475

475 19

19Top features:

Top features:

Bonus:

125% up to $3,125 475

475 19

19

312

312 25

25Top features:

Top features:

Bonus:

50% up to $1,000 312

312 25

25

112

112 15

15Top features:

Top features:

Bonus:

50% up to $250 112

112 15

15We chose these top Minnesota online sports betting sites based on the best bonuses, competitive odds, and market coverage.

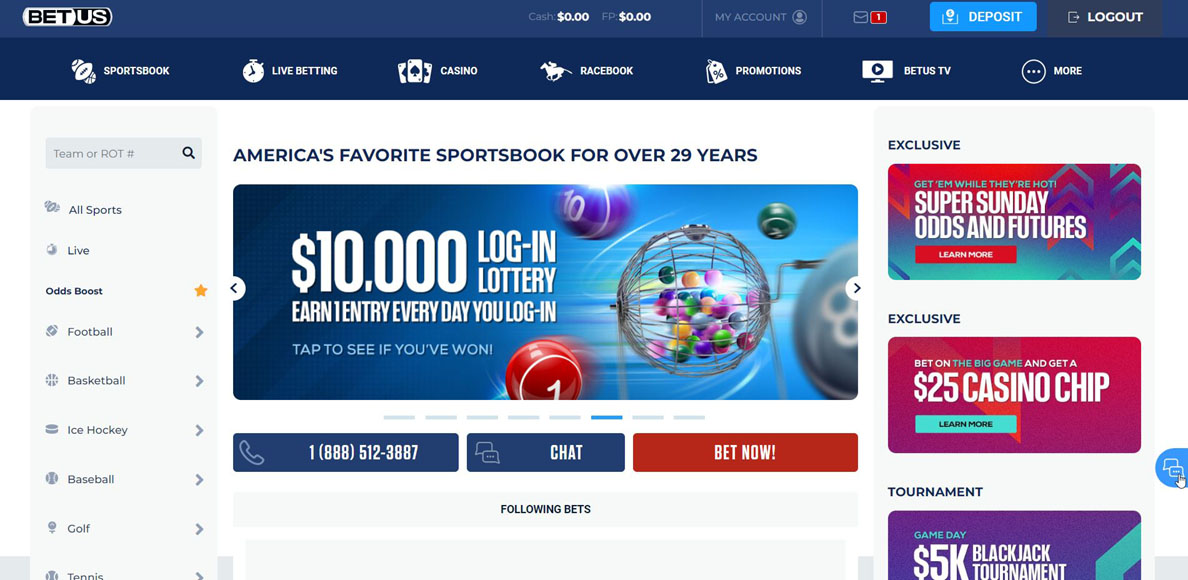

BetUS is the best Minnesota online sportsbook in 2023 because it offers the best welcome bonus and covers almost every sporting event in the nation. This site, owned by Firepower Trading Ltd, is also the most reliable operator in the Gopher State and has been available to residents since 1994.

The BetUS loyalty program is the top feature of the site. This six-level program starts at Blue and goes up to Black, where you qualify for a 10% bonus on deposits.

In addition, you receive points for every wager you place on sports online. The points automatically help you move up through this loyalty program. The other benefits include free payouts, exclusive invitations to the monthly tournaments of your tier, a toll-free number to speak with a dedicated account manager, and a welcome free-play bonus of up to $500 just for moving up in the program.

Minnesota sports bettors looking for the best sports welcome bonus will find it in the BetUS promotion section. The site offers a whopping 100% match up to $2,500 in its welcome bonus. Use bonus code JOIN125 and make a minimum deposit to claim this bonus, which carries a 10x wagering requirement and a 14-day expiration period.

Other bonuses at BetUS include a 150% casino bonus match of up to $3,000 and a 200% crypto bonus match of up to $5,000. Customers enjoy access to as much as $3,750 in sports welcome bonuses and up to $1,250 in casino bonuses.

BetUS offers lines on all the major sporting leagues, including professional football, basketball, baseball, and hockey. You can also bet on golf, soccer, boxing, NASCAR, motorsports, politics, media awards, and more.

BetUS allows decent banking options, including ten deposit methods, such as Visa, Mastercard, and various cryptocurrencies. Withdrawal methods include Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

The minimum deposit requirement at BetUS is $10, and you can deposit up to $50,000 via crypto.

Bovada has been available to Minnesota bettors since 2011 when the site launched its digital operations from Canada. Prior to this, it was known as Bodog, which operated for years in the same space. Now, Bovada is owned by the Mohawk Morris Gaming Group and licensed by the Government of Curacao.

Bovada’s prop builder tool for the NFL is the best thing about this site. Football fans in Minnesota can build unique prop bets, making NFL betting more fun than ever before.

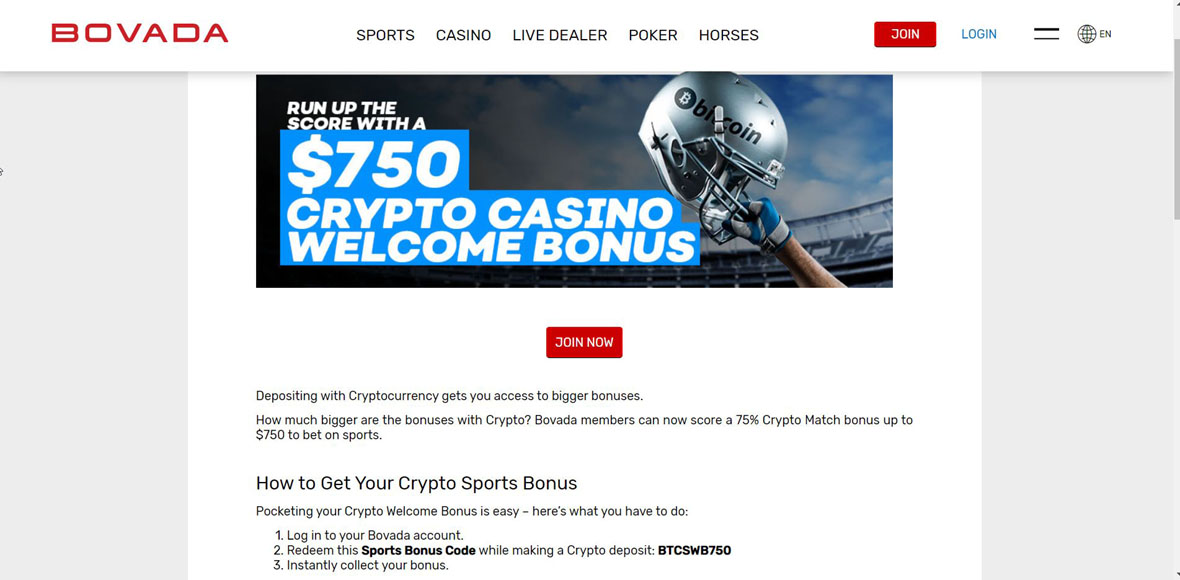

Bovada offers a 75% match up to $750 in its crypto sports bonus. Minnesota bettors can use Bitcoin, Bitcoin Cash, Bitcoin SV, Litecoin, and USDT to claim this exciting promotion.

This bonus carries a 5x rollover. Use the bonus code BTCSWB750 to claim it.

Bovada isn’t just an online sportsbook. It’s also a top Minnesota poker platform and casino with brilliant bonuses to match. Other promotions at Bovada include a $3,750 crypto casino welcome bonus and a 100% poker welcome bonus of up to $500.

If a significant sporting event occurs in Minnesota, the US, or any part of the world, Bovada will most likely cover it. From the big four to college sports, every major sporting event will be listed on this site for legal gambling.

As one of the best NFL betting sites, Bovada offers competitive odds on professional football. The site features all the major betting lines, including moneyline, spread, and totals. But its prop builder tool for NFL betting is ideal for prop betting fans in Minnesota.

Bovada allows eight deposit methods and seven withdrawal options. You can deposit via Visa, Mastercard, or several cryptos, including Bitcoin. However, the inclusion of MatchPay is an exclusive feature, making Bovada the only Minnesota site allowing e-wallet deposits and withdrawals.

The only thing we don’t like about Bovada is that it charges a 15.9% deposit fee on credit cards. However, the crypto deposits are free. The site’s minimum and maximum deposit requirement range is $10 to $5,000 via cryptos.

MyBookie is a reputable sportsbook licensed by the Curacao Internet Gaming Association, providing legitimacy to its operations since its launch in 2014.

Top Feature

MyBookie sportsbook offers exciting ongoing contests for Minnesota players, including ‘Squares.’ This contest involves picking NFL or NCAAF squares on a game board, with the opportunity to win real money prizes every quarter.

Welcome Promotions

This top Minnesota site offers an attractive 50% sports welcome bonus to new bettors, allowing them to receive up to $1,000 in bonus funds. A minimum deposit of $50 is required to claim this bonus.

The promo code MYB50 must be used during the deposit process. The bonus expires in 30 days and comes with a 10x rollover requirement.

Other Promotions

MyBookie offers a 25% Sports Reload Bonus up to $1,000, with a 6x playthrough requirement. Additionally, they offer a generous 200% Referral Bonus up to $200 per referred friend.

Both these ongoing promos allow users to earn bonus funds frequently to enhance their Minnesota sports betting experience.

Sports Betting Markets

MyBookie is highly regarded in the Minnesota sports betting community for its diverse offerings, covering major leagues such as the NBA, NFL, MLB, NHL, and even esports games like League of Legends and Dota 2.

However, we highly recommend this prestigious site for Minnesota sports betting fans looking for the best site for live wagering.

Banking Methods

MyBookie Sportsbook offers a variety of payment methods, making deposits convenient for its users. Traditional banking options include credit cards such as Visa and MasterCard.

This site accepts ten different cryptocurrencies for tech-savvy bettors, including Bitcoin, Bitcoin Cash, Litecoin, Ethereum, and Dogecoin. The minimum deposit using these cryptocurrencies is just $20, making it an accessible option for all levels of bettors.

You can use the following promotions when you bet on sports in Minnesota:

A risk-free bet allows you to get a refund if you lose your first bet. For example, BetUS offers up to $500 in risk-free bets on your first qualifying real-money deposit. If you lose it, the site will credit back the amount as free-play credits up to $500.

A deposit match bonus is where your Minnesota sportsbook will match a percentage of the amount you deposited initially. It usually ranges from 50% to 100% and goes up to 200% with crypto deposits.

For example, BetUS offers a 100% match up to $2,500. It means you will get an additional $2,500 in bonus money upon depositing $2,500, or lower amounts that meet the same terms and conditions. The max is $2,500.

Odds boosts is a promotion where your site offers increased odds on certain wagers and markets. For example, BetOnline’s Odds Boosters offers Minnesota players boosted odds on various betting markets daily.

Parlay insurance allows you to get a refund on your bet if one of the parlay legs misses. In a standard parlay bet, you must hit all your individual wagers to win money.

Leading Minnesota betting sites lavish rewards on their customers who promote their brands. It is called a referral bonus. For example, BetUS features a 100% refer-a-friend bonus of up to $2,000. You just have to refer your friends to BetUS.com.pa. Once they make their first deposit, you will get your reward.

You can join the best Minnesota sportsbook following this three-step process. We will use BetUS as an example to show how you can do this in the next few minutes.

Go to BetUS.com.pa and click on the ‘Join‘ icon. Then, follow the on-screen prompts to register your account. This will include giving your name and email address, as well as creating a passcode for the account.

Once your account is registered, you will see a ‘Deposit‘ icon on your top right. Click on it and choose among the preferred payment method to handle your personal financial choices regarding deposits.

Now, click the ‘Sportsbook‘ icon on the top left of your screen, pick your favorite sport/league, enter a bet amount on the bet slip, and bet online for real money in Minnesota.

State lawmakers are trying to legalize sports betting in Minnesota as we write this review in late February 2023. However, as of now, legalized sports betting under Minnesota law may have to wait, and mobile sports betting may not launch until 2024.

Therefore, the only viable option to bet online is via offshore sportsbooks that accept players from Minnesota.

No, online and retail sports betting is not legal yet in Minnesota. However, this can change in the near future as state lawmakers are working to legalize sports betting in Minnesota in 2023.

Recently, two new Minnesota bills appeared, renewing efforts to regulate sports betting in 2023.

On Feb. 22, 2023, Rep. Zach Stephenson introduced HF 2000, a few days after Sen. Matt Klein filed the companion bill – SF 1949.

The two Minnesota sports betting bills give the state’s 11 tribes and their tribal casinos exclusivity and set a 10% tax rate for wagers not taken on tribal lands. The proposed legislation also sets the legal sports betting age at 18 for retail sportsbooks and online sports betting.

MN sports betting apps will be capped at 11, with one mobile skin for each of the Indian tribes. The measure also calls for tribal compacts with the state for sports betting to remain in effect for 20 years.

Stephenson also proposed a similar measure in 2022, which cleared the Minnesota House but became stuck in the Senate. The upper chamber approved a more inclusive bill adding sports wagering licenses for two horse racing tracks and the state’s tribes. Neither measure received approval in both chambers.

The Minnesota Indian Gaming Association (MIGA) wrote an open letter to Rep. Stephenson, supporting the latest efforts to legalize sports betting in the state.

In January 2023, Rep. Stephenson expressed hope to see Minnesota sports betting becoming law this year. The newly formed alliance between the state’s tribes and six pro sports franchises strengthens his claim.

Stephenson’s bill is a mirror image of his last year’s proposal, which cleared the Democratic-controlled House before stalling in the Republican-led Senate.

Governing Democrats now have the majority in both chambers.

However, Sen. Klien’s bill will not be the only sports betting measure Minnesota Senate will be taking up this term. Sen. Jeremy Miller is also expected to introduce sports gambling legislation. Miller’s proposal does not include a tribal exclusivity component – a sticking point that killed the Minnesota sports betting bill last year.

It remains to be seen whether or not legal sports wagering will come to Minnesota in 2023. But the good news is that Minnesotans can still bet online via trusted offshore sports betting sites.

It depends on the site you pick. Many new sites are operating in Minnesota under dubious circumstances. For secure online gambling with consumer protection concerns (including help for gambling addiction) in mind, stick to the top three MN sports betting sites we have reviewed above.

The leading offshore sites, like BetUS, are the most trusted brands, having accepted Minnesota sports fans for decades. They also offer the best bonuses, competitive odds, and quick withdrawals.

All our recommended Minnesota sportsbooks are specifically designed for mobile betting on any gambling device, especially for Android and iOS users.

Android Sports Betting

BetUS, Bovada, and BetOnline are available for Android devices, offering a top-notch user experience. Minnesota mobile bettors can access the full suite of these sites’ services through their Android phones and tablets. The best part is that there is no downloadable application for Android, meaning you can bet directly from your Android browser.

iOS Sports Betting

Our top Minnesota sites are just as good for iOS platforms. Bettors with iPhones and iPads can enjoy mobile betting via their devices directly on their browsers. From signing up to placing your first sports bet and withdrawing your winnings, everything is just a touch on your device without an iOS casino app.

We have listed the most significant advantages of playing at an offshore sportsbook in Minnesota:

These are the most common sports bet types you can expect from any leading Minnesota site:

Moneyline is the simplest bet type with mostly two (but sometimes three) outcomes. You have to pick which team or player listed on the moneyline bet will win the event. The favorite will be represented by a negative (-) symbol, while the underdog is represented by a plus (+) sign.

A parlay bet ties multiple wagers into one larger bet. You must win each leg to cash your parlay.

For example, in a two-team moneyline wager in an NFL parlay, you think the Minnesota Vikings (-130) and the Tampa Bay Buccaneers (-120) will both win on Sunday. You could bet $10 on each win for a straightforward moneyline bet or parlay them together for a much larger payout. If you bet $20 on this NFL parlay, the payout will be $44.87. In a straightforward moneyline bet on each team separately, you will get $16.02.

Totals or over/under betting considers the combined goal, point, or run total of a game. You have to place a bet on whether or not the total will be more (over) or less (under) than listed by the oddsmaker before the kickoff.

A point spread bet is placed on the margin of victory in an event. Oddsmakers use point spread bets to level the playing field in games involving a favorite and an underdog.

For example, in an NFL game where the Minnesota Vikings are +6.5 (-110) and Buffalo Bills -6.5 (-110), the Bills are the favorite. The -6.5 suggests that your sportsbook believes the Bills are 6.5 points better than the Vikings. A spread bet on the Bills -6.5 means they must defeat the Vikings by at least seven points to cash your bet.

Futures is a bet on an event, such as a series or election, on which the outcome will settle days, weeks, or months after the wager is placed. For example, baseball fans can bet on ‘Who will the 2023 World Series?’

A prop bet is related to any in-game event other than the game’s final outcome. For example, you can bet on ‘Which MLB team will hit a home run first?’ or ‘What will be the length of the national anthem in Super Bowl 2024?’

Live bets or in-game betting allows Minnesota players to bet as a game is underway. The odds constantly change according to the latest in-game events, allowing you to adjust your bet accordingly. This is unique to online gambling and not allowed in retail sportsbooks.

Prohibited bets are those wager types that the licensed sportsbook cannot offer due to illegal gambling restrictions. For example, no licensed sportsbooks in legal sports betting states can offer odds on elections. Luckily, you can still find exciting odds on elections and most other prohibited bets in Minnesota using the top offshore sites.

The NFL is the most wagered-on sport in the nation, and Minnesota is certainly a part of this. The Minnesota Vikings are the most popular team in the state and continue to be, no matter their current Super Bowl record.

NFL fans in Minnesota can bet on their favorite teams on Bovada, which offers the most exciting odds on every NFL game. You can join the live NFL betting action with futures, lines, and spreads. If you’re looking for the best prop betting experience, we recommend Bovada’s prop builder tool for the NFL.

Minnesota has a long history in professional basketball. Minnesota was home to the Minneapolis Lakers, which won five NBA championships before the team moved to Los Angeles in 1960.

The Minnesota Timberwolves, the existing NBA team of the state, was founded in 1989. The team had a modest start in the league but did manage to win the Midwest Division in 2004. However, the Timberwolves have yet to win their first NBA title.

Get the latest betting odds & lines for the 2022-23 NBA season at BetOnline. The site covers the entire list of events and associated props and side bets.

The Minnesota Twins is the Major League Baseball team based in Minneapolis. The Twins hold a special place among Minnesotans as the only professional team to win the championship title – twice, in fact, in 1987 and 1991.

BetUS is one of the best MLB betting sites in Minnesota and offers all the league games to bet on. The site offers odds on MLB Series Prices lines, futures, runlines, and more.

The site currently lists the Houston Astros as the favorite to win the 2023 World Series, with a +600 moneyline bet. Those looking to bet on the Twins will get $4000 for every $100 wagered on their home team.

The Minnesota Wild is one of the most recent additions to the National Hockey League. The Saint Paul-based team started playing in 2000, seven years after the Minnesota North Stars moved to Dallas.

The Wild has made the playoffs in nine of the last ten seasons. Although they have yet to appear in the Stanley Cup Finals, they picked up a Division Championship in 2008.

Hockey fans will find the best odds on our top Minnesota sports betting sites. BetUS is a top-tier NHL site with some of the best moneyline and futures odds in the game.

The site currently lists the Boston Bruins as the favorite to win the 2023 Stanley Cup with +500 moneyline odds. Wild fans looking to bet on the home team will get $2,500 for every $100 wagered on the Wild to win the 2023 Stanley Cup if they do it.

Minnesota United FC is one of the 26 Major League Soccer teams in the US. Based in Saint Paul, United FC plays in the Western Conference of MLS.

XBet, one of the best MLS betting sites, offers competitive odds for point spread, moneyline, and total betting on soccer. The main reason it scores highly with Minnesota fans is props. You can find hundreds of props for soccer games on this site.

The Minnesota Golden Gophers men’s basketball team is one of the most popular programs in the state. The Gophers have won nine Big Ten championships.

BetOnline, one of the top basketball betting sites, is ideal for March Madness betting this season. This top offshore site features a $250,000 Bracket Madness Contest, allowing you to win up to $75,000. You must buy in with a $25 ticket before March 16, 2023. The contest then begins with the First Round of the 2023 Men’s NCAA Basketball Tournament on that day.

Minnesota football fans can also enjoy betting on the Canadian Football League on our recommended sites. The Canada-based Bovada offers early odds on CFL betting. Bovada allows you to bet on CFL futures, moneyline, and prop bets with crypto or credit card.

Minnesota Lynx is one of the 12 teams of the Women’s National Basketball Association (WNBA). Based in Minneapolis, the Lynx plays in the Western Conference and has won four WNBA titles in 2011, 2013, 2015, and 2017.

As a professional basketball specialist, BetOnline features the latest betting odds & lines for WNBA. The 2023 WNBA season will be the 27th season for the association and begins on May 19. BetOnline will cover the entire season, featuring moneyline, futures, and prop betting for Minnesota players.

The Minnesota Golden Gophers have a long history of a football program since it was founded in 1882. The team has won seven national championships, though the last major title came in 1960. Since 2009, the Gophers have played all their home games at Huntington Bank Stadium in Minneapolis.

The Bovada sportsbook is one of Minnesota’s top college football betting sites, offering NCAAF betting odds and attractive bonuses. Bet on NCAAF specials and futures with the best odds from this site.

Horse racing betting has been legalized in Minnesota since 1982. The Gopher State has a small horse racing industry, with two live racetracks – Canterbury Park and Running Aces Casino and Racetrack.

Minnesota horse racing fans can go to these venues for pari-mutuel betting on the Kentucky Derby or other major racing events nationwide. Minnesotans can also place bets online on horse races across America via our recommended sites, such as BetUS, BetOnline, and Bovada.

The Minnesota Racing Commission oversees horse racing in the state.

You can also bet on politics in Minnesota using our top offshore sites. Bovada is ideal for US election betting, offering exciting odds on presidential election futures. And BetUS is the best option if you’re looking to bet on global politics.

With +255 moneyline odds on Bovada, Joe Biden is currently the favorite to get reelected as the US President in 2024.

You will find unique betting lines, such as betting on religion in Minnesota. XBet, one of our top 10 Minnesota sports betting sites, offers to bet on religion and weather. So, the next time you want to bet on ‘Who will be the next pope?’ try the XBet sportsbook.

Minnesota is home to many professional sports leagues and popular college programs, such as:

In addition to the top three offshore sites, few new online sportsbooks have entered Minnesota sports betting to claim any of the market share. But XBet did just that.

This site has variety, allowing Minnesotans to bet on unique betting lines such as religion and weather. Their live betting section particularly surprised us as the site updates odds on every live event literally every minute.

MyBookie is another new entrant to Minnesota sports betting on our top 10 list. This site began operations in the Gopher State in 2014, a year after XBet appeared online.

MyBookie is ideal for experienced Minnesota bettors, who can win up to $350,000 from the sports betting contests on the site.

Look for the following points when choosing the best Minnesota betting site for you:

Reviews: Always do some research before signing up with a Minnesota sports betting site. For example, LetsGambleUSA offers independent reviews of each Minnesota sportsbook operator. You can also complement your research by reading customer reviews from those who used the site before.

Licensing Information: Also, make sure a recognized jurisdiction properly licenses the site you want to join. For example, Panama Gambling Authority and Curacao eGaming Authority are reputed regulatory authorities in the global online gaming space.

Promotions: Bonuses and promotions are also important factors to consider when joining a sportsbook in Minnesota. The bigger bonuses are always ideal to start with. For example, BetUS lavishes up to $2,500 on new players in its welcome sports betting bonus.

Accessibility: Only consider joining those sites that are accessible anytime and anywhere. That said, all our recommended Minnesota sites are 100% mobile-friendly. You can use them 24/7 from the comfort of your home or on the go.

Bets Allowed: The best betting sites offer extensive wagering options in all available betting markets. For example, moneyline, props, parlays, totals, futures, and live betting are some of the most popular wager types to look for.

Odds Pricing: Always do comparison shopping for the best Minnesota sportsbook. One ideal way is to compare the available odds between two or more sites.

For example, your Minnesota site offering -110 on a betting line provides better odds than the competitor site offering -120 on the same game. In the former case, you will have to put $110 to win $100; in the latter case, you will risk $120 to win $100.

Deposit and Withdrawal Methods: The more expansive banking options mean Minnesota players will have more ways to deposit and withdraw when betting online. For example, BetOnline allows 27 deposit and 22 withdrawal methods.

Customer Support: Customer support will help you reach a site representative if you face any issues. So, look for the Minnesota sites with email, phone, and live chat options. Our top Minnesota sites offer responsive customer support.

Minnesota sports bettors can use these banking methods to deposit and withdraw at the top Minnesota sportsbook sites:

Credit and debit card deposits are available across our top Minnesota sports wagering sites. BetOnline allows Visa, Mastercard, American Express, and Discover Card deposits and withdrawals.

The minimum deposit requirement on credit/debit cards is $25, and you can make a maximum deposit of up to $5,000 at BetOnline.

Cryptocurrencies are the most popular banking options in Minnesota sports betting. All top three Minnesota sites allow Bitcoin deposits and withdrawals. With 17 altcoins, BetOnline is one of the best altcoin online betting sites.

BetOnline allows a minimum deposit of $20 using Bitcoin and other cryptocurrencies. The maximum deposit limit with altcoins is $100,000 and goes up to $500,000 with Bitcoin deposits.

Minnesota players can also use wire transfers to deposit and withdraw at our top offshore betting sites. BetUS offers wire transfer deposits, while Bovada allows wire transfer withdrawals only. However, BetOnline allows both deposits and withdrawals using wire transfers.

The minimum deposit requirement for a wire transfer at BetOnline is $1,000, and there is no maximum limit.

Minnesota players can also use e-wallet banking when betting online. Only Bovada allows e-wallet deposits and withdrawals, thanks to its MatchPay option. You can create a MatchPay account to use connected e-wallets such as PayPal, Zelle, and Apple Pay.

The minimum deposit requirement at MatchPay is $20, and you can deposit up to $1,000.

As we write this review, Minnesota has no legal sports betting under the state’s regulator. But any legal sports betting landscape in Minnesota must include a decisive role by the Minnesota Indian tribes.

The latest Minnesota sports betting bill, put forward in February 2023, would authorize online sports betting via the state’s 11 tribal casinos:

No, Minnesota has yet to legalize sports betting, online or retail. However, this may change in the coming days, as at least two Minnesota sports betting bills will be put forward in each legislative chamber in early 2023.

Currently, none of our top Minnesota sports betting sites offer any no-deposit bonus.

Minnesota has failed to legalize online sports betting as of February 2023. However, with the latest push, Minnesota lawmakers and stakeholders seem to agree to the latest sports betting proposals put forward by Rep. Zach Stephenson and Sen. Matt Klein in February 2023.

Yes, offshore sites such as BetUS and BetOnline accept Minnesotans aged 18 and over for online betting on professional and college sports.

DFS remains in a legal gray area. A bill to regulate fantasy sports in Minnesota was defeated in 2018.

BetUS Sportsbook is licensed by Curacao eGaming Authority to operate in Minnesota and other US states.

DraftKings is not yet legal in Minnesota, but it runs fantasy sports operations in the unregulated Minnesota market. However, the Boston-based operator cannot legally offer bets on sports in the Gopher State until lawmakers officially approve a daily fantasy sports bill.

Bovada operates on a Curacao license in 45 states, including Minnesota.

BetOnline is one of the largest offshore online sportsbooks in Minnesota. It is licensed by the Panama gambling regulator.

FanDuel is not yet legal in Minnesota, but it runs DFS operations in the unregulated Minnesota market.

MyBookie is one of the top Minnesota sports betting sites and operates on a Curacao license.

Although Minnesota sports betting is not currently available via the state’s regulatory framework, the latest proposal will set the minimum age to place legal wagers at 18. Our top three offshore sites currently accept Minnesotans aged 18 to participate in mobile wagering.

The Minnesota Lottery will likely oversee sports betting once it launches in the state. It has experience regulating the state lottery and will be able to establish a regulatory framework for sports betting licenses in Minnesota.

Although the Gopher State has yet to regulate online gambling or daily fantasy sports contests despite the state lottery having been legal since 1989, we frequently review the top Minnesota online casinos‘ real money options. They offer thousands of real-money casino games, including online slot machines, table games, live dealer games, and more.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.