475

475 18

18Summary:

Summary:

Bonus:

125% up to $3,125 475

475 18

18

312

312 23

23Summary:

Summary:

Bonus:

50% up to $1,000 312

312 23

23

210

210 18

18Summary:

Summary:

Bonus:

50% up to $1,000 210

210 18

18Our best real money sportsbooks are BetUS, MyBookie, and XBet. All three NJ sportsbooks stand out among their competitors for better promotions, odds, and markets. This section will look briefly at each of these Jersey sportsbooks.

BetUS launched in 1994 and quickly became popular among online bettors in New Jersey. This prestigious site is owned by Firepower Trading Ltd, which holds an online gaming license from the Curacao eGaming Authority. With this license, BetUS accepts players from most parts of the US, including New Jersey.

Top Feature

The BetUS loyalty program is the most impressive feature of this NJ sports betting site. You can earn loyalty points for all sportsbook wagers and climb up BetUS’ six-tier VIP program. The following are some of the benefits that come with VIP status:

Welcome Promotions

BetUS provides a whopping 100% match for up to a $2,500 deposit as its sports welcome bonus. You can claim this offer by making a minimum deposit of $100. This bonus has a 10x wagering requirement and a 14-day expiry.

Use promo code JOIN125 to qualify.

Other Promotions

Other BetUS promotions include a 150% match bonus for casino players depositing up to $3,000; a 200% match for crypto depositors (150% for sports wagers and 50% for casino games); and a 250% match for casino deposits up to $5,000. Combined, these are some of the best casino bonuses on the internet.

Sports Betting Markets

BetUS provides odds on every major sport/league and college sport that a New Jersey bettor would want. So whether you’re an NFL, NBA, or MLB fan, or you want to bet on an international event like Spain La Liga or England Premier League, the BetUS sportsbook has it all.

Banking Methods

BetUS offers all of the most popular banking methods, including Visa, MasterCard, American Express, wire transfer, Google Pay, Apple Pay, and several cryptocurrencies. You can withdraw your winnings using Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. You can also request a cash payout through a customer support representative.

You can deposit as little as $10 on BetUS, and you can increase that number to $50,000 via crypto methods.

Crypto deposits are free and have the quickest withdrawal times.

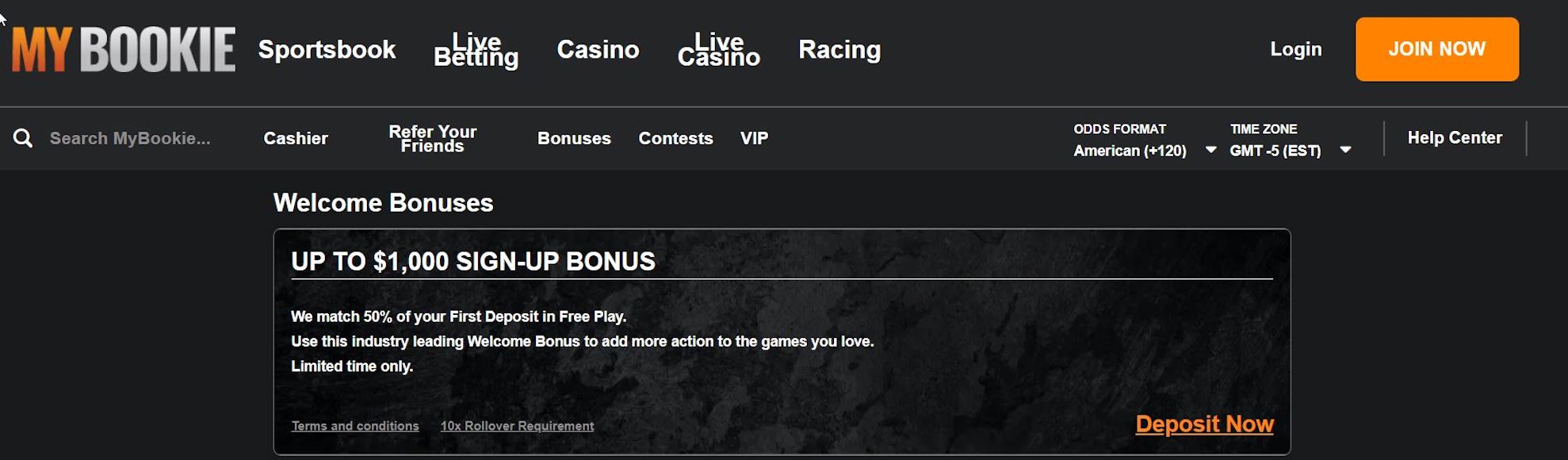

MyBookie is one of the best New Jersey sportsbooks online for mobile play and in-play betting. This Curacao-licensed site launched in 2014 and is owned by Duranbah Limited.

Top Feature

MyBookie is best known for its sports betting contests, which allow experienced NJ sports bettors to demonstrate their knowledge and win significant prizes. You can find these contests by clicking on “Contests” in the menu on the main page.

Welcome Promotions

MyBookie offers a respectable 50% match bonus for up to $1,000 of your first sports betting deposit. This welcome bonus requires a minimum deposit of $50, and you must clear the 10x rollover requirement within 30 days.

Use MYB50 to claim this deal.

Other Promotions

Other significant deposit offers at MyBookie include a 150% match bonus for casino players depositing up to $750, and a 10% match for cash deposits up to $200. The site also offers a 25% match up to $1,000 to reload your sports betting account. And existing players who refer friends to the site can receive a 200% match for their deposits up to $200 as a referral bonus.

Sports Betting Markets

MyBookie offers tons of betting markets, including pro sports leagues, college sports, golf, volleyball, esports, US politics, and more.

Aside from its extensive ‘Featured Odds’ section that includes almost every significant sporting event, players enjoy MyBookie’s ‘Live Betting’ section. You can find live betting odds for ongoing US events, from New Jersey Devils games to the WNBA championships.

Banking Methods

MyBookie offers 13 deposit options: Visa, MasterCard, MoneyGram, and 10 cryptocurrencies. However, the only withdrawal methods are Bitcoin, wire transfer, and e-check.

You can start wagering at this NJ sportsbook for as little as $20, and there is no maximum deposit limit if using Bitcoin.

MyBookie charges a 6% fee on credit card deposits, but crypto transactions are free.

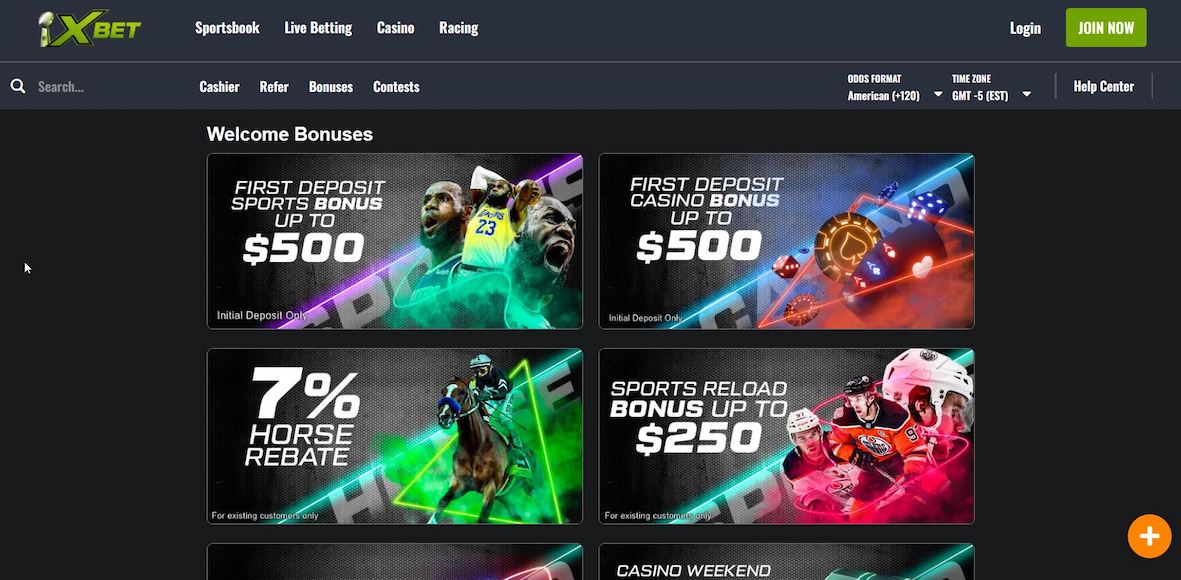

XBet is owned by Duranbah Limited, the same group that owns MyBookie and MYB Casino. This top-tier site launched in 2013 and is licensed by the Curacao gaming regulator to operate in the NJ sports betting market, as well as in most states across America.

Top Feature

The XBet sportsbook has a solid live betting section, allowing live in-play lines on every sporting event. The live betting action increases your chances of winning because you can adjust your bets according to the latest in-game situation.

Welcome Promotions

XBet offers a 50% match bonus up to $500 for sports. You can qualify for this one-time bonus by depositing at least $45. The 7x rollover requirement is very low, a rare gem in today’s legal sports betting industry.

Use the promo code XBET50 on the cashier page to grab this bonus.

Other Promotions

Other promotions at XBet include a first-time casino match bonus of up to $500; a match bonus for sports account reloads of up to $250; a match for casino reloads of up to $500; and a special match bonus for casino players on weekends only for deposits up to $1,000.

Sports Betting Markets

Every sports possibility – sports leagues, college sports, or international sports – is available on XBet. The site lists every betting option neatly in its ‘Sportsbook’ category. In addition, you can pick your favorite event by selecting ‘Featured,’ ‘Live,’ or ‘Top Bets,’ according to your specific taste.

Banking Methods

XBet offers 13 deposit and two withdrawal methods. These include two credit/debit cards (Visa, MasterCard), MoneyGram, and several cryptos, including Bitcoin. However, you can only withdraw using Bitcoin and wire transfers on this top NJ betting site.

The minimum deposit requirement at XBet is $20, with a $10,000 maximum via Bitcoin.

The site doesn’t charge fees for Bitcoin deposits.

You can find major sportsbook promotions at the top NJ sports betting sites, such as:

Risk-free bets are like bonus bets, as this promotion is generally offered on your first real-money bet. The site will offer a return of your initial bet up to a certain amount if you lose. For example, the BetUS sportsbook offers up to $500 in its No-Lose Bet promo on your first qualifying real-money bet. If you lose your bet, the site will credit up to $500 as free play.

A deposit match bonus is a deal in which your New Jersey sportsbook matches a percentage of your initial deposit with bonus bets. This proportion may vary between 50% and 100%, even up to 200% for some crypto deposit promotions. As an example, BetUS features a 100% match up to $2,500 as a sports welcome bonus. If you put in $2,500, the site will give you an extra $2,500 in bonus bets.

An odds boost is a promotion that increases the usual odds. For example, with BetOnline’s Odds Boosters, you can find boosted odds (+800) on the Atlanta Braves winning the 2023 MLB World Series. Without the odds boost, the odds are +500 on the same futures bet.

Parlay insurance allows you to get a return of your initial stake if one of your parlay legs misses. New Jersey sportsbooks usually offer this promotion to encourage customers to try parlay betting without getting discouraged if one part doesn’t hit.

You can win thousands of dollars in free bonus bets for just promoting New Jersey sportsbooks. For example, BetUS currently offers a 300% match bonus for referrals that deposit up to $6,000. When your friend signs up at BetUS.com.pa and deposits three times, you win your bonus.

New Jersey legalized sports betting in 2018. The state became a leading US online sports betting market for nearly four years until New York launched online wagering in January 2022.

Yes. Betting on sports online is legal in New Jersey, as overseen by the New Jersey Division of Gaming Enforcement. Nearly two dozen legal online sports betting applications, such as the Caesars Sportsbook, take statewide bets.

According to New Jersey gambling law, you must be 21 years of age or older to place an online bet in New Jersey. You can bet on all major sports leagues, but betting on NJ-based college teams – or any college teams – is prohibited.

Some of the most significant features of NJ online sports betting include the following:

The New Jersey legislature approved a sports betting bill three weeks after the United States Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) in May 2018. The 1992 federal law had long prevented betting on sports outside of four states, including Nevada.

In June, 2018, the NJ Assembly cleared bill A4111, and the Senate passed the same bill in short order. New Jersey sports betting became legal the next day after then-Governor Phil Murphy signed the bill into law. New Jersey became the third state to allow single-game wagering under state licenses.

Legal sports gambling was a dream realized for Gov. Murphy and all of the proponents of regulated sports betting in the Garden State. Shortly after signing the bill, Murphy released a statement:

“Today, we’re finally making the dream of legalized sports betting a reality for New Jersey. I’m thrilled to sign Assembly Bill 4111 because it means that our casinos in Atlantic City and our racetracks throughout our state can attract new business and new fans, boosting their own long-term financial prospects.”

Gov. Murphy officially launched NJ sports gambling on June 14, 2018, placing the first bet at Monmouth Park Racetrack. In August 2018, legal online sportsbooks began taking bets as well, with the DraftKings sportsbook the first to do so.

As of March 2023, more than two dozen NJ online sportsbooks were taking bets, according to the New Jersey Division of Gaming Enforcement.

New Jersey’s long road to legal wagering actually began in 2011 with a voter referendum supporting an amendment to the state constitution that would allow sports gambling. In January 2012, then-Governor Chris Christie signed S3113, a sports betting bill that would allow New Jersey bettors to wager on sports.

However, federal law at that time permitted only four states – Nevada, Delaware, Oregon, and Montana – to offer any type of sports wagering.

In August 2012, the NCAA and four major professional sports leagues filed a lawsuit against New Jersey, asserting that the state’s plans to go ahead with sports betting violated federal law. That case went all the way to the US Supreme Court.

Although Gov. Christie left office in January 2018, his efforts bore results four months later. In May 2018, the US Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) as unconstitutional. On May 14, 2018, the Supreme Court issued a 6-3 decision in Murphy v NCAA, ruling in favor of New Jersey.

More than 36 states have since legalized sports betting, with New Jersey leading the industry until neighboring state New York joined in January 2022.

The New Jersey Division of Gaming Enforcement (DGE) licenses and regulates sports betting in New Jersey, including online and mobile betting sites.

There are nearly two dozen online sports betting apps in New Jersey. The DraftKings sportsbook was the first to go live in the Garden State in August 2018. Others that followed included the FanDuel sportsbook, Barstool Sports, Borgata, and the Caesars sportsbook.

For secure online betting, we recommend the offshore online sportsbooks we reviewed on this page. These NJ mobile sports betting sites feature the best bonuses, competitive odds, expansive deposit methods, and quick withdrawals.

Here is a list of New Jersey mobile sports betting sites along with their retail sportsbook partners:

All the reputed NJ sportsbooks have mobile-friendly features for both Android and iOS users. The top offshore operators prefer not to offer downloadable applications for customer convenience, as frequent software updates can be onerous.

All top NJ sportsbooks are available for Android users. BetUS and BetOnline stand out as the best Android sports betting options. These mobile betting sites are specifically optimized for your Android phones and tablets. All services and betting options are readily available via your mobile web browser.

The top NJ online sportsbooks are also well-optimized for iOS devices. You can place your sports bets on your iPhones or iPads without downloading any software from the Apple Store. Simply pull up your web browser, and the site will provide all of its features on your device.

Nine Atlantic City casinos and three operating horse racing tracks offer NJ retail sports betting in the Garden State.

Here are some major reasons you should consider offshore sportsbooks for betting online in New Jersey:

These are the primary betting options when using our top NJ sports betting sites:

A moneyline is a bet on the outcome of a game. Your NJ sportsbook will list the odds for teams, with the favored team represented by minus (-) odds and the underdog by plus (+) odds.

For example, in an NFL game between the New York Giants and Detroit Lions, the Giants might be the -110 favorite, with the Lions as the +120 underdog. Betting on the New York Giants to win, you can receive $100 for every $110 wagered. In contrast, when betting on the Lions, a win will garner $120 for every $100 wagered.

A parlay is a combination of multiple wagers on a single ticket. You must win all the individual wagers – or legs – to win your parlay. Insurance allows you to miss one leg and still win.

A total bet (over/under bet) considers the number of points scored by both sides/teams. You can predict whether the total score will go over (more) or under (less) than a total predetermined by the oddsmakers before the game begins.

For example, in a game, your NJ sportsbook sets the over/under at 52 for the Giants versus the Dolphins. As a bettor, you can wager on the total points being over or under 52. If the Giants win 35-24 – a total of 59 points – the over bettor wins.

A point spread is a bet on the margin of victory in an event. NJ bettors can win bets when their team wins by a margin greater than the point spread.

For example, if the Giants are favored over the Chiefs by 5.5 points, and if the Giants win by seven points, the Giants cover the spread, and those bettors win.

A futures is a wager on an event with a result to be determined days, weeks, months, or years in the future. This can be a bet on the New Jersey Devils to win the NHL Stanley Cup or on a particular candidate to win the 2024 presidential election.

A prop bet is placed on events not necessarily linked to a final game outcome or score. This includes everything from which team will win a coin toss to how many times Academy Award winners will thank their parents.

Live betting begins after an event starts. These are bets during a game, as NJ sportsbooks continually update odds as a game progresses, allowing many more opportunities for wagering.

Prohibited bets are ones not allowed by legal NJ sportsbooks due to state licensing restrictions by the New Jersey Division of Gaming Enforcement.

For example, the DraftKings sportsbook cannot offer bets on NJ college teams or out-of-state college teams that play within the borders of the Garden State. Offshore sites like BetOnline do allow those otherwise prohibited bets due to sports betting market demand.

NJ sports fans support the New York Giants and the New York Jets as home teams. Although both NFL teams are based in the New York metropolitan area, both play their home games at MetLife Stadium at the Meadowlands Sports Complex in New Jersey.

Using the leading offshore betting sites, you can bet on any NFL team from New Jersey. BetUS is a top NJ mobile betting site that provides NFL live odds, moneylines, and futures, even offering early lines for primetime matchups.

You can also bet on all these leagues and sports in New Jersey:

NBA betting is big in New Jersey. The Brooklyn Nets initially played in NJ as the New Jersey Americans during their first season before relocating to New York in 1968. The team returned to New Jersey in 1977 to play as the New Jersey Nets until 2012. Although the team moved to Barclays Center in Brooklyn that year, the Nets remained one of the most popular NBA betting options in New Jersey, along with the New York Knicks and Philadelphia 76ers.

BetOnline is our top pick for the variety of NBA bets it offers, including moneylines, spreads, and totals. In addition, you will find plenty of futures, props, and alternative bets, along with live betting options.

New Jersey has no MLB team to carry its name, but that doesn’t stop baseball fans from supporting the Yankees and Mets, both based in New York. Using the top NJ online sports betting sites, you can bet on any MLB team.

We recommend BetUS for MLB betting for its competitive odds, Vegas-style lines, fast payouts, and generous welcome bonus.

The New Jersey Devils team is the only franchise in the state that is officially identified as a home team. The Devils compete in the National Hockey League (NHL) as a member of the Metropolitan Division in the Eastern Conference. This professional hockey team won three Stanley Cups – in 1995, 2000, and 2003. It also won five conference championships and nine division titles throughout the last five decades.

Alongside the Devils, you can also bet on the New York Islanders, New York Rangers, Philadelphia Flyers, or any other NHL team using our top NJ sports betting sites.

MyBookie offers excellent NHL odds and bonuses for New Jersey sports bettors. You will find early odds and lines on the NHL Stanley Cup playoffs in April, as well as the Stanley Cup itself. You can bet on any team, from the Devils to the New York Islanders or Rangers, or the Philadelphia Flyers.

The New York Red Bulls is a professional soccer team based in the New York metro region that plays its home games in New Jersey. You can bet on the Red Bulls or the New York City Football Club (another NY-based professional team) using reputable offshore betting sites.

The BetUS sportsbook is ranked among the top MLS betting sites for its generous promotions and competitive odds. There is a significant range of betting options, including moneyline bets, live bets, spreads, and MLS futures.

New Jersey is home to the Princeton Tigers and the Fairleigh Dickinson Knights. While state law does not allow college basketball betting, you can still enjoy excellent odds on March Madness action at offshore betting sites.

BetOnline brings you the top NCAA basketball betting action with the latest odds and lines on every game of the tournament. This sports betting application offers special March Madness promotions ahead of every NCAA tournament.

You can bet on the Canadian Football League from New Jersey. BetUS is our top pick for CFL betting, offering exciting signup bonuses and impressive CFL Grey Cup futures.

The New York Liberty is one of the most popular WNBA teams among NJ basketball fans. You can bet on any WNBA team using our recommended online sportsbooks. BetOnline stands out, as it will complete WNBA betting action for the 2023 regular season and then move right into the WNBA playoffs. BetOnline will have the latest betting odds and lines throughout.

Thanks to offshore sportsbooks, you can still bet online on NJ college football teams and other college teams with matches held in Garden State. These are not prohibited bets at a site like MyBookie. It offers excellent NCAA football lines, as well as live and competitive odds on college football.

While our top four offshore NJ sports betting sites offer unrivaled services, a few new operators have joined in to participate in New Jersey’s competitive market. Nitrogen Sports is one of those new entrants that has attracted many new bettors since it launched in 2012.

This user-friendly site has a simple design and is ideal for those looking to start betting with a secure mobile sports betting app. Nitrogen Sports makes it easy to join in two easy steps and offers fully anonymous betting via Bitcoin banking.

You should follow some guidelines when seeking the best NJ online sportsbook:

Reviews: Find out if your sportsbook application of interest has a good reputation. LetsGambleUSA offers honest reviews of every New Jersey sports betting site, poker room, and casino. You can then follow up by checking real customer reviews at online betting forums.

Licensing Information: Ensure the site is properly licensed by a recognized authority. For example, the Panama Gambling Commission and the Curacao eGaming Authority are reputed regulatory authorities in online gaming.

Promotions: A sports betting site’s ability to offer attractive bonuses reveals its financial reliability. It also shows that a site makes customers the priority and wants to earn their business.

Accessibility: Only consider New Jersey sports betting applications with mobile-friendly features. For example, all our top offshore sites are optimized for your mobile devices, both Android and iOS devices.

Bets Allowed: The site must allow various wager types and betting markets. For example, our top NJ sites allow moneylines, props, parlays, futures, totals, live bets, and more. Additionally, you can participate in NJ collegiate sports and politics betting using offshore sites only.

Odds Pricing: Always do comparison shopping when deciding between the New Jersey sports betting applications. Odds pricing is one effective way to find the best odds online.

Deposit and Withdrawal Methods: All the best NJ sportsbooks are sure to offer multiple convenient banking methods for their bettors. There should be credit cards in the mix, as well as some type of bank or wire transfers and multiple cryptocurrency choices.

Customer Support: Always choose an NJ sports betting site with efficient customer support. For example, your online betting home should offer support communications via email, phone, and live chat.

New Jersey reported $1.08 billion in sports betting handle in January 2023, which was the fourth straight month with a billion-plus handle. The legal NJ sportsbooks generated $72.3 million in revenue in January, resulting in $9.44 million in tax receipts for the state.

According to the December figures released by the Division of Gaming Enforcement, the Garden State reported nearly $11 billion in total bets placed in 2022. Of that sum, operators claimed $726 million as revenue.

In 2021, NJ became the first state to top the $10 billion mark in yearly sports betting handle. The NJ sportsbooks generated $815.7 million in revenue from that handle.

New Jersey initially levied an 8.5% sports betting tax on gross gaming revenue for retail wagering, with racetracks paying an additional 1.25% to the Division of Local Government Services in the Department of Community Affairs.

However, in October 2018, Gov. Murphy signed off on a 1.25% sports wagering increase to benefit the Casino Reinvestment Development Agency. That meant retail sports betting taxes were up to 9.75% in New Jersey, with online sports betting taxed at 14.25%.

You can use all these banking methods while betting online in New Jersey:

You can fund your NJ sports betting account using any of four credit and debit cards – Visa, MasterCard, American Express, and Discover Card.

MyBookie, which offers two of those options, charges a 4.9% fee on MasterCard deposits and a 6% fee for Visa. BetOnline offers all four card options but charges 9.75% on all credit card deposits.

You can deposit into your New Jersey sports betting account via Bitcoin and dozens of other cryptocurrencies. All our recommended NJ sports betting sites allow Bitcoin deposits and withdrawals, with BetOnline offering 15 crypto options. It is known as one of the best altcoin online sportsbooks in New Jersey.

Wire transfers are also available at our top NJ sports betting sites. While BetUS allows wire transfer deposits, MyBookie and XBet allow wire transfer withdrawals only. BetOnline is the only one that allows both wire transfer deposits and withdrawals.

New Jersey borders Delaware, Pennsylvania, and New York, all of which are legalized sports betting states. Delaware was, in fact, the first state to allow wagering on sports in the post-PASPA era.

Delaware outpaced New Jersey in becoming the first state to allow single-sport betting in June 2018. The Diamond State kicked off legal wagering with three retail sportsbooks that month. The Delaware Lottery released its sports betting revenue data showing $109.5 million in the fiscal year 2022.

Pennsylvania launched retail and online sports betting in May 2019. The Keystone State now has nearly a dozen mobile sportsbooks, almost half the number of NJ. The PA sports betting industry reported an annual handle of $7.25 billion for 2022. The PA sportsbooks generated $401 million in yearly sports betting revenue, an 18% year-on-year increase.

New York online sports betting launched in January 2022 and soon replaced New Jersey as the national leader. In January 2023, the New York State Gaming Commission released its full mobile betting revenue numbers for the first full year with $16.2 billion in total wagers. That resulted in nearly $1.36 billion in sports betting revenue and more than $692.8 million in tax receipts for the first full year of legal wagering.

Yes, both retail and online sports betting in New Jersey is legal and operational.

Unfortunately, none of our top offshore sportsbooks offer any no-deposit bonus bets.

Although New Jersey had been trying to legalize sports betting since 2012, the state finally did it in June 2018. Gov. Murphy signed the sports betting bill into law less than a month after the US Supreme Court declared PASPA unconstitutional.

Yes, reputed offshore operators accepted NJ players for decades before the state-regulated applications, like Caesars Sportsbook and FanDuel Sportsbook, went live in 2018.

Yes, daily fantasy sports are allowed in New Jersey. You can participate in DFS contests via Boom Fantasy, Monkey Knife Fight, Yahoo, DraftKings, and the FanDuel sportsbook.

BetUS has been available to NJ sports bettors since 1994. The site is licensed in Curacao to operate in Garden State.

Yes. The DraftKings sportsbook was the first locally-licensed mobile betting site to kickstart NJ sports betting in August 2018.

Bovada does not operate in New Jersey.

BetOnline is licensed by the Panama Gambling Authority to operate in all states, including New Jersey.

The FanDuel sportsbook operates legally in the Garden State for DFS as well as sports.

MyBookie is one of the top international gambling sites that accept NJ residents. The site operates in NJ with a Curacao license.

You must be 21 or older to bet online via any legal New Jersey sports betting app. However, the top offshore sites accept NJ bettors aged 18 and older.

The New Jersey Division of Gaming Enforcement (DGE) regulates all licensed gaming in the state, including online sports, DFS, and iGaming.

Yes, online casino gaming is legal and operational in New Jersey. We reviewed the best New Jersey online casinos for real money, which allow you to play thousands of online casino games, including online poker in NJ.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.