475

475 19

19Top features:

Top features:

Bonus:

125% up to $3,125 475

475 19

19

312

312 25

25Top features:

Top features:

Bonus:

50% up to $1,000 312

312 25

25

112

112 15

15Top features:

Top features:

Bonus:

50% up to $250 112

112 15

15Our experts have picked these three top Indiana online sports betting sites based on the best bonuses, broader market coverage, secure payment methods, and quicker payouts.

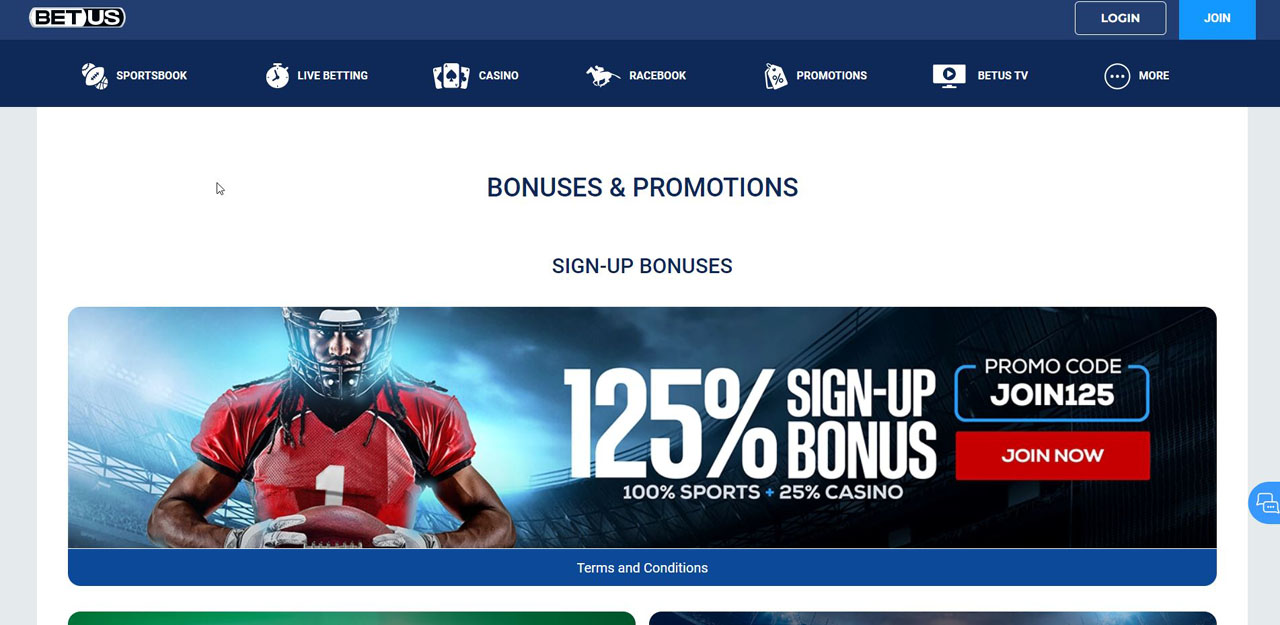

BetUS is the most trusted online sportsbook and has been available to Indiana players since 1994 – the year of its launch. This Costa Rica-based site is licensed by Curacao eGaming Authority to run legal operations in the US sports betting markets, including Indiana.

Indiana sports bettors will find all betting lines for almost every major sporting event on this trusted platform. So, whether you want to bet on the major sports leagues, college sports, or international sporting events, BetUS has you covered. However, this operator is one of the best MLB betting sites, thanks to the most competitive odds for this league.

The most exciting feature of BetUS is the simplicity it offers to every player who joins this top Indiana site. Even first-time online bettors can join, find their favorite sport/league, and place a bet without external guidance, thanks to a straightforward betting interface. This top sports wagering site also has a section called Locker Room to update new and existing Indiana players about the latest sports betting events.

BetUS offers a 100% up to $2,500 sportsbook bonus – the best welcome bonus in Indiana sports betting. You must deposit at least $100 to claim this bonus, which has a 10x rollover requirement. You have 14 days to clear the bonus requirements. Use bonus code JOIN125 to claim this bonus.

BetUS offers eight deposit options, including Visa, Mastercard, and Bitcoin. However, the only withdrawal options currently are Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. We want this top Indiana site to add some more withdrawal options to facilitate more Indiana players looking for traditional payout methods.

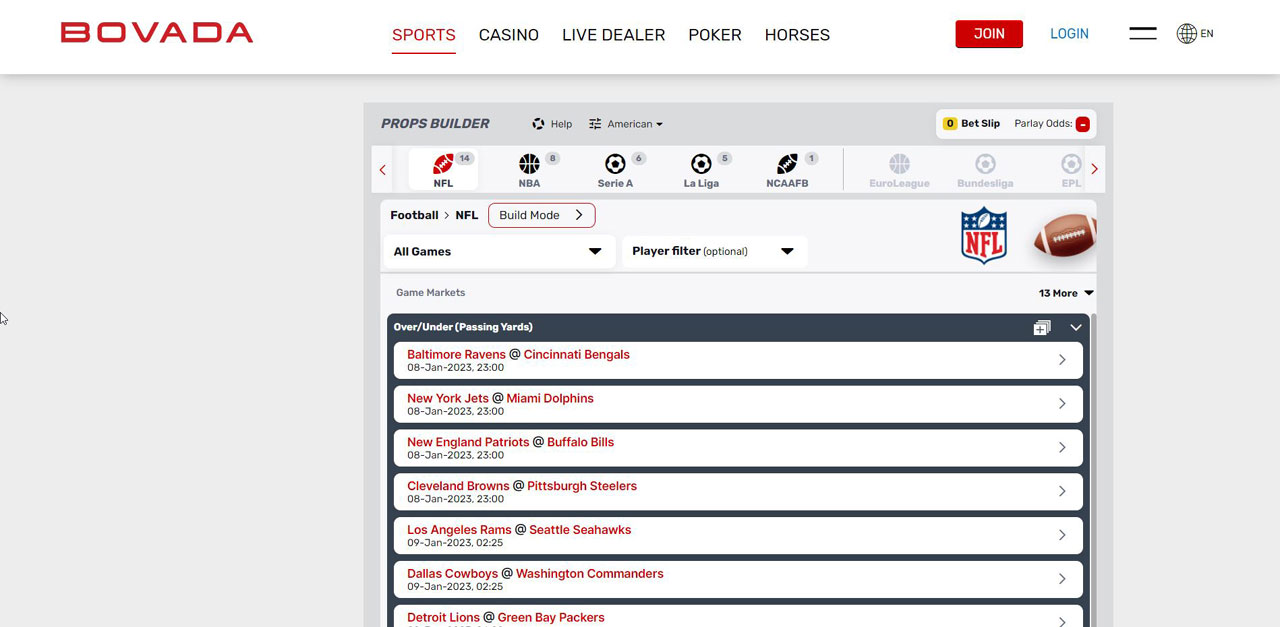

Bovada has become the third most popular Indiana mobile betting site since its launch in 2011. This leading offshore operator is licensed by Curacao to operate legal sports wagering in 45 US states, including Indiana.

Bovada covers almost every sporting event in the world. However, the site owners intended this operator to be US-specific. So, Bovada is ideal if you’re looking for the most competitive odds on professional American football, basketball, baseball, and ice hockey.

While almost every prominent feature has overlaps across the leading Indiana sports betting sites, Bovada’s prop builder is still a standout feature. So, if you’re an Indianapolis Colts fan, you must try this top-notch site. You will find exciting props on all kinds of NFL players, making Bovada one of the best online sportsbooks for prop betting.

Bovada offers a modest 50% up to $250 welcome bonus to new Indiana players. However, you must deposit at least $500 to claim the maximum bonus amount ($250). We think the minimum deposit requirement is too high considering the maximum bonus amount. Still, the site makes up for a bit of unfair minimum requirement with a fair 5x wagering requirement.

Indiana players can deposit their Bovada account using eight methods – including Visa, Mastercard, and Bitcoin – and seven withdrawal methods. However, the inclusion of MatchPay makes Bovada the only sportsbook in Indiana with e-wallet banking. You only need to create a MatchPay account to use e-wallet services like PayPal in Indiana sports betting.

MyBookie, launched in 2014, has rapidly become one of the leading US-facing sportsbooks in 2023. Duranbah Ltd. – the parent group – holds a Curacao license to operate this premium wagering platform across the 50 states, including Indiana.

Market Coverage

As a bettor, you’ll be impressed by MyBookie’s extensive coverage of various sports. Whether you’re a fan of the NBA, NFL, MLB, esports, or horse racing, MyBookie has got you covered.

They offer a variety of betting options, including moneylines, spreads, totals, and futures. For Indiana bettors seeking the best live betting site, MyBookie is an excellent choice.

Unique Feature

One of MyBookie’s standout features is its ongoing contests. Currently, they offer ‘Squares’ – a contest where you select your NFL or NCAAF squares and can win real money prizes.

Welcome Bonus

Upon signing up, MyBookie greets you with an attractive welcome bonus package – 50% up to $1,000. You can qualify for this sign-up sports bonus by making a $50 deposit and using the MYB50 promo code. Remember, this bonus has a 10x playthrough requirement and will expire in 30 days.

Banking Options

MyBookie provides a significant range of banking methods, including 13 deposit options such as credit cards, Moneygram, and several cryptocurrencies. A minimum deposit of $20 is required to get started.

The withdrawal methods at this top IN site include wire transfer and e-check, but we recommend Bitcoin for the fastest withdrawals.

| Sportsbook | Welcome bonus | Playthrough | Valid for | Min. deposit |

|---|---|---|---|---|

| BetUS | 100% Up to $2500 | 10x | 14 days | $100 |

| Bovada | 75% up to $750 | 5x | doesn’t expire | $20 |

| Ignition | 200% Up to $2000 | 25x | 30 days | $20 |

| XBet | 50% Up to $500 | 7x | 15 days | $45 |

It depends on the offshore site you choose. Many offshore sites are not reliable and operate under dubious circumstances. These shady sites last for only a few weeks or months. However, for secure online betting in Indiana, we recommend you stick to the best Indiana sports betting sites. The top Indiana operators we have reviewed have been in the online gambling business for the last three decades. These allow crypto banking options – the best and safest method to bet online anonymously.

State law permits licensed Indiana casino operators and off-track betting (OTB) facilities to partner with up to three mobile skins. The Hoosier State has 11 casinos and three OTB parlors, making up 14 sports betting licenses in total. Theoretically, there can be up to 42 sports betting applications in a fully saturated market. However, most licensed facilities have settled on one mobile partner.

Key things about Legal Indiana sports betting:

Yes, online sports betting is legal and operational via Indiana’s licensed casinos and OTBs. Currently, more than a dozen legal online betting applications are operational in a market that can have up to 42.

State law empowers the Indiana Gaming Commission (IGC) to oversee and regulate statewide mobile sports betting.

According to the law, residents must be 21 years or older to bet on sports in Indiana. Luckily, our top three offshore sportsbooks accept Indiana bettors aged 18 or older.

Indiana, one of the nation’s first legal sports betting states, followed the New Jersey model less than a year after US Supreme Court struck down the PASPA. In May 2019, Gov. Eric Holcomb’s signed Indiana’s sports betting bill – HB 1015 – into law.

The first retail sportsbooks launched just four months later, on Sept. 1, 2019. Gov. Holcomb placed the first bet at Indiana Grand Racing and Casino in Shelbyville. In total, three legal retail sportsbooks became operational on the launch day, four days before the 2019 NFL season kicked off.

Mobile betting was launched a month later, with BetRivers and DraftKings sportsbooks being the first two operators to go live on Oct. 3, 2019.

Today, all 13 land-based casinos have retail sportsbooks and at least one mobile skin each. Most recently, Hard Rock Sportsbook – the 13th mobile application in Indiana – went live days ahead of the 2022 NFL season in September.

On May 8, 2019, Gov. Holcomb signed House Bill 1015, which legalized Indiana sportsbooks, both retail and online.

The executive signature came two weeks after a dramatic development in the state legislature. The Indiana Legislature voted to approve HB 1015 on April 24, 2019 – the final day of the state’s legislative session.

The state lawmakers in the House and Senate hammered out details of Indiana’s sports betting measure. It is the second Midwest state after Iowa to have legal sports betting.

The bill cleared 59-36 in the House and 37-12 in the Senate before it was sent to the governor for a signature. Republican Gov. Holcomb signed the bill on his final day to act on the measure.

Sen. Jon Ford, who sponsored the original legislation, told the media he expected to have the governor’s signature.

“He will be good with the bill,” Ford said. “He told me…he will sign it.”

HB 1015 allows any licensed casino operator to apply for an Indiana sports betting license. The Indiana Gaming Commission reviews the application.

As of now, 15 properties – including casinos, racetracks, riverboats, and OTBs – have secured sportsbook licenses.

Any mobile sportsbook application must be partnered with one of these license holders to begin digital operations in the Hoosier State. Each facility can have up to three mobile skins.

Here are some additional details about the Indiana sports wagering bill:

Indiana’s sports betting legalization efforts predate the annulment of PASPA in May 2018. In January 2018, two sports betting measures were filed in the two chambers. Senate Bill 405 was introduced by Sen. Jon Ford, and Alan Morrison filed House Bill 1325 shortly after.

The bills aimed to legalize sports wagering at Indiana State’s casinos, racetracks, riverboats, and satellite facilities if the Federal ban was lifted.

However, HB 1325 included a bombshell provision – an integrity fee. According to this controversial provision, the sports leagues would get a 1% fee on amounts wagered at the Indiana sportsbooks. According to a report by ESPN, the MLB and NBA officials put up a joint lobbying effort to materialize HB 1325.

The idea of the integrity fee, which drew condemnation from the gaming industry, was not included in Ford’s bill – SB 405.

Indiana’s only tribal casino, Four Winds South Bend, is owned and operated by the Pokagon Band of Potawatomi Indians. The gaming tribe cannot offer mobile wagering until the renegotiated compact allows them to do so.

However, the Eastern Band of Cherokee Indians (EBCI) has recently struck a partnership with Betr to offer mobile betting in the state. However, EBCI has done so as a Delaware Limited Liability Company that acquires and manages commercial casinos throughout the USA. The tribal-owned company operates Caesars Southern Indiana, using the Caesars name under license from Caesars Entertainment.

Sportsbook Name – Land-Based Partner

All the promotions described below are available for Indiana bettors who sign up with the top three Indiana sports betting sites we have suggested above.

A risk-free bet allows sports bettors to get a refund if they lose their first bet. Usually, players get a refund as a free bet or site credit. For example, if you lose BetOnline’s $250 risk-free bet, the site will refund your account in free play up to $250.

A deposit match – or welcome bonus – is when the Indiana site loads your account with free bets equal to the amount you deposited on sign-up. BetUS has one of the biggest deposit matches in the Indiana sports betting industry at $$2,500. Thanks to their 100% Sports Bonus, Indiana players can get up to $2,500 if they deposit the full amount.

A referral bonus is an ideal way to get some free bonus from your Indiana sportsbook. You just need to refer your sports betting site to your friends. Currently, BetUS offers a whopping 300% Referral Bonus Up to $6,000. Indiana players must refer their friends to BetUS.com.pa, and after they make their first, second, and third deposit, you will get your reward.

Some leading Indiana sports betting mobile sites feature Odds Boosts, offering better odds on particular wagers. Top operators like BetOnline do so by sacrificing the house edge in order to increase the payout for their regular customers. BetOnline’s Odds Boosts are the best example of maximizing the value on your sports bets.

Parlay insurance is a way some Indiana betting apps encourage bettors to play parlay betting. Usually, a player must win all legs of the parlay in order to win a payout. However, parlay insurance protects against some of your losses by returning your initial stake. So, if you lose a leg of your parlay, you will get a refund thanks to parlay insurance. The returning amount usually comes in the form of free bets in the site credit.

Some sportsbooks offer no deposit bonus, allowing new players to place wagers without depositing real money. All you need to do is to sign up to grab a no-deposit bonus, sufficient to put in a few small wagers. Currently, none of our top three Indiana sports betting mobile sites offer any no-deposit bonus.

Indiana has a fully operational mobile sports betting industry, with most residents preferring to bet online via their smartphones.

All our top three Indiana sites are 100% mobile-friendly, allowing players to recreate an experience that is similar to what they’re used to on their computers and laptops. Everything from signing up to finding your favorite sport betting markets to placing your first wager and withdrawing your winning is now just a touch away. All you need is a smartphone (iPhone or Android) and a stable internet connection.

The best part is that the sports betting giants like BetOnline and Bovada don’t have downloadable applications. So, instead of downloading the software and the frequent updates, you can directly browse their mobile sites and get in a few moments of online betting between meetings or at your physician’s clinic waiting your turn.

Many Indiana gamblers may have a legitimate question: ‘Why should I prefer offshore sportsbooks when locally licensed sportsbooks are available?’

Some gambling sites – often for promotional purposes – will almost convince you that offshore sportsbooks are unreliable because they are not regulated. This is not true.

Leading offshore sportsbooks predate legal US online sports betting, which occurred in 2018. For instance, BetUS and BetOnline have been the most popular sportsbooks in Hoosier State for the last three decades. In contrast, MaximBet, the most recent sports betting brand in Indiana, closed operations in November 2022 within two months of launching.

Besides reliability, offshore sportsbooks like BetUS and BetOnline offer more exciting bonuses, competitive odds, and extensive betting markets than do their local counterparts. You can even find exciting odds for prohibited bet types like politics and college player props.

However, the ability to make crypto deposits has left offshore sportsbooks without rivals in the Indiana sports betting market. No locally licensed Indiana sportsbook applications allow cryptocurrencies.

Cryptocurrency has made mobile betting in Indiana more secure than ever. Crypto deposits have several advantages. Most crypto deposits are free compared to credit card deposits that incur up to 15% of the deposit fee. Crypto deposits also come with boosted promotions and quicker withdrawals.

However, the biggest advantage of offshore sportsbooks is that Indiana players can gamble for real money without even revealing their identities.

The National Football League (NFL) is the most popular sports league in the USA, and the Hoosiers are not immune to this national fever. The Indianapolis Colts, the home team, was a founding member of the NFL. The Colts, who began playing in Baltimore in 1953, relocated to Indianapolis in 1984. The celebrated Colts won three NFL championships in 1958, 1959, and 1968. They are twice Super Bowl champions, with wins in 1970 and 2006. Since the 2008 season, the Colts have played their home games in the Lucas Oil Stadium.

While football fans in Indiana have been wagering for decades, Bovada has become their first choice for doing so since 2011. Bovada is ideal if you’re looking for the best odds for NFL betting. Bovada’s NFL betting guide section provides a step-by-step guide for how to bet on NFL games, allowing you to become a pro and begin winning real money in no time. In addition, Bovada’s sports-betting experts offer tips on the season’s strongest sides, enabling you to place the best type of bets for your game.

While Bovada is one of the newer online sportsbooks on our top three Indiana online sportsbook list, some excellent operators have recently joined to compete for the market share. XBet is one of those new online sportsbooks in Indiana that became operational in 2013.

XBet, a stellar offshore sportsbook licensed by Curacao, is owned by Duranbah Limited. This top Indiana site claims to be the last sportsbook you’ll ever join. Although it’s a tall claim, our experts have approved XBet as one of the five best Indiana online sportsbooks with all its popular betting options. It is also one of Indiana’s best online sportsbooks for live betting.

Yes. Indiana law permits betting on online horse racing. Indiana horse racing fans may bet in person at authorized racing events or via online racebooks.

Luckily, our top three Indiana sportsbooks also serve as full-fledged racebooks. You will find competitive odds on these sites on all major horse racing events in the USA or worldwide.

Indiana has two major racetracks – Indiana Grand and Harrah’s Hoosier Park. These tracks host live racing seasons throughout the year for thoroughbreds, standardbreds, and quarter horses.

The Indiana Horse Racing Commission regulates the industry.

No licensed Indiana sportsbook application allows election betting. However, you can still bet on election outcomes thanks to the top offshore sites in Indiana State. Bovada is the best choice if you want to bet on US elections, including “Who will win the US President 2024?” You will also find odds on every major political development in US politics. Those Indiana bettors looking to bet on global politics should try BetUS, which covers almost everything from Australian elections to the European Union.

Our top three Indiana betting sites offer odds on all these bet types:

Moneyline is the simplest bet type in sports betting, mainly involving two outcomes. Moneyline betting odds represent plus or minus numbers for the two sides. The favored team will be listed as a negative number, like -130, meaning you have to bet $130 to win $100. For the underdog, the odds will show a positive number, like +190, meaning you only have to risk $100 to win $190.

A parlay bet simply combines two or more wagers on a single ticket for a larger payout. For the parlay to pay out, you must win every individual wager or leg. A parlay can be a multi-game or one-game parlay.

For example, a three-leg parlay could have Colts -3.5, Hoosiers basketball -120, and Pacers-Knicks over 212.5 points on the moneyline. If all three legs hit, it will result in a huge payout. However, you must hit each of the three legs to win your parlay bet.

Total betting or over/under betting is when you place a wager on a game to predict the combined final score of both teams. The oddsmakers already provide those numbers before the game kicks off. You will wager on whether or not the combined point, score, run, or point total of a game will be higher or lower than the oddsmakers determined already.

Point spreads is a bet on the margin of victory in a game, mostly in football and basketball. Unlike moneyline, where you’re betting on a side to win, the spread sets one team as the favorite and the other as the underdog and sets a betting line that subtracts from the favorite team’s points total to level the playing field.

Take the NFL for example. If the Indianapolis Colts are a 7-point favorite over the Jacksonville Jaguars, it will be shown as “-7” in your Indiana sportsbook. It means Colts must win by more than seven points for you to win the payout on your bet Jaguars -7 bet. However, you will get your initial bet amount back if they win by exactly seven points.

Points spread essentially puts pressure on the favorite team to cover the spread while giving the underdog a head start before the kickoff.

A futures bet is wagered on an event – a series, award, or election – whose outcome will be determined days, weeks, months, or years later. For example, BetUS allows you to place a futures bet on the New York Giants Super Bowl odds at +2800 heading into the 2023 NFL season. A $100 bet on the Giants could net you $2,800 in winnings if they hoist the Lombardi Trophy at State Farm Stadium, Arizona.

A prop bet – short for proposition bet – is a wager on a game not directly tied to the final score or outcome of a contest. Rather, it rather involves betting on whether a particular event will or won’t happen during a contest.

While there are many types of props, player props, game props, and novelty props are the three most common types. Player props is the most popular. For example, ‘Will Tom Brady throw for more than 350 yards?” or “Will Jonathan Taylor score a touchdown?” A simple example of game props could be “Which team scores first?” or “Which team gets to 10 points the fastest?”

Live betting, or in-game betting, allows Indiana players to place bets while a game is underway. This exciting opportunity will enable you to bet on odds that might not have been offered before the kickoff.

For example, Indiana Pacers may have had a -11.5 point spread pregame with -110 odds. However, following a great first quarter, your Indiana site may have updated the line to -14.5 with -110 odds. With live betting, you can double down on the Pacers to cover both the original 11.5-point spread and the live spread of 14.5.

You can even bet on those events that Indiana sports betting law doesn’t authorize. Politics is one of the prohibited bets. The leading Indiana operators also offer betting lines on elections, including one of the most wagered-on political events: “Who will win the 2024 Presidential Elections?”

We have prepared a checklist of the points you might consider when choosing the best Indiana betting site:

You must conduct research when joining a sports betting site in Indiana. For instance, reputed online Indiana sportsbooks offer independent reviews on every market-leading online gambling site – including the best online poker rooms and casino sites. For example, LetsGambleUSA has hired experts to compare the reputed sports betting mobile site, and we only recommend the best Indiana online sportsbooks. However, we encourage you to complement our research by reading customers’ reviews.

Only join an Indiana site that is properly licensed by a recognized authority. For example, while Indiana Gaming Commission is the state-specific regulatory authority, Panama Gambling Commission and Curacao eGaming Authority are globally recognized online gambling jurisdictions.

Promotions are one of the biggest reasons most gamblers have turned to online sports wagering. So, always compare the Indiana sportsbooks for better promotional offers. For instance, BetUS offers up to a $2,500 welcome bonus to new Indiana sports bettors. In contrast, BetRivers – the first locally-licensed application in Indiana – offers only $500.

A leading Indiana sportsbook must be accessible anytime and anywhere. Since over 90% of Indiana bettors prefer to place mobile bets, you must consider updated platforms that are 100% mobile friendly.

The more betting options an Indiana site offers, the better. Increased betting options mean you will have more variety to bet online. One of the biggest advantages of top offshore sportsbooks in Indiana is that they can offer those bet types – like politics, awards, and college props – that licensed betting mobile sites cannot offer.

You should also look for odds pricing when searching for the best Indiana sportsbook site. For favored odds, you need to compare the bet odds. For instance, when betting on a favorite team, the odds will start with a negative number, telling you how much you need to wager to win $100. For example, if the odds are -120, you will need to bet $120 to win $100. Likewise, if the odds are -130, you must bet $130 to win $100. Obviously, the Indiana site offering -120 is winning in this odds pricing competition.

Banking options are another make-or-break point when deciding the best online Indiana sportsbooks. Usually, top Indiana betting sites must include expansive deposit and withdrawal options to facilitate a wider public. With 27 deposits and 18 withdrawal options, BetOnline provides the most expansive banking options in Indiana sports betting.

Customer is one of the most ignored aspects that you should consider when signing up with an Indiana sportsbook. Email, phone, and live chat support are major customer support channels to look for.

Indiana is home to several major professional sports leagues, including NFL’s Indianapolis Colts and NBA’s Indiana Pacers.

In addition, the Hoosier state is also home to the Indianapolis 500 – the most famous motorsports race in the nation. This event is held annually at Indianapolis Motor Speedway. The track, nicknamed the “Brickyard,” is also home to a major NASCAR race every year.

According to the latest IGC report, Indiana sportsbook operators reported $42.7 million in revenue from the total monthly sports betting handle of $431 million in December 2022. In addition, the Hoosier State generated $4 million in taxes. The December handle represented a slight decline from November’s $452 million handle – six million more than October’s $446 million mark.

November 2022 was also a milestone month for Indiana sports betting, making it the sixth state to surpass $10 billion in lifetime handle.

Since sports wagering began in Indiana in 2019, licensed operators have reported nearly $850 million worth of sportsbook revenue and almost $84 million worth of taxes for the Hoosier State.

Nearly 40% of Indiana sports betting’s lifetime handle came from the year 2022 alone. Hoosiers wagered over $4 billion in 2022. The overall yearly handle in Indiana for 2022 was a little short of $4.5 billion – a 16.7% increase year-over-year. The Hoosiers wagered $3.8 billion in 2021.

Revenue also saw a 26.5% increase in 2022 to $387 million, and Indiana posted $36.8 million in tax revenue in 2022 – $7.7 million more than was reported in 2021.

In the calendar year of 2020, Indiana didn’t disappoint either. The Hoosiers wagered over $1.7 billion on sports betting in the first full year of legal wagering.

All these deposits and withdrawals are available across our top three Indiana betting sites:

Indiana players can deposit their online betting budget with Visa, Mastercard, American Express, and Discover Card. However, credit card deposits usually incur a fee ranging from 6% to 15.9%, depending on the Indiana site you choose.

You can also deposit and withdraw from your Indiana sportsbook account using bank wire transfers. BetOnline is one of the best Indiana sports betting sites for bank transfers, allowing a minimum deposit of $1000 and up to a $25,000 maximum withdrawal. However, the minimum deposit requirement is a bit higher.

Bovada claims a monopoly over e-wallet banking in Indiana. Usually, offshore online sportsbooks don’t include popular e-wallet banking options for US-based customers. However, Bovada still allows Indiana customers to move their money using popular e-wallets like PayPal. You only need to create a MatchPay account and link it with your preferred e-wallet service.

Bitcoin is the most popular banking option among Indiana sports bettors. However, only leading offshore betting sites allow Hoosiers to make Bitcoin deposits. Bitcoin deposits are mostly without a fee, and Bitcoin withdrawals are the quickest.

Most other cryptocurrencies – called altcoins – are also available across leading offshore Indiana sportsbooks. You can deposit and withdraw using Ethereum, Litecoin, Dogecoin, Ripple, Ria, Polygon, ApeCoin, Avalanche, Binance Coin, Cardano, ChainLink, Shiba Inu, Solana, Tether, USDCoin, and Bitcoin Cash on our top three Indiana sports betting sites.

Indiana bettors have plenty of betting options in Hoosier State, which has several major leagues and many college teams too.

Yes, online sports betting is legal and operational via Indiana State’s 14 licensed casinos and OTBs. Find out more about Indiana gambling laws here.

Indiana sports betting law requires residents to be 21 or older to place mobile bets within the state borders. However, our top three offshore sportsbooks accept Indiana players who are 18 years old or above.

Indiana sports betting became legal on May 8, 2019, when Gov. Eric Holcomb signed HB 1015 into law, allowing the state’s licensed facilities to offer online sports betting in the state.

Yes, Indiana-based bettors can claim bonuses and promotions by signing up with top offshore sportsbook sites like BetUS, BetOnline, and Bovada. These leading operators also reward regular bonuses to their loyal customers.

The Indiana Gaming Commission (IGC) is responsible for retail and online sports betting in the state.

No. You can either be a resident or a visitor to place mobile bets in Indiana. All you need to do is to create an account (we have provided details above) and start betting online in the Hoosier State.

Yes. You can play daily fantasy sports contests via DFS sites like FanDuel and DraftKings in Indiana.

Yes, DraftKings is legal in Indiana, offering DFS contests and sports betting in the state.

FanDuel also runs legal DFS and sports betting operations in Indiana.

Bovada is licensed by Curacao to operate legally in 45 US states, including Indiana.

Yes, BetOnline is the largest legal online sportsbook in Indiana. This site is licensed by Panama Gambling Authority to operate in all 50 states.

MyBookie is one of the new online offshore sportsbooks that are legally available in Indiana.

BetUS has been the most trusted online betting site known to Indiana bettors for the last three decades. Curacao eGaming Authority licenses this top Indiana betting site.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.