621

621 21

21Top features:

Top features:

Bonus:

350% up to $2,500 621

621 21

21

350

350 23

23Top features:

Top features:

Bonus:

$5,000 Welcome Package 350

350 23

23

231

231 9

9Top features:

Top features:

Bonus:

$8,000 Welcome Bonus 231

231 9

9It’s an exciting time for Michigan as their iGaming industry inclusive of online sports betting, casino gambling, and online poker fully launched on January 22, 2021. Things have gotten off to a flying start. Already there are 11 betting and gaming operators live in the state, and the first ten days of the legal market alone debuted with $42.7 million in gross gaming revenue (GGR).

With such a new industry emerging that is already showing huge potential in becoming a US market leader, thousands of Michigan residents are looking to get involved. But knowing where to start when such an array of internet gambling sites have appeared in such a short space of time can be confusing, especially to Michiganders who are new to online wagering and casinos. Thankfully, we’ve got you covered. You’ll find all the info you require on this page, from legalities to the options currently available for making real money online.

Our expert team researched the market to come up with the top three online casinos accessible to Michigan-based gamblers.

These are the best real-money casino apps reviewed as follows:

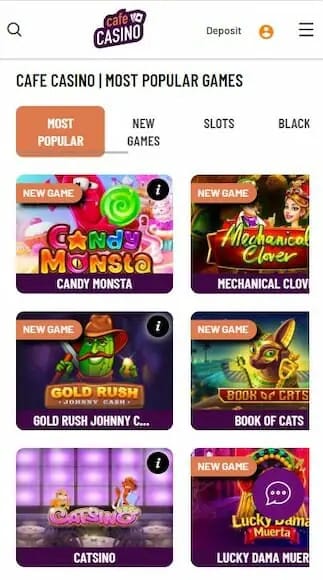

Since its foundation in 2016, Café Casino, which is run and acquired by a company called Lynton Limited, has obtained licensing from the Gaming Commission of Kahnawake. The operation of this online casino in such a jurisdiction ensures that it maintains compliance with fair play norms and standards, making it a trusted choice for players around the world.

Welcome promotions

Cafe Casino presents new players with an attractive welcome bonus package. The regular welcome bonus entails a 250% match of up to $1,500. Moreover, if you opt for cryptocurrencies, Cafe Casino extends a 350% Bitcoin Welcome Bonus that can reach a $2,500 limit. You should note that these bonuses carry a 40x wagering requirement, applicable to slots, keno, scratch cards, and specialty games.

Game selection

The game selection at Cafe Casino is robust, with game software provided by prominent developers like Rival and Real Time Gaming. Options range from traditional three-reel slots to five-reel video slots like “Cleopatra’s Gold”. Along with these, a variety of table games, notably blackjack and roulette, are also accessible. For those seeking the real casino feel, Cafe Casino offers live dealer games.

Other promotions

Apart from the generous welcome bonuses, Cafe Casino conducts a lucrative referral scheme where you have the chance to earn up to $100 for each friend you refer. Weekly mystery bonuses are also on offer to maintain an exciting gaming environment. The wagering requirements for these promotions typically range from 20x to 50x and depend on the specific offer.

Banking methods

Cafe Casino supports various banking methods for deposits and withdrawals, including credit card, Bitcoin, and lastly Bitcoin Cash. The minimum deposit is set at $20 for both Bitcoin and credit cards, with maximum deposit limits varying based on your level. Withdrawals can be facilitated via Bitcoin, bank wire or courier check. The minimum cashout amount is $20 for Bitcoin and $50 for courier checks, with Bitcoin offering the quickest payout times, often within 24 hours.

Established in 1994, BetUS Casino, owned by Lunada N.V., is one of the oldest players in the online casino industry. Working under the authority of Curacao, it provides a licensed and secure avenue for online casino gaming to players worldwide.

Welcome promotions

New players on this platform are greeted with a 150% casino bonus up to $3,000. For those favoring cryptocurrencies, BetUS offers an appealing crypto bonus boost of 250% which is capped at $5,000. It’s essential to be aware that these bonuses carry a 30x and 40x wagering requirement, applicable to games like slots, keno, or scratch cards.

Game selection

When it comes to game diversity, BetUS Casino offers a wide range of slots and other casino games, developed by prominent companies like Nucleus Gaming and Visionary iGaming. You can enjoy popular slots inclusive of “Fruit Crush” and “Bounty of Troy”, in addition to classic table games like blackjack, poker and roulette. For a more immersive gaming experience, live dealer games are also on offer.

Other promotions

BetUS Casino is not short on additional promotions. The ‘Casino Daily Promotions’ offers rewards like ‘Video Poker Wednesdays’ and ‘Roulette Fridays’, each with unique bonus codes, which can be found on their promotions page. There’s also a generous loyalty program offering additional bonuses and cashback. These bonuses carry wagering requirements typically ranging from 10x to 50x.

Banking methods

BetUS supports a variety of banking methods, inclusive of credit cards and cryptocurrencies such a Bitcoin and Litecoin. Minimum deposits start at $10 for crypto and $50 for credit cards, with maximum deposits reaching $5,000.

Withdrawals can be processed via crypto, courier check, or bank wire, with a minimum withdrawal limit of $50 for crypto and $100 for courier checks. Typically, crypto withdrawals are processed within 48 hours, making it the fastest option.

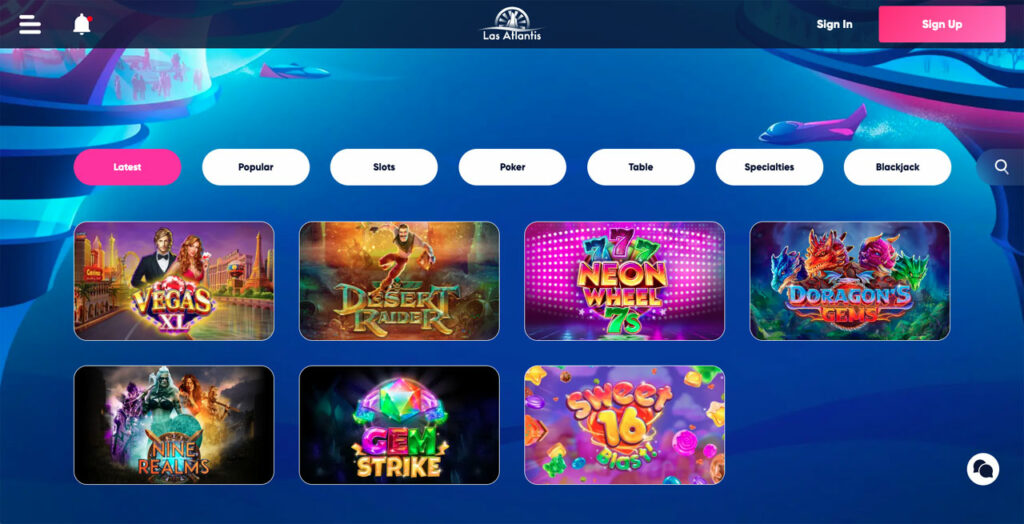

Las Atlantis Casino, owned by ArbathSolutions OU, made arrived in the gaming industry in 2020. Operating under the licensing and jurisdiction of the Government authorities of Curacao, it is regarded as a trustworthy entity in the international gambling industry. Las Atlantis additionally delivers one of the most generous Michigan no-deposit bonuses.

Welcome promotions

The platform welcomes its newest additions with a generous welcome bonus. Traditional gamers can enjoy a 280% bonus for slots on their first deposit. Crypto enthusiasts are not overlooked, as Las Atlantis offers a 300% Bitcoin bonus. These bonuses have a rollover condition of 35x, applicable to slots, keno, scratch cards, or board games.

Game selection

Las Atlantis Casino offers a remarkable selection of slots and other casino games, powered by the industry-leading software developer, Real Time Gaming. You can choose from a range of classic three-reel slots to modern video slots like “Cash Bandits 3” and “Asgard”. Additionally, table games such as blackjack, roulette, and poker are available, along with a live dealer casino for a more authentic experience.

Other promotions

Apart from the sign up bonuses, the online casino also offers a 165% slots bonus as part of its Game of the Month promotion, with no maximum limit. Furthermore, with the promo code ‘LASATLANTIS’, you can access a 160% bonus for slots and table games. All these bonuses carry a minimum 30x wagering requirement before withdrawal.

Banking methods

Las Atlantis Casino provides several banking options, including the prepaid option called Neosurf, credit cards, and the Bitcoin cryptocurrency. The lowest deposit threshold begins at $10 while using Neosurf, $20 when making payment via Bitcoin, as well as $30 when paying via credit cards, while The maximum deposit is between $250 and $2,500. Withdrawals can be made via credit cards, Bitcoin, or bank wire, with minimum and maximum limits of $150 and $2,500 respectively. Payout times vary between from one to five working days, with Bitcoin offering the quickest withdrawals.

| Welcome promotion | Bonus code | Wagering requirement | Minimum deposit | |

|---|---|---|---|---|

| Cafe Casino | 350% up to $2,500 | None | 40x | $20 |

| BetUS | 250% up to $5,000 | CAS250 | 40x | $100 |

| Las Atlantis | Up to $9,500 | UNDERTOW (1st deposit); DEEPSTREAM (2nd & 3rd deposit); WHIRLPOOL (4th & 5th deposit) | 40x | $20 |

| Ignition Casino | 300% up to $3,000 | None | 25x | $20 |

| Bovada Casino | 125% up to $1,250 on first three deposits ($3,750 total) | BTCCWB1250 (1st deposit); BTC2NDCWB (2nd & 3rd deposit) | 25x (1st deposit); 50x (2nd & 3rd deposit) | $20 |

| Red Dog Casino | 275% uncapped | None | 35x | $20 |

| XBet | 200% up to $500 | XBC200 | 40x (bonus only) | $45 |

| MyBookie | 150% up to $750 | MYB150 | 40x (bonus only) | $45 |

| Welcome promotion | Bonus code | Wagering requirement | Minimum deposit | |

|---|---|---|---|---|

| Cafe Casino | 120% up to $1,500 | None | 40x | $20 |

| BetUS | 150% match up to $3,000 | CAS150 | 30x | $50 |

| Las Atlantis | 280% up to $2,800 on five deposits ($14,000 total) | LASATLANTIS | 35x | $30 |

| Ignition Casino | 200% up to $2,000 | None | 30x | $50 |

| Bovada | 100% up to $1,000 three deposits ($3,000 total) | CAWELCOME100 (1st deposit); BV2NDCWB (2nd & 3rd deposit) | 25x | $20 |

| Red Dog Casino | up to $2,500 first deposit bonus | Bowmate | 35x | $20 |

| XBet | 200% up to $500 | XBC200 | 40x (bonus only) | $45 |

| MyBookie | 150% up to $750 | MYB150 | 40x (bonus only) | $45 |

| App | Slots | Progressive | Penny slots | Software |

|---|---|---|---|---|

| Cafe Casino | 161 | RTG, Revolver Gaming, Rival, Woohoo Gaming, Spinomenal, proprietary titles | ||

| BetUS | 350 | Betsoft Gaming, DGS, Nucleus | ||

| Las Atlantis | 200 | RTG | ||

| Ignition | 123 | Revolver, RTG, Rival, Spinomenal, proprietary titles | ||

| Bovada | 230 | DGS, Genesis, Revolver Gaming, RTG, Rival, Spinomenal, and proprietary titles | ||

| Red Dog | 153 | Rival, RTG | ||

| XBet | 150 | Betsoft, Concept Gaming, Rival | ||

| MyBookie | 200 | Betsoft, Rival, Concept Gaming, DGS, Rival, proprietary |

| Gambling App | Blackjack games | Min. bet | Live dealer blackjack |

|---|---|---|---|

| Café Casino | 8 | $1.00 | |

| BetUS | 32 | $1.00 | |

| Las Atlantis | 3 | $1.00 | |

| Ignition | 8 | $1.00 | |

| Bovada | 8 | $1.00 | |

| Red Dog | 3 | $1.00 | |

| XBet | 18 | $1.00 | |

| MyBookie | 24 | $1.00 |

| Gambling App | Roulette games | Min. bet | Live dealer roulette |

|---|---|---|---|

| Cafe Casino | 4 | $1.00 | |

| BetUS | 5 | $1.00 | |

| Las Atlantis | 1 | $1.00 | |

| Ignition | 4 | $1.00 | |

| Bovada | 4 | $1.00 | |

| Red Dog | 1 | $1.00 | |

| XBet | 5 | $1.00 | |

| MyBookie | 5 | $1.00 |

| Minimum deposit | Maximum deposit | Deposit fees | Withdrawal fees | |

|---|---|---|---|---|

| Cafe Casino | 0.0002BTC | Unlimited | Free | Free |

| Ignition Casino | 0.0002 BTC | 1BTC | Free | Free |

| Red Dog Casino | $20 | $1,000,000 | Free | Free |

| Minimum deposit | Maximum deposit | Deposit fees | Withdrawal fees | |

|---|---|---|---|---|

| Cafe Casino | $25 | $1,000 | None | None |

| Ignition Casino | $25 | $1,000 | None | None |

| Red Dog Casino | $30 | $1,000 | None | None |

Online casino gaming also became legal in Michigan in December 2019, overseen by the Lawful Internet Gaming Act. Citizens of the state and guests aged 21 or older can enjoy a wide range of casino games such as slots, roulette, blackjack, and even live dealer games online.

Michigan has a mix of 26 tribal and commercial casinos. These offer a comprehensive array of casino games including table and slot games, poker rooms, and other forms of gambling. Many also provide additional amenities like hotels, restaurants, and entertainment venues.

Poker is legal and can be played both online and at retail casinos in Michigan. Various formats, including Texas Hold’em and Omaha, are commonly available.

The Michigan Lottery has been in operation since 1972, offering an array of games such as instant tickets, number games, and interstate lottery competitions namely Powerball and Mega Millions. An online version of the Michigan Lottery also exists, providing a convenient way to play.

Charitable gambling in Michigan is overseen by the Michigan Charitable Gaming Division. Various forms of this type of gambling exist, including raffles, charity game tickets and bingo. These contests are frequently arranged by religious institutions, educational organizations, and non-profits to raise funds for charitable purposes. It’s crucial for these organizations to acquire the necessary licenses and adhere to state guidelines, which stipulate who can conduct the games, where they can be held, and how the proceeds can be used.

Bingo is a sought-after type of charitable gambling in Michigan. Numerous bingo halls are scattered throughout the state, providing a community-based atmosphere where players can enjoy the game while contributing to a charitable cause. Some noteworthy bingo halls in Michigan include:

These bingo halls not only offer a great gaming experience but also contribute significantly to community fundraising efforts.

Michigan’s gambling sector was revamped with the signing of HB 4311 in December 2019, introducing online casinos, sportsbooks, and poker sites.

Online casinos in Michigan are overseen by the Michigan Gaming Control Board (MGCB) and must partner with land-based casinos along with paying a substantial application fee.

Since its inception on January 22, 2021, Michigan’s online gambling market has seen rapid growth, with 10 licensed online casinos, 12 sportsbooks, and a poker site currently operational.

Land-based casinos are regulated differently, with tribal casinos having their own set of rules and Detroit’s casinos operating under the Michigan Gaming Control and Revenue Act of 1996.

Michigan is home to 26 local casinos. Of these, 23 are owned by Native American tribes, while the remaining three are in Detroit, authorized by the Michigan Gaming Control and Revenue Act of 1996.

While the minimum age for gambling online in the state is 21, some land-based gambling activities are available to those 18 and above, especially at tribal establishments.

While it’s true that offshore sites aren’t overseen by the Michigan Gaming Control Board (MGCB), it’s worth noting that these platforms offer an additional option for Michigan residents interested in online gambling. Importantly, there has been no recorded instance of legal action being taken against individuals in the state for participating in offshore online casino activities.

Our recommended choice for online gambling in the state is Cafe Casino, though other options we have previously evaluated are also worth considering.

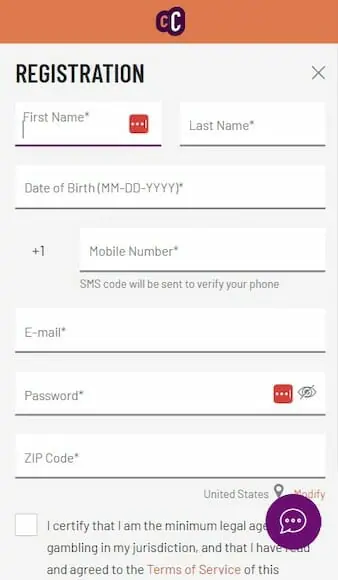

Navigate to the website known as Cafe Casino and click on the button that says “Join.” Insert basic information that includes your name, your provided email, and birth date to initiate your account creation. Upon completion, an email with a link will be forwarded to your provided inbox. Click on the link to finish your account setup.

With your account successfully set up, all you need to do is deposit funds. Go to the banking section for this. Cafe Casino offers a substantial bonus for initial deposits made with cryptocurrency, up until an additional $2,500. Select your favorite payment option, then continue with depositing the funds.

Having funded your account and availed any relevant bonuses, you may now proceed with wagering. Explore the plethora of available games, such as live dealer options, video poker, or high-stakes slots. Choose your preferred game, place a bet on your desired game, and commence with gameplay.

Address: 1777 3rd Ave, Detroit, MI 48226

This upscale casino offers over 3,500 slot machines, 143 table games, in addition to a poker room. Amenities include multiple dining options, a luxury hotel, and a full-service spa.

Address: 2700 Orchard Hwy, Manistee, MI 49660

Located in Manistee, the casino offers slots, table games, and a high-limit area. Amenities include a hotel, an indoor swimming pool, and multiple dining options.

Address: 11386 W Lakeshore Dr, Brimley, MI 49715

This casino offers a selection of slots and table games. Facilities include a hotel, golf course, and several dining options.

Address: 2901 Grand River Ave, Detroit, MI 48201

Situated in Detroit, the casino provides around 2,800 slot machines, 59 table games, plus a poker room. Amenities include a luxury hotel, multiple restaurants, and live entertainment venues.

Address: 11111 Wilson Rd, New Buffalo, MI 49117

Located in New Buffalo, this casino offers an assortment of slots, a poker room and table games. Facilities include a hotel, various dining choices, and a center where you can hold events.

Address: Various locations including Baraga (16449 Michigan Ave, Baraga, MI 49908) and Marquette (105 Acre Trail, Marquette, MI 49855)

These casinos offer slots, table games, and bingo. Amenities include hotels, dining options, and bars.

Address: 1760 Lears Rd, Petoskey, MI 49770

Situated in Petoskey, this local casino features, table games, slots and a poker room. Amenities include a hotel, several dining options, and a nightclub.

Address: W399 US-2, Harris, MI 49845

Located in Harris, this casino offers slots, table games, and poker. Amenities include a luxury hotel, golf courses, and multiple dining establishments.

Address: 7741 M-72, Williamsburg, MI 49690

This casino features a variety of slots and table games. Facilities include a hotel, multiple dining options, and shuttle services to and from the casino.

Address: Various locations including Sault Ste. Marie (2186 Shunk Rd, Sault Ste. Marie, MI 49783)

These casinos offers many game alternatives, such as slots and table games. Facilities include hotels, dining options, and entertainment venues.

Feel free to take a look at our comprehensive guides below, providing detailed information on other forms of legal gambling in the state.

The state of Michigan offers a diverse array of casino gaming options for enthusiasts to enjoy, both in local establishments and online platforms. Below, we delve into the details of various gaming choices you can engage in within the state’s borders.

Slot machines are among the leading casino games in Michigan. Available in almost all local casinos and online platforms, these games come in numerous variations, including video slots and traditional reel games. Progressive jackpots offer players a chance at significant wins.

Table games are a staple in most Michigan casinos. Players can indulge in classics such as craps, roulette and blackjack. The rules can vary from one establishment to another, so it’s advisable to familiarize yourself with the specific rules at each casino.

Video Poker combines elements of slots and Poker into a single game. This game is particularly popular among players who enjoy strategy-based games. Michigan casinos offer multiple variations like Jacks or Better, Deuces Wild, and more.

For fans of Poker, several Michigan casinos host dedicated Poker rooms. Here, you can partake in various Poker styles, including Texas Hold’em, Omaha, and Seven-Card Stud. Tournaments are frequently held, offering an added layer of excitement.

Several online casinos in Michigan offer live dealer games, delivering a real-time casino experience from the comfort of your home. Games featuring live dealers that are popular include roulette, baccarat and blackjack.

In addition to the mainstream games, Michigan casinos also offer niche games with the likes of Keno, Bingo, and scratch-off tickets. These games are usually geared toward casual gamers looking for quick, straightforward entertainment.

Michigan has a history of being open to gambling, with three commercial casinos in Detroit and 23 tribal casinos statewide, established after the passage of the Michigan Gaming Control & Revenue Act in 1997. Online gambling has had a more uncertain status, initially banned in 1999, then seeing the ban lifted in 2000. Until recently, online gambling existed in a legal gray area, neither explicitly prohibited nor officially legalized.

Now, all categories of gambling online are live and legal in the Great Lakes State. Here’s how the iGaming industry went from being unclear to fully legalized in a few years.

Michigan has a robust land-based gambling industry that includes both tribal and commercial casinos, primarily concentrated around Detroit, as well as sportsbooks. The state’s gambling roots stretch back to the early 20th century and also include a state lottery, pari-mutuel horse racing, and charitable gaming. The signing of HB 4311 in December 2019 fully legalized online gambling in the state, encompassing online casinos, sportsbooks, and poker rooms. Daily Fantasy Sports (DFS) and online lottery tickets are also legally available to Michigan residents.

In Michigan, the lowest legal gambling age for all forms of gambling online is 21. However, people age 18 can legally place wagers at some land-based tribal establishments and participate in pari-mutuel betting and charitable gambling. You can also purchase online lottery tickets at age 18.

Land-based gambling establishments and home games are covered by the Michigan code, with the most important regulations included in Section 432. Online gambling laws are covered in Public Act 152. You can see the full text of these on our Michigan Gambling Laws page.

No, you do not need to be a Michigan resident to bet online, but you do need to be located inside state lines when placing your wagers, playing games, or buying tickets for real money.

All the best Michigan online casinos, sportsbooks, and all other forms of gambling sites use geolocation technology which is powered by GeoComply. They can accurately determine your location in the world by using the GPS on your device, and if you’re not in Michigan, you won’t be granted access to place any wagers.

Depositing to an offshore gambling site usually involves using either a debit or credit card. The brands we recommend are Visa and MasterCard, in this specific order. American Express is available with some sites, but many Michigan-based players have been complaining about reliability issues when dealing with this particular brand. When it comes to cashing out, most sites will allow you to choose between a wire transfer and a couriered check.

Yes – Michigan online gambling sites are safe. The Michigan Gaming Control Board (MGCB) is responsible for awarding licenses to safe online gambling operators and has spent over a year drafting all the rules for online gaming. They oversee the entire industry to help protect players, as well as help with problem gambling.

All MI gambling websites – including online casinos, top Michigan sportsbooks, poker rooms, and DFS sites – are supervised by the Michigan Gaming Control Board (MGCB). The Michigan Lottery, however, is overseen by the Michigan Lottery Bureau.

Yes – Michigan has had a state lottery since November 13, 1972, when the Green Ticket game had its first sales. Today the Michigan Lottery has 7 in-house draw games and 3 multi-state draws, alongside pull-tab games and scratch cards. In 2014, online lottery ticket sales went live for anyone over the age of 18 to purchase.

Although it is a new industry, Michigan’s online gambling industry is flourishing. State projections suggest the mature market could bring $25 million of annual tax revenue, which would be divided between the home cities of land-based casinos, the state gambling fund, and the agriculture equine industry development fund. After the economic turmoil following the COVID-19 pandemic, this new revenue stream is much needed in the Great Lakes State.

Rhode Island has become the seventh state to launch an online casino market with the opening of Bally’s online casino on Tuesday. The new Rhode Island online casinos market will, […]

The gambling bill that aimed to put a comprehensive Alabama gambling law reform proposal before voters in November has stalled in the state Senate this week. HB151 and 152 call […]

Nevada’s January gambling revenues fell significantly on December 2023’s numbers. But operators still (just) hit a new record for the first month of the year. In total, all the Nevada […]

Recently closed Michigan racetrack Northville Downs is suing a nearby township over its negotiations to bring a new venue to the area. The final Michigan horse race betting venue shut […]

Eight North Carolina online sports betting operators are getting ready to launch on March 11. But one sportsbook has been able to jump the gun and make a limited launch […]

The Senator behind the recent — and most likely failed push to legalize online casinos in New York– has set up an open online meeting to discuss gambling addiction and […]

In a recent piece on the long-debated issue of online casino market cannibilization in the U.S, we discussed the demographic differences between physical casino customers and online gamblers. One thing […]

Caesars Digital, the online gambling arm of Nevada-based Caesars Entertainment, has signed two partnerships this week to expand its brand. The two deals will enhance its live dealer casino offering […]

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.