final cleanup was done later in the Senate Committee. Sen. Curtis Hertel Jr. told the media that the substitute language was agreeable to the governor and industry stakeholders.

On Dec. 11, 2019, the Michigan sports betting and iGaming bills were sent to the governor’s desk for her final consideration.

Three months after the governor’s approval, retail sportsbook wagering began in Michigan. Two city casinos – MGM Grand Detroit and the Greektown Casino – began retail sports betting on the first day in March 2020. Motor City Casino joined the two retail sportsbooks the very next day.

However, the three commercial casinos were forced to shut down in-person sports betting operations amid the peak of March Madness betting due to the pandemic-led restrictions.

Legal Online Sports Betting Arrived in January 2021

In December 2020, the state took another step toward launching Michigan legal online sportsbooks, with the MGCB website listing the launch as “early 2021.” The update came as the regulator announced provisional licenses for 15 sports betting operators.

The following 15 were granted provisional licenses:

You must be 21 years of age or older to place a sports bet in Michigan. However, our top three offshore sports betting sites accept Michigan sports bettors aged 18 and above.

The Michigan Gaming Control Board oversees all licensed sports betting activities in the state, including licensing and regulating mobile and retail sports betting.

It depends on the site you choose. Sites can be involved in shady practices, especially newer ones. For secure online betting in Michigan, we recommend only joining the offshore sites we reviewed above.

The top three Michigan mobile sports betting sites boast decades of experience and offer excellent bonuses and competitive odds. Besides accepting bettors aged 18, these Michigan sportsbooks offer bets frowned upon by other sites, such as college prop and election betting.

The Michigan legislature began working on sports gambling legislation in 2015. Here are some of the key highlights of Michigan sports betting:

All top three Michigan betting sites are 100% mobile-friendly for all kinds of mobile devices.

BetUS and Bovada are the best mobile sports betting sites for Michigan customers with Android phones. These top Android betting applications cover your sports betting action from signup to cashing your winnings. All you need is a stable internet connection.

Michigan sports bettors with iOS devices will also find BetUS, BetOnline, and Bovada 100% optimized for their iPhones/iPads. These best Michigan sports betting sites don’t have iOS compatible software. So, instead of dealing with frequent irritating updates, you can place direct online bets through your iOS browser.

Playing at the leading offshore sportsbooks has the following advantages:

Michigan players will find all these wager types to bet online on their favorite professional and college sports:

A moneyline bet is the simplest form of betting involving two common outcomes. For example, you must choose one side to win in a game in which two players or teams are listed on a moneyline bet. A favorite in a moneyline bet is represented by a negative (-) symbol, while an underdog is represented by a plus (+) sign.

A parlay bet is where your Michigan online sportsbook ties multiple wagers into a larger bet. In order to win the whole parlay, you must win all individual wagers – or legs – on a parlay ticket.

For example, you can bet $100 on a three-team baseball parlay with the Detroit Tigers +150, Cleveland Guardians +100, and Cincinnati Reds +203. If all MLB teams win, your $100 bet will pay out $1,515.

Totals betting – also called over/under – pertains to the combined score of the two sides/teams. Michigan bettors can place a bet on whether or not the combined score, goal, or run total will be over or under what the sportsbook listed before the start of the game.

A point spread bet is placed on the margin of victory in a game. Oddsmakers place certain handicaps on a team, attempting to reach a specific number line for spreads they think would make the forecasted final score closest to even.

The perceived favorite must win by a specified number of points for you to win. The underdog can lose by fewer than that number of points or just win the game for you to cash.

For example, the Super Bowl spread for this year’s Big Game was Kansas Chiefs +1.5 and Philadelphia Eagles -1.5. So if you had wagered on the Eagles – favored by 1.5 points – they would have had to win by two points or more for your bet to cash.

Conversely, if you had wagered on the Chiefs – +1.5 points as the underdogs, they would have had to win the game or at least not lose by two more more points.

A futures bet is placed on an event – a series, award, or election, for example – with a result that will settle weeks, months, or years later. It is different from the same-day outcome, where you get immediate results.

For example, offshore casinos allow you to bet on ‘Who will win Super Bowl 2024?’ or ‘Who will win the US Presidential Election 2024?’

A prop or proposition bet can be placed on almost anything other than the game’s final outcome. A prop bet can range from picking the first player to record a basket in an NBA game to the length of the national anthem at the next Super Bowl. Even betting on the coin toss outcome is a prop bet.

A live bet is placed as the game is underway. Also called in-game betting, it allows you to bet online anytime after the game kicks off but before it ends.

The best part about live betting is that it allows you to make informed decisions. The odds can change drastically depending on the in-game situation as it proceeds. You can always adjust your bet in those cases.

Prohibited bets are those wagers not offered by licensed Michigan operators like Caesars Sportsbook due to regulatory restrictions. But luckily, you can still bet on things such as college prop bets and election betting in Michigan.

Our top three Michigan sites, which don’t come under local regulatory control, offer almost all kinds of usually-prohibited bets.

Michigan has four major sports leagues, each with a unique fan following. However, the NBA’s Detroit Pistons is one of the most popular betting options in the state. The Pistons are three-time NBA champions, including their back-to-back victories in 1989 and 1990. Most recently, the Pistons won in 2004.

BetOnline is one of the best NBA betting sites offering competitive and boosted event odds. Besides offering an exciting 50% up to $1,000 to new NBA fans in Michigan, this top offshore site provides a unique ongoing promotion on NBA betting. Get a risk-free bet of up to $250 when you bet on the NBA this weekend, exclusively on BetOnline.

Besides the NBA, all the major leagues and sports are open for betting on our recommended sites that offer online betting in Michigan:

Michigan is home to the Detroit Lions, the only NFL team operational for the entirety of the Super Bowl’s history, which began as the AFL-NFL World Championship Game back in 1967.

The Detroit Lions won four NFL championship games in 1935, 1952, 1953, and 1957. Since 1957, the franchise has only won only a single playoff game in 1991. Despite the long championship drought, the Lions are one of the most popular betting options in Michigan.

However, we suggest you consider NFL betting without local bias. Bovada offers the best NFL betting odds, allowing you to place moneyline, spreads, totals, and live betting on a professional football event. In addition, we recommend you try their prop builder tool for NFL betting in Michigan.

Michigan is also home to the Detroit Tigers, one of eight charter franchises of the American League (AL) in Major League Baseball. The Tigers, who began play in the AL in 1901, are four-time World Series Champions – in 1935, 1945, 1968, and 1984.

BetUS offers all the MLB games, offering new Michigan customers an exciting one-time deposit bonus up to $1,000. The top MLB site currently lists Houston Astros as a +600 betting line favorite to win the 2023 World Series. If you bet on the Tigers to win the World Series with Game 7 on Nov. 4, 2023, you will win $15,000 on each $100 wagered.

Michigan hockey fans will also find excellent odds on NHL betting on our top offshore sportsbooks. For example, BetUS offers excellent futures on the NHL Stanley Cup, featuring the Boston Bruins (+475) as a favorite to win the annual championship trophy.

Detroit Red Wings fans will get $25,000 on every $100 wagered on their local team to win the championship. The Red Wings, the 11-time champions, have won the most Stanley Cup championships of any NHL franchise based in the US.

Michigan soccer fans can also enjoy betting via top offshore sports betting sites. Bovada and MyBookie are among the top MLS betting sites. Bovada is a specialist in MLS spread betting, while MyBookie offers the best moneyline odds for the 2023 Major League Soccer MLS Cup.

When it comes to basketball, nothing beats the popularity of March Madness betting. The Michigan Wolverines men’s basketball team is one of the best college basketball teams.

The Wolverines have won the NCAA Championship. The Michigan State Spartans won two championships in 1979 and 2000. The Central Michigan Chippewas, another prominent team, has made the NCAA tournament four times.

College basketball fans in Michigan have plenty of options to wager on. They can participate fully in NCAAB betting via BetOnline, one of Michigan’s best March Madness betting sites.

The Canadian Football League (CFL) is another popular betting option in Michigan. The Canada-based Bovada provides early odds on CFL betting. The operator features all the betting lines, including point spreads, score props, moneyline, and more.

The Women’s National Basketball Association (WNBA) has offered another level of excitement to bettors since 1997. As one of the top WNBA betting sites, BetOnline features excellent odds and lines for WNBA Basketball. In addition, new sports bettors looking to bet on the WNBA can claim up to $1,000 in welcome bonuses.

Like college basketball, NCAA Division I Football Bowl Subdivision is one of the most wagered-on events in Michigan.

The Michigan Wolverines boast of being the most successful program in college football history. The Wolverines play their games at the Big House on campus in Ann Arbor. It is the largest stadium of its kind in the nation.

Bovada is our top pick for college betting because it offers many match markets days before the kickoff. In addition, we love their lines for every single college football game. Meanwhile, their prop builder tool adds flavors to existing wager types, such as moneyline and spreads, taking NCAAF betting to the next level.

Michigan legalized horse racing in 1933. The Racing Act of 1933 authorized and regulated pari-mutuel horse racing in the Wolverine State.

The Northville Downs harness track, opened in the 1940s, is the only operating racetrack in Michigan. However, in late 2019, the state lawmakers approved advance deposit wagering, effectively allowing online horse betting in Michigan.

That said, all of our top three Michigan sites also include full-fledged online racebooks. For example, the BetUS racebook has offered online horse racing for decades, allowing Michigan horse betting fans to enjoy wagering on their favorite horse racing events like Kentucky Derby.

Politics betting is one of many exclusive features you’ll find only on the top offshore betting sites in Michigan. Bovada is ideal for betting on US elections, while BetUS should be your first choice if you’re more interested in global politics betting.

Bovada offers the best odds on the US Presidential Election 2024 winner. With +255, Biden is the favorite. It means you will get $255 for every $100 wagered on Biden’s chance to win his reelection bid in 2024.

Religion betting is also exclusive to offshore betting in Michigan. So next time, if you want to bet on who will become the next pope, you can do so only at XBet – one of our top 10 offshore sportsbooks in Michigan.

Michigan has four professional and many college sports teams. All of Michigan’s pro teams are in the Detroit metropolitan area.

Aside from our three top Michigan sites, some new offshore operators have recently arrived to claim their piece of the pie in the Michigan sports betting market. XBet is the most prominent name, which has attracted a unique fan base in the Wolverine State ever since it became operational in 2013.

This top Michigan site features unique betting lines, such as betting on religion and weather. Additionally, XBet is also one of the best online sportsbooks for live betting because it offers early odds on every live sporting event of any significance.

MyBookie is another worth-mentioning sports betting site that is more popular among experienced bettors. Seasoned players in Michigan can cash in on their sports betting knowledge on this site, which currently features sports betting contests and awards up to $350,00 in those contests.

We have prepared a checklist to use when choosing the best Michigan betting site:

Reviews: It is important to know what industry leaders have to say about the site you want to join.

LetsGambleUSA offers unbiased and detailed reviews on all the top Michigan sports betting sites. You should read from as many sources as possible, provided they are reliable and offer independent reviews.

You can also complement your research by reading customer reviews of those players who joined those sites that you are considering joining.

Licensing Information: Only join a licensed operator for secure online betting. Check the licensing information before signing up. The Panama Gambling Authority and Curacao eGaming Authority are some of the trusted online regulatory authorities.

Promotions: Only the top Michigan sites can afford to offer great promotions. So, compare these sites to see which gives better promotions and bonuses. For example, our top Michigan site, BetUS, offers up to $2,500 in just its welcome promotion.

Accessibility: You must be able to bet online whenever and wherever in the Wolverine State. So, your MI sportsbook must be optimized for mobile users of all kinds. All of our top Michigan online sportsbooks are specifically designed for iOS and Android users.

Bets Allowed: More betting options will increase your online betting fun in Michigan. So, look for the available betting lines and markets that you can choose from. For example, moneyline, spreads, props, totals, futures, and live betting are the most popular online wager types.

Odds Pricing: You should do some comparison shopping before you bet on sports in Michigan. The best site will provide better odds than the average site. For example, your Michigan site offering -110 on an NFL betting line is offering better odds than the competitor site offering -120 on the same betting line. In the former case, you will be putting $110 to win $100; in the latter case, you will have to risk $120 to win $100.

Deposit and Withdrawal Methods: Always check the available banking methods before joining a site in Michigan. The more deposit and withdrawal methods you find on a site, the better. For example, BetOnline offers 27 deposit and 22 withdrawal options.

Customer Support: Customer support can make or break your online betting experience. So, choose a site with responsive customer support. Pick a site that includes email, phone, and live chat support – or at least any two of these.

Michigan sports betting posted a $4.81 billion handle in 2022, up 21.4% from 2021. According to the MGCB’s report released in late January 2023, the state’s sportsbooks took in nearly $495 million in handle for December 2022. It was only a slight dip from November’s $498 million.

In October 2022, Michigan’s retail and online sportsbooks witnessed $504 million worth of sports betting handle, a 31.6% rise from the $383 million wagered in September. The sudden boost in October was partly due to the NBA and NHL seasons kicking off.

Overall, Michigan’s sportsbooks generated $418.6 million in sportsbook revenue for the calendar year 2022. In addition, the state generated $14.5 million in tax receipts and $7.6 million in local taxes.

Michigan kicked off online wagering in late January 2022, and the state’s sportsbooks capped off the first calendar year with $3.9 billion in handle. For the launch year, MI sportsbooks generated over $319 million in gross sports betting revenue. The State of Michigan generated $13.6 million in taxes for 2021.

The Michigan Department of Treasury initially estimated that the legalization of sports betting would bring $19 million in new revenue to the Wolverine State. It was estimated to bolster the School Aid Fund by $4.8 million, with an additional $4 million for the FRPCF.

Michigan players can use these popular banking methods for deposits and withdrawals:

Leading Michigan sites allow Visa, Mastercard, American Express, and Discover for deposits and withdrawals. BetOnline offers all four credit card deposits and withdrawals. The minimum deposit at BetOnline is $25, and the maximum deposit limit is $5,000.

Credit card deposits come with a fee ranging from 9.75% (at BetOnline) to 15.9% (at Bovada).

Cryptocurrencies are the most popular banking method in Michigan. All our top three Michigan sites allow Bitcoin deposits and withdrawals. BetOnline is one of the best altcoin online sportsbooks with 17 crypto options, including Ethereum, Litecoin, and Ripple.

The wire transfer is also one of the payment method options at our top Michigan sites. BetUS allows wire transfer deposits, while Bovada only allows wire transfer withdrawals. BetOnline allows both wire transfer deposits and withdrawals. However, you must deposit at least $1,000 for a wire transfer deposit. There is no maximum deposit limit.

Although offshore sites don’t allow popular e-wallets to transact with US-based customers directly, Michigan sports bettors can still have e-wallet banking exclusively on Bovada. All you need is to create a MatchPay account to use PayPal and other leading e-wallets in Michigan.

The minimum deposit requirement at MatchPay is $20, and you can deposit up to $1,000.

Michigan is bordered by Indiana, Ohio, and Wisconsin. Illinois, one of the biggest sports betting markets in the nation, is also a neighboring state.

Indiana’s sports betting market is the nearest competitor to Michigan. The Hoosier State, which launched sports betting in September 2019, currently has 13 online sports betting sites. The Indiana sports betting generated $42.7 million from the $432 million wagered for December 2022. It translated to nearly $4 million worth of state taxes.

Ohio is one of the most recent states with legal wagering. The Buckeye State kicked off mobile sports betting on Jan. 1, 2023 –more than a year after Gov. Mike DeWine signed the sports betting bill into law.

Wisconsin sports betting is also legal but in one location. The Oneida Indian Nation began to accept legal sports bets in November 2021 in Green Bay. Another location will soon open, also at another federally recognized tribe.

Illinois has been the third-largest sports betting market in the nation after New Jersey and New York. For the month of December 2022, Illinois posted over $1 billion in sports betting handle.

Tribes are a crucial part of MI online sports betting. Of 15 mobile skins, the law allocates 12 to the state’s tribes. However, a third party (commercial operator) must also seek a license from the Michigan Gaming Control Board to collaborate with the state’s tribal casinos.

In 2018, the Michigan tribes paid $53.4 million in gaming proceeds to the state. It is significantly more than the $20 million in fees and taxes that sports betting is estimated to deliver annually. This was the reason the state deemed the participation of tribes crucial in negotiating the final legislative package.

Yes, online sports betting is legal and has been live in Michigan since January 2021.

Unfortunately, none of our top Michigan sports betting sites offer a no-deposit sports bonus.

Online sports gambling in Michigan became law after Gov. Gretchen Whitmer signed iGaming bills in December 2019. This came less than two weeks after the state lawmakers agreed on the final proposal.

Yes, leading offshore sportsbooks like BetUS accept Michigan players aged 18 and older to bet online on professional and college sports, as well as many other exciting markets.

Yes, you can participate in daily fantasy sports in Michigan. Daily fantasy sports contests also became legal in 2019 as part of the comprehensive iGaming legislation. DraftKings, FanDuel, and Yahoo Fantasy Sports are among the leading DFS operators in the Wolverine State.

BetUS is licensed by the Curacao eGaming Authority to operate across the US, including in Michigan.

DraftKings is a legal DFS and online sportsbook operator in Michigan. It was one of the 10 MI online sportsbook applications that launched on Jan. 22, 2021.

Bovada has been operating legally in Michigan and 44 other US states on a Curacao license since 2021.

BetOnline has been the biggest sportsbook giant in the Wolverine State since 2001. It operates on a Panamanian license.

FanDuel Sportsbook is one of the locally licensed DFS and sportsbook operators that made their debut following the 2019 legalization.

MyBookie is one of the new online sportsbooks and one of Michigan’s top 10 online sportsbooks. It is licensed by the Curacao regulator.

You must be 21 or above to bet online via the locally licensed MI sportsbook applications. However, top offshore sites like BetUS and Bovada accept Michigan bettors aged 18 and above.

The Michigan Gaming Control Board is responsible for licensing, regulating, and controlling licensed casino gaming operations in the state.

Yes, it’s legal to play online casino games in Michigan. We have also reviewed the top Michigan online casinos for real money for you to check out and sign up to play thousands of online slots, table games, and more.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.