475

475 19

19Top features:

Top features:

Bonus:

125% up to $3,125 475

475 19

19

312

312 25

25Top features:

Top features:

Bonus:

50% up to $1,000 312

312 25

25

112

112 15

15Top features:

Top features:

Bonus:

50% up to $250 112

112 15

15Our team of experts has picked the following three top real money betting sites in Illinois following rigorous research. Our top picks provide the best bonuses and the most extensive market coverage.

BetUS was one of the first-ever sports betting sites for Illinois bettors online. This prestigious site was launched in 1994 and is licensed by Curacao eGaming Authority.

This offshore site covers every major sport, including professional football, basketball, baseball, and ice hockey. BetUS also provides competitive odds on college sports betting, making it one of the best online sportsbooks for NCAA betting.

The BetUS loyalty program is one of its top features, as players can gain VIP status on this site. As you continue betting on this trusted platform, you’ll earn “player points” with BetUS. You can exchange these points for a risk-free bet like free play, reload bonuses, and more benefits. In addition, each VIP member can correspond with their own personal account manager, who will provide updates about exclusive bonuses and help with expedited withdrawals.

Of all the leading Illinois sportsbooks, BetUS offers the best welcome bonus: 100% up to $2,500. New Illinois sports bettors can grab this one-time sign-up bonus by making at least a $100 deposit. This bonus has a 10x wagering requirement and expires after 14 days. Use bonus code JOIN125 to activate this stellar bonus.

You can deposit to your BetUS Illinois account with Visa, Mastercard, American Express, and several cryptocurrencies, including Bitcoin. However, Bitcoin, Bitcoin Cash, Ethereum, and Litecoin are the only withdrawal options on this site. We hope to see BetUS increase its withdrawal options to accommodate more Illinois bettors.

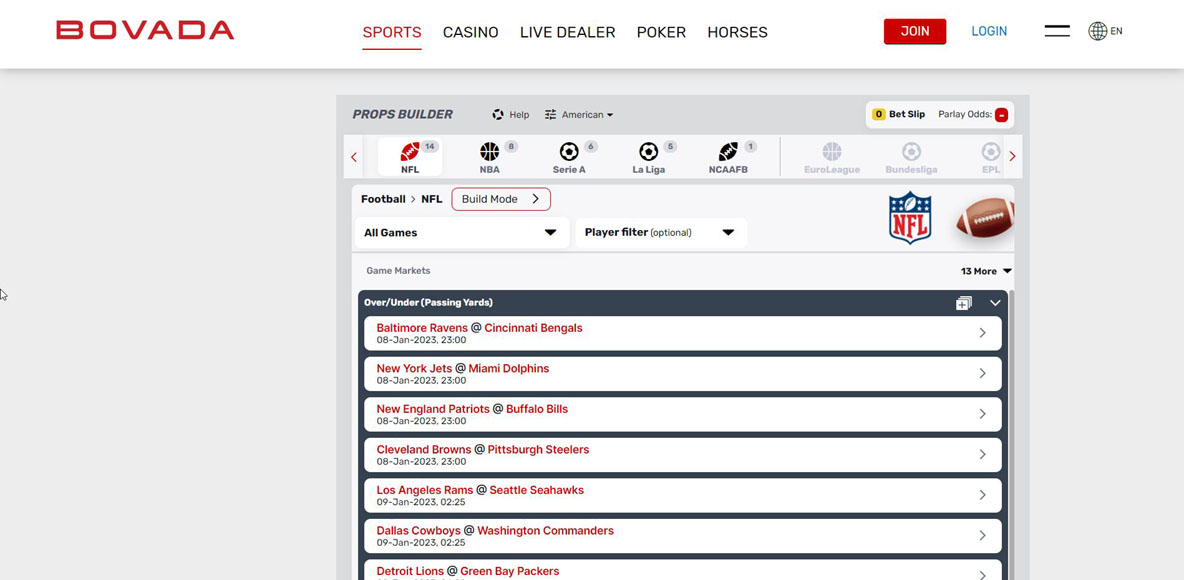

Bovada made its debut in 2011 as a full-service gambling site. However, thanks to their fully-operational mobile wagering platform, you can place mobile sports bets directly from your iOS or Android browsers. The best part is that this Curacao-licensed site does not have a downloadable application. It means you don’t have to download frequent updates on your smartphone.

Although Bovada covers sporting events across the globe, it is specifically designed for the US sports betting market. Luckily, Illinois is one of the 45 states where this site is live. So, Illinois players can bet on every major US sports league, including NBA, MLB, and NHL. Specifically, Bovada is one of the best NFL betting sites, thanks to the competitive odds it offers on professional football betting.

You will find all wager types to bet on football on Bovada. Its prop builder tool for the NFL is a comprehensive approach to prop bets. So, if you’re a football fan looking for the best Illinois site for prop betting, you must try Bovada.

Bovada boasts one of the best crypto sports welcome bonuses in Illinois, a 75% up to $750 crypto bonus. Use BTCSWB750 and make your first deposit using Bitcoin, Bitcoin Cash, Bitcoin SV Deposit, Litecoin, or USDT. This excellent bonus has a 5x wagering requirement.

Whether you want to deposit with Visa, Mastercard, or major cryptos like Bitcoin, Bovada has you covered. Overall, eight deposits and seven withdrawal methods are currently available on this site. The only downside is that Bovada charges a credit card deposit fee of 15.9%. However, the best part is the inclusion of Matchpay – an umbrella platform that includes popular e-wallets like PayPal, Venmo, Zelle, and more.

MyBookie entered the US market in 2014, specifically catering to Illinois bettors. Its parent company, Duranbah Ltd. N.V, obtained a Curacao license to offer a regulated betting environment for Illinois bettors.

Market Coverage

MyBookie provides a comprehensive range of betting markets. Whether you’re interested in the big four (NFL, NBA, MLB, and NHL) or more into college football and basketball, this top IL betting operator has you covered. You can even bet on popular horse racing events like the Kentucky Derby or who will win the 2024 US Presidential Election on this prestigious bookmaker.

MyBookie’s ‘Live Betting’ section is notably impressive, offering live odds on every significant sport and league that an Illinois bettor would want to wager on.

Top Feature

However, the single most compelling reason we rank MyBookie among the top three IL sportsbooks is their contest section. As an Illinois resident, you can also participate in MyBookie’s ‘Squares’ contest, where you pick your squares on the game board and have the chance to win huge prizes frequently.

Welcome Bonus

MyBookie welcomes new IL bettors with a generous sports sign-up bonus – 50% up to $1,000. To claim this one-time bonus, deposit at least $50. Use the MYB50 promo code and fulfill a 10x wagering requirement within 30 days, or the bonus expires.

Banking Options

You will find flexible banking methods – 13 for deposits and three for withdrawals. Deposit methods include two credit and debit cards, Moneygram, and 10 cryptocurrencies.

However, we would like them to include more withdrawal methods besides Bitcoin, wire transfer, and e-check. You can start wagering on MyBookie for as low as $20, with no upper limit on the maximum amount via the supported cryptocurrencies.

| Sportsbook | Welcome bonus | Playthrough | Valid for | Min. deposit |

|---|---|---|---|---|

| BetUS | 100% Up to $2500 | 10x | 14 days | $100 |

| Bovada | 75% up to $750 | 5x | doesn’t expire | $20 |

| Ignition | 200% Up to $2000 | 25x | 30 days | $20 |

| XBet | 50% Up to $500 | 7x | 15 days | $45 |

It depends on the site you choose. As long as an offshore sportsbook is properly licensed by a recognized authority, it is safe.

Our top three Illinois sportsbook operators have long been the only options on which to place online wagers for US sporting events. They are secure and reliable, offer the best value for your money, and help you transact your winning quickly and easily. Besides, they feature more exciting bonuses and competitive odds than the locally licensed mobile sites in Illinois.

Yes, online sports betting has been legal and operational in Illinois since June 2020, a year after state lawmakers legalized it. Caesars was one of the companies in first with sports betting through Grand Victoria Casino. And a DraftKings sportsbook in Casino Queen sprung up quickly, too.

However, offshore sportsbooks are also available. In fact, they are always open online, unlike a DraftKings sportsbook, for example, with hours dependent upon the casino with which they are affiliated. Offshore sites also offer other considerable benefits, like much larger welcome bonuses and cryptocurrency deposits.

Illinois, one of the largest states to offer online sports betting, allows up to 23 master sports betting licenses in a fully-operational market. Currently, seven online sportsbook applications are live and fully operational. Anyone who is 21 or older can bet on college and professional sports.

Betting on Illinois college teams is currently available at retail casinos only. Further, the Illinois sports betting law prohibits wagering on individual performances, such as player props for in-state school games.

Key Components:

Yes, retail sportsbooks are also legal and fully operational in Illinois. Rivers Sportsbook obtained the first sports betting license and was the first retail book in the Prairie State to accept bets at its location, Rivers Casino Des Plaines, in March 2020. Argosy Casino Alton, owned by Penn National Gaming, followed soon after.

On June 11, 2022, the Illinois Gaming Board approved seven casinos for master sports wagering licenses.

Soon after, Caesars Sportsbook (then William Hill) opened its retail sportsbook at Grand Victoria in Elgin on Aug. 1, 2020. DraftKings at Casino Queen opened its retail book on Aug. 5. Hollywood Casinos also opened their retail locations at properties later that month. Par-A-Dice Casino and its FanDuel sportsbook began accepting retail bets on Sept. 30, 2020.

Illinois sports betting is the outcome of contentious negotiation and intensive lobbying in 2019. Gov. J.B. Pritzker signed the bill on June 28, 2019. Physical sportsbooks began taking bets in March 2020, just in time for NCAA tournament. However, retail betting locations like the FanDuel sportsbook at Par-A-Dice Casino shut down a week later due to the COVID-19 crisis.

Due to the 18-month in-person registration requirement, new Illinois bettors could not participate in mobile betting in the Prairie State, even as several sporting events returned.

However, Pritzker temporarily allowed online registration in June 2020. Mobile wagering began on June 18, 2020, and in-person wagering resumed on July 1, 2020.

BetRivers temporarily benefited from the online-only window for weeks after it became operational on June 18.

The seven Illinois casinos that were granted master licenses by the state’s gaming board in June 2020 are:

Legal online wagering officially began in Illinois on June 18, 2020. Initially, BetRivers held the monopoly thanks to the controversial in-person registration requirement. It meant that only the state’s retail entities could be granted online sports gambling licenses in the 18-month window beginning in June 2020.

Rush Street Interactive, which owns Rivers Casino, was officially granted a master license on June 11, 2020, and BetRivers became the first online sports betting application in Illinois a week later.

As Illinois casinos reopened in July 2020, Pritzker reinstated the in-person requirement, a tough blow to DraftKings sportsbook, which required residents to visit its Casino Queen location in East St. Louis – nearly 5 hours away from Chicago.

Illinois permanently eliminated the in-person registration requirement for sports wagering on March 5, 2022.

As part of a larger gaming expansion package called the Illinois Sports Wagering Act, Illinois legalized sports betting in 2019.

On June 2, 2019, the Illinois Senate approved Senate Bill 690 by a 46-10 vote less than 24 hours after the House overwhelmingly passed it 87-27. A supermajority was required after Illinois Legislature announced that it would extend its session.

SB 690 was designed to put local casinos and venues in an advantageous position by allowing them to launch both physical and online sports betting mobile sites ahead of online-only operators.

In May, Rivers Casino owner Neil Bluhm asked Illinois lawmakers to penalize mobile operators FanDuel and DraftKings because, according to him, the two had been operating their DFS operations illegally in the Prairie State.

However, both operators joined forces, hired attorneys, and aired advocacy campaigns aimed at amending the penalty-box clause that would keep the two out of the Illinois sports betting market for three years.

Rep. Mike Zalewski, the main sponsor of the bill, realized the penalty clause could make or break the new industry. “(The penalty clause) remains the No. 1 issue to be decided upon and then I think we can file a final amendment,” he said.

Zalewski realized that the issue was consuming “all the oxygen related to sports betting.” “We know we need to make a decision on whether to include a penalty box or not. We still haven’t reached a consensus way to move forward on this.” He realized that if the penalty clause remained, the two companies would surely file a lawsuit.

Lawmakers eventually shortened the delay to 18 months, and the bill no longer called out the DraftKings sportsbook or FanDuel sportsbook specifically.

The original measure prohibited betting on Illinois college teams. It changed in December 2021 so that Illinois bettors could lay legal wagers on in-state college state teams. It came with Pritzker’s signing of HB 3136 into law on Dec. 17, 2021.

However, limited wagering expansion did not include betting on individual athlete performances or live betting action. Bets on in-state college teams can only be placed in person at the retail sportsbooks. (Here again, our top offshore Illinois operators provide alternatives.)

Illinois Gov. J.B. Pritzker signed sports betting bill on June 28, 2020. The law allows the state’s 10 casinos, three horse racing tracks, and seven sports venues to obtain licenses. The law also included the provision authorizing three online-only licenses after the first master license was issued. Sports betting facilities were also allowed to have one mobile skin each after they opened retail sportsbook facilities.

SB 690 was one of the four bills signed by the governor as part of the $45-billion Rebuild Illinois capital plan. Besides including six new land-based casinos, it also included Rep. Rita’s sports betting act – S 516.

The bill set out a $10 million license fee for master licenses for casinos and racetracks like the Hawthorne Race Course. Online-only licenses were to pay $20 million. Both licenses were renewable after four years.

Additionally, sports venues with a capacity of 17,000 or greater were also allowed to obtain a license at the cost of $10 million, which included mobile wagering within a five-block radius of the licensed venue.

Operators pay a 15% sports betting tax. The money goes to counties to support the criminal justice system and the Capital Projects Fund.

For the first 18 months of legal wagering, Illinois residents must sign up in person for an online account.

Rep. Bob Rita hailed the passage of the Illinois sports betting legislation. I’m proud to join Gov. Pritzker, Sen. Link, and our many dedicated advocates … that will benefit greatly from the gaming expansion package in Senate Bill 690,” Rep. Rita said.

The Democratic lawmaker said it is a testament to bipartisan work in the state’s capitol to create jobs and bring new entertainment and tourism dollars.

Besides the DraftKings sportsbook and FanDuel sportsbook, another key opponent of the bill was Chicago Mayor Lori Lightfoot. She opposed the proposal out of concern for the impact that betting at stadiums would have on Chicago casinos.

“I strongly support a gaming bill that directs a new casino and dollars to the city of Chicago. However, I oppose the inclusion of a provision that would open up sports wagering in venues like Soldier Field.”

Illinois was the second state after Tennessee requiring sportsbooks to purchase “official league data.” This refers to the set of statistics compiled by bet-on-sports entities and their authorized partners.

The concept has raised concern among legal sportsbook operators regarding this monopoly situation. The idea of empowering the leagues to control US sports betting first appeared in February 2018. The National Basketball Association and Major League Baseball officials demanded a 1% integrity fee from US sports betting operators in a legal market.

The Volunteer State was the first state with an official league data mandate in its sports betting law. Illinois soon followed suit. Michigan and Virginia launched their online sports betting industries in January 2021 and also have the data mandate.

The Illinois Gaming Board (IGB) regulates the entire sports betting industry and issues every sports betting license, including for online sportsbook applications. The IGB’s regulatory powers also cover the rest of the Illinois gaming industry.

Illinois sports betting law allows residents aged 21 and older located within state lines to participate in online sports gambling. However, our top three Illinois offshore sportsbooks accept Illinois players who are 18 or older.

Online Sportsbook – Land-Based Partner

All the following bonus types are available across our top three Illinois online sportsbooks.

A risk-free bet works like an insurance policy where you’re refunded your initial bet if you lose it. Online sportbooks in Illinois like BetOnline feature a risk-free bet of up to $250 when you bet on the NBA. Risk-free bets are a highlight of betting online.

A deposit match is where your Illinois sportsbook will match the amount of money you put into your account. Few licensed operators in the Prairie State offer deposit matches. Luckily, all of our recommended sites feature enticing deposit match bonuses. BetUS sportsbook’s 100% sports bonus up to $2,500 is the best deposit bonus in Illinois. The minimum deposit required to claim this bonus is $100.

Leading Illinois sportsbooks find pretexts to reward their regular customers. A referral bonus is one of those ways you can earn hundreds or thousands in bonus cash. All you need to do is refer a friend to your sportsbook, suggest he/she make a deposit, and you get a referral bonus. For example, BetUS offers a 100% refer-a-friend bonus of up to $2,000.

Odds boosts allow you to earn a bigger payout on specific bets. Leading Illinois sportsbook sites offer this promotion to incentivize regular players. BetOnline’s Odds Boosters offer boosted odds on various sports betting markets every day on numerous sports and wager types.

Leading Illinois sports betting sites offer parlay insurance to bettors. Usually, you must win each log of your parlay to win. However, with parlay insurance, one leg of your parlay wager is insured. If you lose one leg of your parlay, your sportsbook has you covered for a refund of your initial bet.

Some Illinois sportsbook sites allow you to place a bet on sports without depositing real money. All you need to do is to sign up to claim a no-deposit bonus, another type of risk-free bet. Unfortunately, none of our top Illinois online sportsbooks offer risk-free bets in the form of a no-deposit bonus.

Considering that most Illinois sports bettors prefer to place mobile bets, we have only rated the sites with 100% mobile-friendly features. Our recommended sites, like Bovada and BetOnline, are specifically optimized for mobile users. So whether you’re an Android or Apple user, our top three sports betting sites have you covered. You can directly browse their mobile website from your mobile browsers, place mobile bets, and withdraw your winnings anytime and anywhere.

Check out our overview of the top Illinois sports betting apps.

Offshore sportsbooks are more experienced, as they had existed for decades before legal US sports betting was born after the fall of the PASPA in 2018. Offshore operators also cover a wider market and have more competitive odds.

A significant downside of legal operators is that they must pay heavy licensing fees and taxes. Obviously, the end consumers (Illinois sports bettors) have to bear the brunt of these taxes. It results in worse odds at licensed sites. In contrast, offshore operators can offer competitive odds and more enticing bonuses than the locally licensed Illinois sportsbook applications can offer.

Another great advantage of using offshore sports in Illinois is crypto. You can deposit and withdraw using leading cryptocurrencies like Bitcoin, Ethereum, Bitcoin Cash, Litecoin, Ripple, and more.

Football is king in Illinois and usually attracts the most sports betting revenue in the state. According to the IGC’s latest report, football betting represented a record $358.2 million for October 2022.

Bovada is an ideal betting platform for NFL betting in Illinois. Its NFL page offers all the latest odds and bets, as well as game lines for various bet types, including moneylines, totals, and point spreads. You will also find futures odds, parlays, and specials on events such as the annual NFL Draft.

You can also enjoy Bovada’s exciting betting option using their Player-Props Prop Builder.

Besides our top three Illinois sportsbooks, we have also found some other commendable players in the market. XBet is one of the best online bookmakers in Illinois that became operational in 2013. An online sportsbook is worth considering if it has been around for some years (ideally five years or more). MyBookie is another significant operator that has played a crucial role in Illinois sports betting since it went online in 2014.

The Prairie State has three racetracks and multiple off-track wagering facilities. Illinois horse racing fans can also bet on their favorite horses via our top three Illinois sportsbooks, which include full-fledged racebooks.

The best part is that using BetUS, BetOnline, and Bovada racebook do not limit you to in-state racing events. Instead, these top Illinois racebooks provide competitive odds on global horse racing events. BetOnline, for example, features betting options for all three Triple Crown races, including the most celebrated Kentucky Derby.

Elections are one of the most popular betting choices among US bettors. However, betting on elections in the US, including Illinois, is prohibited. Our top recommended IL sports betting operators allow you to participate in prohibited bet types like elections.

Bovada is ideal if you’re looking to bet on the US presidential elections. BetUS is also our top pick if you want to bet on global politics futures, such as Australian state elections, Finland’s parliamentary election, European Union elections, and more.

Illinois gamblers can bet on a range of wager types via leading sports betting sites:

A moneyline is the simplest bet type in sports betting. You only need to pick a team or player to win. This bet type only includes odds. For example, a moneyline of +140 is just +140 odds ($100 to win $140) for the listed team to win. In contrast, a moneyline of -140 is just -140 odds ($140 to win $100) for the listed team to win.

A parlay combines multiple wagers on a single ticket to create a larger payout. An Illinois bettor must win each individual bet – or leg – to win the whole parlay.

A three-team parlay bet might include the Bears, Bulls, and Cubs – the trio of Chicago sports teams – each winning a playoff game.

Totals betting – or over/under betting – is wagering on the number of points both teams/sides will combine to score in a contest. This bet type has nothing to do with the winner or loser of the game. Illinois bettors may simply guess both teams’ total number/points/run total in a game. They don’t have to predict the exact total to win.

Point spreads are wagers on the margin of victory in a contest, usually in football and basketball. Take the NFL, for example. If the Chicago Bears are a seven-point favorite over the Indiana Colts, your Illinois sportsbook will show “-7” on betting lines. It means the Bears must win by more than seven points for you to win your Colts -7 bet.

Future bets are placed on an event – an award, contest, or election – that will be decided weeks, months, or years later. For example, futures bets include ‘Who will be the 2023 Super Bowl champion?’ and ‘Who will win the 2024 Presidential Election?’

A prop – short for a proposition – is a bet placed on smaller events within a game. It is not directly linked to the final outcome of a contest. Player props and team props are its most popular forms. An example of a player prop could be: ‘Will the Chicago Bulls lead in all four quarters against the Indiana Pacers?’

Live betting allows you to place an online wager as the game is underway. Unlike the pre-game bets, which offer fixed odds, live bets involve updated odds in real time in response to what’s happening during the event.

A prohibited bet is a wager type that the law does not allow licensed sportsbooks to offer. For instance, you cannot bet on ‘Where will the next classified Biden documents be found?’ via the DraftKings sportsbook at Casino Queen. However, Bovada offers +20,000 for a $100 bet if the next classified Biden document is found ‘In An Envelope At the Oscars.’

The top Illinois sports betting sites have made your online wagering experience more personalized, thanks to their world-class platforms. This section will provide some of the top features to expect from such sites.

Independent gambling reviews will help you find out how Illinois sports betting compares sites and what to look for when choosing the best one. An ideal way to complement your research is to check customers’ feedback. Those who have used a sportsbook could provide important information when making a final decision.

Licensing information is a make-or-break point when choosing a sports betting site. Considering your safety and financial security, only join a licensed Illinois betting site. While Illinois Gaming Board is a local regulator, it is not the only legitimate authority. The Panama Gambling Commission and Curacao eGaming Authority are the leading jurisdictions in online gambling.

Promotions are essential for two reasons. First, they offer risk-free bet offers, free bonus money and enable you to place more wagers. Secondly, it reveals the financial viability of the site.

When looking for a top Illinois betting site, you must choose one that allows a wide variety of wagering options. These include wager types and sports that are offered.

You must do comparison shopping when picking the best Illinois sports betting site. Creating accounts at different sites is a good option. Look for the best odds.

For example, let’s say the betting lines on an Illinois site are -110 for moneyline bets, and another site offers -120. It means the sportsbook offering -120 features worse odds, as you will have to risk $120 to win $100.

The last thing you want is to join an Illinois site and then struggle to withdraw your winnings due to a lack of payment options. The more deposit and withdrawal options a site offers, the better.

You will hardly face any issues if you join one of the top sites, mainly due to comprehensive Illinois sports betting FAQ pages. When you do need assistance or have a question, though, you must be able to reach out to customer support. Email, phone, and live chat support are the three most important communication channels.

For any player who suspects a gambling problem, contacting a customer support representative can provide options. Whether a bet on sports put you in a bad position or a friend or family member appears to have a gambling problem, hop on the live chat to seek help.

Illinois is home to some of the most popular sports leagues in the nation. The Chicago Bears, who won the last Super Bowl in 1985, is one of the most popular NFL teams in the nation. Thanks to the loyal fanbase of the Bears, Illinois posts the largest chunk of the betting handle on NFL betting. However, Chicago Bulls are no less popular in the Prairie State. During the Michael Jordan era, who led the Bulls to six NBA championships, the team was the most popular league in the state.

Chicago Blackhawks, a part of the Original Six in the NHL, dominated the league in the 2010s. It is now one of the most popular sports leagues to bet on in Illinois, along with the Chicago Cub, who won the 2016 World Series.

Illinois sports betting has posted a lifetime handle of $17.62 billion since it went operational in March 2020. The state’s sportsbooks have reported $1.41 billion in revenue for the same period. The Prairie State has generated $219.3 million in its lifetime sports betting taxes.

According to the latest IGB report, Illinois posted a record $1.03 billion in sports betting handle for November 2022. It was just $5526 (0.05%) more than October’s $1.029 billion.

The November figures put Illinois as the third-largest market – its traditional place – after New Jersey and Nevada.

While banking options may vary from one sportsbook to another, most leading Illinois operators will offer the following common deposit and withdrawal methods:

Illinois sports bettors will find four credit card deposit banking options via our recommended sites. While Bovada and BetUS include Visa, Mastercard, and American Express, BetOnline also includes Discover Card as a deposit option. However, credit cards come with a deposit fee, which may vary from 6% to 15.9%, depending on your chosen site and the bank that issues the card.

Bank wire transfers are also available across most Illinois sportsbooks, including the top three we reviewed above. However, bank transfers may have a higher minimum deposit requirement and may take up to two business weeks to process your withdrawals.

Usually, offshore sites don’t offer popular e-wallet banking options to US-based customers. However, Bovada makes an exception by allowing Illinois players to use PayPal and other e-wallet options via MatchPay. You need to create a MatchPay account to use this platform to connect leading e-wallet services like Venmo, Zelle, Chime, and CashApp.

Bitcoin is undoubtedly the most popular banking option in the Prairie State and one of the biggest advantages of offshore sites over the locally available Illinois sports betting mobile sites. Bitcoin deposits are almost always free and come with boosted promotional offers.

In cases of withdrawals, Bitcoin is the fastest. The best part is that Bitcoin online sports betting allows Illinois players anonymity, meaning they can securely place mobile bets without giving their personal details and identity.

Other cryptocurrencies – called altcoins – are also available. Our recommended offshore sites allow Bitcoin Cash, Ethereum, Litecoin, Ria, Ripple, Polygon, ApeCoin, Avalanche, Binance Coin, Cardano, ChainLink, Dogecoin, Shiba Inu, Solana, Stellar, Tether, and USDCoin.

Our top Illinois online sportsbooks offer lines on major professional and college sports teams and most major sporting events worldwide.

Yes, online Illinois sports betting is legal and operational across the state through state-licensed sites and their offshore competitors. You can learn more about gambling laws in Illinois here.

The state law restricts mobile betting to those 21 and older. But our top three Illinois operators accept players aged 18 and older.

Illinois online sports betting became legal on June 28, 2019, after Gov. J.B. Pritzker signed a sports betting bill – SB 690 – into law. Unfortunately, Illinois online casinos and Illinois online poker were not regulated under the new gambling legislation.

Yes, top offshore online bookmakers like BetUS and BetOnline dish out attractive bonuses and promotions for new and existing Illinois bettors.

The Illinois Gaming Board (IGB) regulates the entire sports betting industry, including online betting sites in the state.

You can either be a resident or a visitor to bet online in Illinois via state-licensed sites. You just need to sign up with one of the reputable betting operators to place mobile bets in Illinois.

Yes, you can play daily fantasy sports in Illinois using DFS operators like DraftKings and FanDuel. No law explicitly prohibits you from playing DFS contests in the state, though Illinois has yet to legalize the industry formally.

All the licensed operators in Illinois are safe for play. However, for the most secure online wagering, you should stick to the best Illinois sports betting sites.

DraftKings is legal and one of the licensed operators in Illinois sports betting via its partner, Casino Queen.

FanDuel is also legal in Illinois via a sports betting partnership with the Fairmount Park Racetrack.

Bovada is a legal online sportsbook with a Curacao license to operate in 45 states, including Illinois.

Yes, BetOnline is one of the largest online sportsbooks in Illinois and is licensed by the Panama Gambling Commission.

MyBookie also runs legal sports betting operations in Illinois, thanks to its Curacao license.

BetUS is the most trusted mobile betting platform, operating legally in Illinois since 1994. It is also licensed by Curacao eGaming Authority.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.