475

475 23

23Summary:

Summary:

Bonus:

125% up to $3,125 475

475 23

23

315

315 35

35Summary:

Summary:

Bonus:

50% up to $1,000 315

315 35

35

112

112 29

29Summary:

Summary:

Bonus:

50% up to $250 112

112 29

29The best online sportsbooks in Pennsylvania are BetUS, Bovada, and MyBookie. All these sports betting sites provide the best promotional offers, a top selection of betting lines and payment options, and a 100% mobile-friendly betting platform.

Let’s take a closer look at all five PA sportsbooks.

BetUS launched in 1994 and is one of the oldest online sports betting sites in Pennsylvania. This granddaddy of online betting is owned by Firepower Trading Ltd, which possesses a Curacao license to operate BetUS in the Keystone State.

Top Feature

The BetUS loyalty program is impressive and enables you to qualify for bigger bonuses, free payouts, exclusive access to an account manager, and special invitations to loyalty program tournaments.

You can climb this six-tier VIP program with every real-money sports wager placed. You will receive up to $500 in free play just for moving up one tier. In addition, if you reach one of the top three tiers – Platinum, Diamond, or Black – you will qualify for an extra 10% bonus on every deposit.

Welcome Promotions

BetUS provides its PA customers with lucrative promotions, including a 100% match welcome bonus for up to $2,500 in deposits. You must deposit at least $100 to claim it, and then the bonus requires a 10x rollover within 14 days to cash out any winnings from the bonus bets.

Use promo code JOIN125 to claim this exciting bonus.

Other Promotions

BetUS offers other promotions, such as a 150% match bonus for casino deposits up to $3,000; a 250% match casino bonus for up to $5,000; and a 200% match bonus for crypto deposits (150% match for sports wagers and 50% for online casino action).

Sports Betting Markets

BetUS offers wagers on every sporting event in Pennsylvania and across the United States. It has you covered to bet on leagues like the NFL, NBA, MLB, or NHL, as well as for international events. Click ‘All Sports’ in the sportsbook section of the main page to find your favorite leagues, sports, and betting lines.

Banking Methods

BetUS shows 10 deposit options, including Visa, Mastercard, wire transfer, Google Pay, Apple Pay, and several cryptocurrencies. In addition, the site offers withdrawal options of Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

PA bettors can deposit between $10 and $50,000 using Bitcoin at this site. All crypto deposits are free of fees.

Bovada was known as Bodog when it launched in 2004. This Canada-based site, now owned by the Morris Mohawk Gaming Group (MMGG), was rebranded to Bovada in 2011. Pennsylvania is one of the 45 American states in which Bovada operates legally with a Curacao license.

Top Feature

Bovada’s prop builder is the best feature of this site, allowing you to create your own prop bets if you don’t like the existing lines on the standard boards. This feature puts you in charge, allowing you to create thousands of custom prop parlays for bigger payouts.

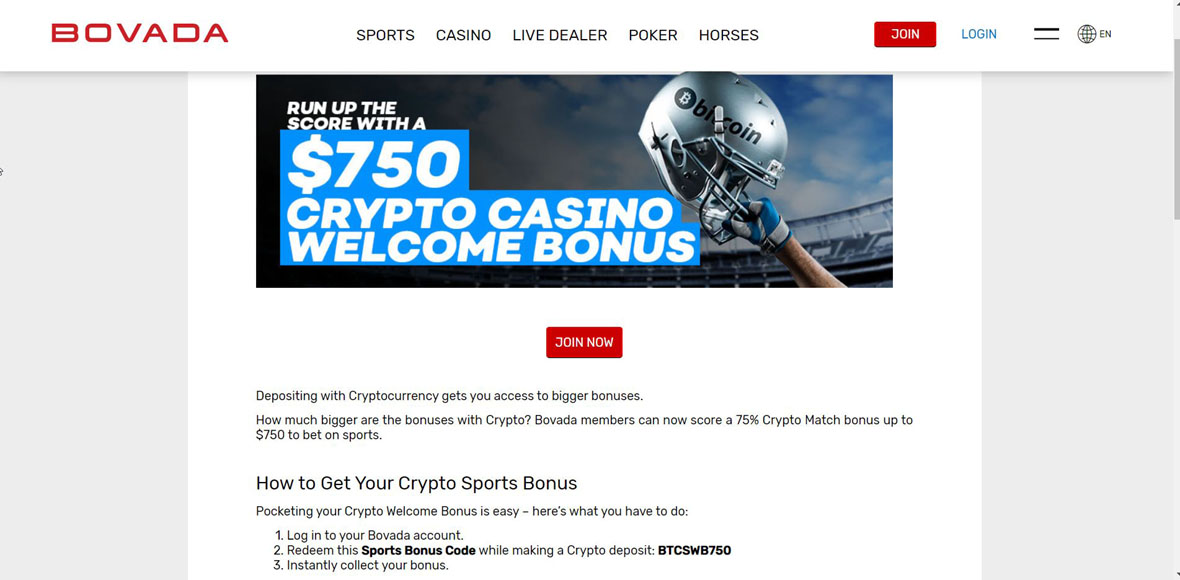

Welcome Promotions

Bovada offers an excellent 75% match welcome bonus for crypto deposits up to $750. New Pennsylvania bettors can grab this one-time bonus using Bitcoin, Bitcoin Cash, Bitcoin SV Deposit, USDT, or Litecoin. There is a 5x rollover on the initial deposit and the bonus amount.

Use code BTCSWB750 to claim this bonus.

Other Promotions

Bovada also offers a $3,750 bonus for crypto casino depositors, a $3,000 casino welcome bonus, and a 100% match welcome bonus for poker players depositing up to $500.

Sports Betting Markets

Bovada allows wagering on every American sport, including the Big Four and collegiate sports. You will find special betting events like March Madness in the ‘Trending Events‘ portion of the ‘Sports‘ section. If you want to look for your particular sport alphabetically, click the ‘All Sports (A-Z)‘ icon.

Banking Methods

Bovada offers eight deposit choices, including three credit cards (Visa, Mastercard, and American Express) and various cryptos. The withdrawal methods include wire transfer, check by courier, and crypto options. The site also includes MatchPay for banking, an exclusive payment method for e-wallet banking at PA sportsbooks.

Bovada has a minimum deposit requirement of $10 and a maximum limit of $5,000 when using cryptos. The site charges a 15.9% deposit fee on credit cards, but crypto deposits are free.

MyBookie is one of the new PA sports betting sites known for its live betting and contests. This Curacao-licensed site is owned by Duranbah Ltd and is licensed by the Curacao eGaming Commission. This gambling site launched in 2014, a year after its sister site – XBet – began its digital operations.

Top Feature

MyBookie’s sports betting contests are an excellent feature of this site, as they allow you to demonstrate your sports knowledge and win substantial cash and prizes.

You can find this trivia feature by clicking on ‘Contests‘ in the main menu. This sports betting site currently offers two contests, ‘MYBRACKET’ and ‘SQUARES.’ Read the terms and conditions to learn more about each contest.

Welcome Promotions

You can grab a 50% match welcome bonus for up to $1,000 when you make your first deposit at MyBookie. You must deposit at least $50 to qualify for this bonus, which has a 10x rollover and a 30-day time period.

Use MYB50 in the cashier to get this bonus and start clearing the bonus terms.

Other Promotions

Other significant promotions at MyBookie include a 150% match bonus for first-time casino deposits up to $750; a 25% match on reloads for existing sports customers; and a 200% match referral bonus for up to $200 in bonus bets for existing players.

Sports Betting Markets

MyBookie offers an extensive range of sports for wagering, including professional and college sports. The site’s ‘Sportsbook‘ section is neatly divided into ‘Featured,’ ‘Live,’ and ‘Top Bets.’ The live betting section is the most unique, as it allows you to watch games while betting at the same time.

Banking Methods

MyBookie provides PA bettors with impressive banking options. There are 13 deposit methods available, including two major credit cards (Visa and Mastercard), MoneyGram, and 10 cryptocurrencies. However, the only withdrawal options are Bitcoin, bank wire transfers, and e-checks.

The minimum and maximum deposit limits at MyBookie range from a minimum of $20 to a maximum of $10,000 via Bitcoin.

MyBookie charges a 4.9% fee on Mastercard deposits and a 6% fee for using Visa. Crypto deposits, on the other hand, are free.

Nearly all the leading Pennsylvania online sports betting apps offer some kind of promotion. Here are some of the most common bonuses for new and existing players.

A risk-free bet is a promotion that refunds your initial wager if you lose. For example, BetUS offers up to $500 in a risk-free bet on your first qualifying real-money wager. If you lose it, the site will credit back the amount as free play or bonus bets up to a $500 cap. BetUS calls it the No-Lose Bet.

The deposit match is a promotion to match a percentage of your deposit and award the bonus amount in site credits or bonus bets. Usually, the match percentages range from 50% to 100% with traditional deposit methods, but it can go up to 200% or more with crypto deposits.

For example, BetUS offers a 100% match deposit bonus for up to $2,500. So, if you make a deposit of $2,500, the site will offer an additional $2,500 in bonus bets. It will swell your account total to $5,000.

Leading PA sportsbooks may award odds boost promotions to offer better payouts to their customers on their winning bets. For example, BetOnline’s Odds Boosters are beneficial for futures betting on the MLB World Series. Pittsburgh Pirates fans may not be excited about the choices, but they can get +800 odds on the Atlanta Braves winning the World Series this year. Without this promotion, the site offers +500 on the same bet.

Parlay insurance gives you a refund on your initial bet if all but one of your parlay legs hit. Usually, you must win all your parlay legs to win the bet, but parlay insurance provides room for one missed prediction.

PA sports betting applications sometimes offer referral bonuses to customers who promote their brands or recommend them to friends. BetUS, for instance, awards a 300% match bonus for all referred players who deposit up to $6,000 across their first three transactions and give you credit for the referral.

Yes. Pennsylvania sports betting has been legal since 2017. However, the sports betting law didn’t become effective until after the US Supreme Court struck down the Professional and Amateur Sports Protection Act (PASPA) in May 2018.

Licensed state casinos can offer Pennsylvania sports betting at retail locations and via online and mobile partners.

Yes. Pennsylvania online sports betting is legal and operational per state law. The launch of the first mobile sportsbook in the Keystone State happened in May 2019.

Currently, there are 14 PA online sportsbooks that take statewide mobile bets.

Legal Pennsylvania sports betting is the outcome of House Bill 271, which passed the legislature in 2017, pending a change to federal law. Legal online sports betting later launched in May 2019, six months after the PA sports betting industry began offering retail wagering.

Here are some main points of HB 271:

In October 2017, the PA legislature agreed to House Bill 271 to legalize sports betting, though federal law had yet to allow it. This comprehensive legislative package was part of the state’s $2.3 billion budget that year. State lawmakers expected the legal sports betting market would bring $238 million to the state’s coffers that year. The high hopes reflected the hefty taxation on the new industry.

With regard to sports betting, HB 271 read in part: “It is also the intent of the General Assembly to authorize sports wagering when federal law is enacted or repealed or a federal court decision is filed that permits a state to regulate sports wagering.”

The bill cleared the Senate by a vote of 31-19, and it passed the House by 109-72. On October 31, 2017, the bill was officially signed into law by the Governor.

The bill didn’t only legalize sports betting; it also legalized PA online casinos and PA poker sites. Therefore, signing of the new legislation made Pennsylvania the fourth state in America to legalize online gambling. Delaware, New Jersey, and Nevada were the other three, though Nevada chose to omit internet casino games from its iGaming offerings, sticking with NV online poker only.

PA sports betting legislation was criticized for its $10 million license fee. In addition, its 36% tax rate was six times higher than the rate in Nevada and four times higher than in New Jersey.

Citing the operators’ fee and an exorbitant tax rate, Dan Shapiro, then VP of Business Development for William Hill, said, “There are other states that are more interesting to us.”

However, lawmakers were confident that their bet would win, believing that the huge business potential of the PA sports betting market would be too hard for casinos and online operators to resist.

Rep. Rob Matzie, who sponsored the 2017 gaming bill, said the competition was important for the Pennsylvania casinos.

“If the Sands in Allentown decides to do it, or the Rivers in Pittsburgh, or the SugarHouse in Philadelphia, then … everyone will fall in line, and they’ll all want to be a part of that,” Matzie said.

Even the National Football League (NFL) urged state lawmakers to reconsider the taxes as they would make licensed PA sportsbooks uncompetitive with offshore bookmakers.

“As the board works with state policymakers, we respectfully ask that you reconsider laws and regulations that could have the unintended consequence of advancing illegal sports betting,” Jocelyn Moore, NFL Senior VP of Public Policy and Government Affairs, said in a letter to the gaming board.

However, the lawmakers did not revise the tax rate.

Hollywood Casino at Penn National was the first Pennsylvania casino to take a legal sports bet in November 2018. Rivers Casinos in Pittsburgh and Philadelphia followed suit in December.

Hollywood Casino Morgantown, which opened its doors in December 2021, immediately launched retail wagering, putting the total at that time at 15 retail sportsbooks in the Keystone State.

In late May 2019, SugarHouse Casino became the first PA casino to offer mobile sports betting. As of April 2023, the Keystone State had 14 mobile sportsbook applications. Barstool, BetMGM, BetRivers, Caesars, and FOX Bet are among the legal mobile sportsbooks in Pennsylvania.

Since online sports betting went live in 2019, Pennsylvania has been consistently among the top five markets in the nation. Despite its high licensing fee and tax rate, the Keystone State already crossed the $20 billion in lifetime sports betting handle – becoming the fourth state to do so – according to the February 2023 revenue report.

The Pennsylvania Gaming Control Board (PGCB) oversees and regulates live and online sports betting, as well as most other forms of gambling in the state. Horse racing is a notable exception, as the State Horse Racing Commission oversees that.

The seven-member PGCB board is responsible for licensing and enforcing all sports betting laws and regulations. The board also releases monthly revenue reports.

The legal age for betting online at a PA sportsbook is 21. However, the top offshore sportsbooks accept Pennsylvania residents aged 18 and older for statewide mobile betting.

Player safety depends on the site you use. For secure online betting in Pennsylvania, we recommend the trusted brands we have reviewed here for many reasons, safety included. These top five Pennsylvania sports betting sites are known for protecting their players, as well as for providing the best bonuses, competitive odds, and quick withdrawals.

As of April 2023, there are 14 legal online sportsbooks in Pennsylvania. Each PA sportsbook application operates statewide as a mobile skin of a land-based casino partner:

The best PA sports betting sites allow you to bet on your mobile devices with just a few taps on your screen. Our recommended sites are ideal for every mobile device, including Android and iOS smartphones and tablets.

Our top five PA betting sites are designed for Android devices. Navigation is simple, and the pages load quickly, allowing you to place your online bets within seconds.

You will find a wealth of features and wagering options on the sites. Although there are no downloadable features, you can easily browse your phone or tablet to place mobile bets directly from your web browser.

PA mobile sports bettors with iPhones or iPads can try BetOnline or Bovada for the best online sports betting experience. Both of these sites allow you to bet directly from any iOS device without downloading any software from the Apple Store, making mobile betting simple and quick.

If you choose offshore sportsbooks for mobile betting in Pennsylvania, you will enjoy the following benefits:

You will find all these sports bet options when betting online in Pennsylvania:

Moneyline is the simplest and most popular type of pregame bet on the outcome of a game. For example, if the Philadelphia 76ers are -150 to beat the Dallas Mavericks (+120), you must wager $150 to win $100 on the favored 76ers. Or you can wager $100 to win $120 on the underdog Mavericks.

A parlay combines wagers on two or more games onto a single ticket for a larger payout. You must win all selections – individual wagers or legs – for a parlay bet to win. You can also combine various bets to create same-game parlays.

The more teams in your parlay, the higher the odds and the potential payout. For example, a four-team parlay with each game at -110 pays close to +1200. A $100 winning bet on this four-leg parlay would cash for $1,200.

A total bet, sometimes called an over/under bet, is based on the number of points/runs/goals scored in a sporting event. As a bettor, you have to choose whether the total will be over (higher) or under (lower) the line determined by the PA sportsbook.

A point spread is based on the margin of victory. As a bettor, you will wager on how many points it takes for a team to win or lose.

For example, in the most recent NFL Super Bowl between the Philadelphia Eagles and the Kansas City Chiefs, the Eagles were a -1.5 favorite and the Chiefs a +1.5 underdog. Those who wagered on their Philadelphia Eagles would have cashed their bets if their team won by two or more points. (The final score was 38 for the Chiefs, and 35 for the Philadelphia Eagles, a win for Chiefs bettors.)

Futures are bets placed on a player, team, or event when the results are to be determined at a later date. An example is an MLB futures bet on a baseball team, like the Pittsburgh Pirates, to win the World Series before the MLB season begins.

A prop or proposition bet is a side wager not necessarily tied to the final outcome of a game. Almost anything can be a prop bet, from picking the first player to score in a Philadelphia Flyers game to guessing the result of the coin toss at the Super Bowl. The four main types of prop betting focus on a player, game, team, and situation (novelty).

Live betting, or in-game betting, has become popular in recent years. It allows you to bet on an event after it begins. You will have plenty of options, from real-time props to adjusted point spread betting. In addition, leading Pennsylvania online sports betting sites, like BetOnline, Bovada, and MyBookie, update in-game wagering odds almost every minute.

These are bets that are banned by the Pennsylvania sports betting law. For example, if you want to bet on the NFL Draft or the Academy Awards, or even an upcoming political election, offshore sites can provide those opportunities.

Bovada is ideal for betting on US politics, like the 2024 US presidential election. BetUS features exciting odds on global politics.

The NFL is the most popular sport for wagering in America, and Pennsylvania is no exception. The Keystone State is home to two NFL teams, the Philadelphia Eagles and the Pittsburgh Steelers.

The Eagles attract the lion’s share of the state’s monthly sports betting handle. The team was the favorite in the 2023 Super Bowl prior to the game because they had won the Super Bowl as recently as 2018 when they defeated the Patriots 41-33.

The Pittsburgh Steelers team is the oldest franchise in the American Football Conference. The team has won six Super Bowls and eight AFC championships. The Pittsburgh Steelers’ last appearance in a Super Bowl, however, was in 2011, when they lost to the Green Bay Packers.

Bovada is ideal for NFL betting in Pennsylvania. The site features a massive NFL betting menu that can rival any other NFL betting site. Bovada offers exciting NFL odds on game lines, props, and totals. Additionally, you will find the NFL Draft and futures betting, even for those who want to bet on the Pittsburgh Steelers for the next season.

You can wager on all these sporting events in Pennsylvania using our recommended PA sportsbooks:

The NBA is the second most popular sport in Pennsylvania, which is home to the Philadelphia 76ers. The team was founded in 1946 as the Syracuse Nationals and now competes in the NBA as a member of the league’s Eastern Conference Atlantic Division. The 76ers have won three NBA Championship titles, the latest in 1983. Despite a decades-long drought, the Sixers still have a huge fan base in the Keystone State.

BetOnline is our top pick for NBA betting in Pennsylvania. The site offers dozens of sports wagering options on every game of the season. This site will also give you up to $1,000 in its welcome bonus to start your NBA betting.

Pennsylvania is home to two major league baseball teams – the Philadelphia Phillies and the Pittsburgh Pirates. Both MLB franchises have been playing in the Keystone State since the early 1880s. The Phillies have won two World Series titles (1980 and 2008). The Pirates, however, haven’t won the World Series since 1979.

BetUS, one of the best MLB betting sites, covers all betting for the 2023 MLB season, which kicked off on March 30. The site offers excellent MLB betting lines, featuring tons of markets and props on all of the baseball games, including the postseason games starting on October 3.

Pennsylvania is home to two NHL teams: the Pittsburgh Penguins and the Philadelphia Flyers. The National Hockey League is comprised of 32 teams, including 25 based in the US. The Stanley Cup is awarded annually to the winning playoff championship team.

BetUS gives NHL bettors quite a few options throughout the NHL season and into the playoffs, which begin in mid-April. You can bet on any games and for any team, even putting your money on the Philadelphia Flyers to win the 2023 Stanley Cup in the BetUS ice hockey futures betting section. (The Boston Bruins are the favorite to win.)

The Philadelphia Union is a professional team in Major League Soccer as a member of the Eastern Conference. The team was founded in 2008 and began playing in 2010, with home games played at Subaru Park in Chester.

Bovada is one of the best MLS betting sites in Pennsylvania, allowing four different ways – moneyline, spread, totals, and live – to participate in professional soccer betting.

In Pennsylvania, you can also bet on National Collegiate Athletic Association Basketball (NCAAB), more commonly known as March Madness. College basketball is a massive market, with the Pittsburgh Panthers and Villanova Wildcats being the most popular teams in the Keystone State.

You will find the latest betting odds and lines for March Madness betting at BetOnline. This NCAA basketball season may be over, but it is never too early to start betting futures for the next season.

Besides professional American football and college football, you can bet on the Canadian Football League (CFL) from Pennsylvania. The CFL consists of nine teams, all vying for the Grey Cup at the end of the season.

Bovada’s CFL bet selection is among the best in the market. The odds are more competitive than most, including appealing futures odds for the 2023 Grey Cup, with Winnipeg Blue Bombers currently the favorite to win.

Pennsylvania doesn’t have a WNBA team at this time. That shouldn’t stop you from betting on any of the 12 teams currently in the women’s league, however. The league’s regular season begins on May 19 and features 40 games per team.

BetOnline is the best of the Pennsylvania sports betting sites for WNBA wagers, with the latest betting odds, moneylines, and futures available.

College football is one of the most popular sports in Pennsylvania, home to the Pittsburgh Panthers. As one of the nation’s top college football teams, Pitt has won nine national championships for the University of Pittsburgh.

You will find dozens of different ways to bet on college football in Pennsylvania using Bovada. The site offers exciting NCAAF betting odds, as well as the prop builder tool to add some spice by creating additional wagering options.

Besides our top five PA sites, XBet has been one of the top online sportsbooks available to Pennsylvania residents since 2013. It isn’t exactly new, but it is one of the newest in the market. This Curacao-licensed site offers excellent ‘Featured Odds’ on every ongoing sporting event. Its ‘Live Betting’ section even includes lines on major global events as they happen.

You should consider a number of factors when choosing an online sportsbook in Pennsylvania.

Reviews: The best way to learn about a site you want to join is to listen to what bettors have to say. LetsGambleUSA is a leading source of reviews for every major mobile sportsbook in Pennsylvania, though customer reviews can be found on a variety of internet forums.

Licensing Information: Only join a licensed site for secure online sports betting in PA. Valid licenses hail from regulators like the Panama Gambling Authority and the Curacao eGaming Authority.

Promotions: Look for the PA sportsbooks that offer lucrative promotions. A site’s ability to provide better bonus packages reflects its financial viability and the importance it places on customer satisfaction. For example, BetUS features up to $2,500 in sports welcome bonuses.

Accessibility: It’s best to choose sites with mobile-friendly features. Our recommended PA sportsbooks are specifically optimized for Android and iOS devices, allowing for betting on the go to match your busy lifestyle.

Bets Allowed: The more betting types on a site, the better. Our top PA sportsbooks allow odds on moneylines, props, totals, futures, parlays, and live betting.

Odds Pricing: Always comparison shop for the best odds. For example, a PA betting site offering -110 (bet $110 to win $100) moneyline odds on a Pittsburgh Steelers victory is better than the competitor site offering -120 (bet $120 to win $100) on the same line.

Deposit and Withdrawal Methods: Consider joining an online sportsbook offering numerous banking options. This provides more flexibility when depositing and withdrawing money from your PA sportsbook. For example, BetOnline offers 27 deposit and 22 withdrawal methods, a surefire way to find the most convenient transfer method for you.

Customer Support: Only join a sportsbook with an efficient customer support system. If a PA betting site includes email, phone, and live chat, you can feel comfortable that any questions will be answered.

Pennsylvania sportsbooks generated $401 million in operator revenue in 2022. The revenue came from the total sports betting handle of $7.25 billion, which was a 10.67% increase from the $6.55 billion in 2021.

The Keystone State has generated over $1.5 billion in lifetime sports betting revenue from a total handle of more than $19.6 billion. In addition, the state has raised more than $380 million in tax receipts from legal sports betting.

Pennsylvania levies a 36% tax on sports betting after a one-time $10 million license fee.

The tax revenue from the sites goes to the state to help fund new projects and to distribute to local towns and cities where the casinos or horse racing tracks are located.

You can use all of the following banking methods for online Pennsylvania betting:

When using our top PA online sportsbooks, you can choose from four credit and debit cards. BetUS and Bovada allow Visa, Mastercard, and American Express. BetOnline goes a step further to add Discover Card to the list.

BetOnline allows a minimum deposit of $25 and a maximum deposit of $2,500. However, the site charges a 9.75% fee on credit card deposits.

All of our recommended PA online sportsbooks allow Bitcoin and other cryptocurrencies for deposits and withdrawals. However, BetOnline is one of the best crypto online sportsbooks with 16 options.

The minimum deposit requirement at BetOnline is $20, and you can deposit up to $500,000 using Bitcoin. There is no fee for crypto transactions.

The wire transfer is a method of transferring money to and from all leading Pennsylvania online sportsbooks. BetUS allows wire transfer deposits, while Bovada and MyBookie allow wire transfer withdrawals only. BetOnline and Sportsbetting.ag allow for both.

The sites’ minimum and maximum deposit limits range from $500 to $10,000. However, BetOnline charges a $45 fee, plus 3% of the payout amount, for all wire transfer transactions.

Offshore gambling sites don’t offer popular e-wallets to US-based customers. However, PA bettors can still use e-wallet banking at Bovada through a MatchPay account.

MatchPay is a P2P (player-to-player) credit trading platform that enables you to transfer funds between your preferred e-wallet and Bovada. The minimum requirement to make a MatchPay deposit is $20 and maxes out at $1,000. All MatchPay transactions are free.

Pennsylvania borders New York, New Jersey, Delaware, Maryland, West Virginia, and Ohio. All of these are legal sports betting states, with New York and New Jersey being two of the nation’s largest sports betting markets.

New Jersey was the first major state outside of Nevada to launch full-scale mobile sports betting, which it did in 2018. The Garden State soon became the national leader in terms of sports betting handles until New York launched mobile wagering in January 2022.

In 2022, the Garden State reported nearly $11 billion in sports betting handle. This was the largest annual betting handle New Jersey had ever seen. After paying off winning bets and other expenses, the operators kept $726 million of that total yearly handle as revenue.

New Jersey is no longer the top dog in the industry because of New York’s industry launch in January 2022. New Yorkers no longer had to cross the Hudson River to place their mobile bets in the Garden State.

New York online sports betting garnered $16.2 billion in total handle for the year 2022. The NY sportsbooks generated $1.36 billion in annual sports betting revenue. The Empire State, which charges a whopping 51% tax rate, recorded $692.8 million in tax receipts from the industry in 2022.

Delaware was one of the four states with legal sports gambling before 1992. However, it actually outpaced New Jersey in becoming the first state to allow legal wagering after PASPA was overturned in May 2018. But as of April 2023, Delaware sports betting was still limited to three retail locations. While online sports betting is legal, Delaware has yet to launch its mobile market.

The Delaware Lottery reported sports betting revenue of $109.5 million for FY 2022.

Maryland launched online sports betting in November 2022, nearly a year after retail betting began. The MD online sportsbooks posted $478.2 million in handle in December 2022, the first full month that the state’s seven mobile sportsbooks were all in operation.

Ohio is one of the most recent states to launch sports betting, which it did on January 1, 2023. The Buckeye State reported taxable sports betting revenue of $208.9 million in its launch month, breaking the post-PASPA record set earlier in January 2023 by New York.

Ohio residents and visitors wagered approximately $1.1 billion during the launch month. Ohio’s stunning revenue record is already $60 million more than New York’s short-lived record of $149.9 million.

West Virginia sports betting became operational in 2018, thanks to an amendment to state gambling laws that was approved before PASPA was struck down. WV generated a total of $7 million in revenue from a total of $53.3 million in sports betting handle from December 2022.

Although there are no tribal casinos in Pennsylvania, two Native American tribes own and operate gambling facilities in the state.

In 2019, the Poarch Band of Creek Indians secured regulatory approval to operate Sands Bethlehem. The $1.4 billion plan was approved by the Pennsylvania Gaming Control Board.

The Poarch Band joined the Mohegan Tribe in operating a commercial gaming facility in the Keystone State. The Mohegans operate Mohegan Sun Pocono in Wilkes-Barre.

Yes. Retail and online sports betting are legal in Pennsylvania, with over a dozen mobile applications taking statewide bets.

Unfortunately, no top PA online sportsbook currently offers a no-deposit bonus.

Online sports betting was legalized in Pennsylvania as part of an extensive gaming bill – HB 271 – in October 2017. However, the new industry had to hold its sports betting plans until after the Supreme Court struck down PASPA, which was the federal law that prohibited sports gambling outside Nevada for nearly two decades.

Yes. All the leading offshore betting giants accept Pennsylvania residents aged 18 and over to participate in professional and college sports betting.

Yes. Daily fantasy sports (DFS) was a part of HB 271, which also legalized sports betting, real-money online casino games, and poker. You can participate in daily fantasy sports contests using licensed DFS operators like DraftKings, FanDuel, or Yahoo.

BetUS is licensed by the Curacao eGaming Authority to operate across the US, including in Pennsylvania.

DraftKings is legal as a DFS operator and online sportsbook. The Boston-based operator partners with the Meadows.

Bovada is approved by the Curacao gambling regulator to operate in Pennsylvania, as well as in 44 other states.

BetOnline has been available to Pennsylvania bettors since 2001. This gambling giant is licensed by the Panama Gambling Authority.

FanDuel is legal in Pennsylvania as a DFS and sportsbook operator.

MyBookie runs legit online gaming operations in Pennsylvania thanks to its Curacao license.

According to state law, you must be 21 or older to place online and retail sports bets in Pennsylvania. However, our top offshore sportsbooks accept Pennsylvania residents at the age of 18 to participate in online betting.

The Pennsylvania Gaming Control Board (PGCB) is responsible for overseeing most gaming-related activities, including online sports betting. The board also licenses and enforces sports betting laws.

Online casinos are live and legal in Pennsylvania. You can join locally-available online casinos or trusted online gambling sites based offshore.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.