475

475 19

19Top features:

Top features:

Bonus:

125% up to $3,125 475

475 19

19

312

312 25

25Top features:

Top features:

Bonus:

50% up to $1,000 312

312 25

25

112

112 15

15Top features:

Top features:

Bonus:

50% up to $250 112

112 15

15These three real money betting sites are ranked the top Missouri sites based on excellent bonuses, competitive odds, and extensive market coverage.

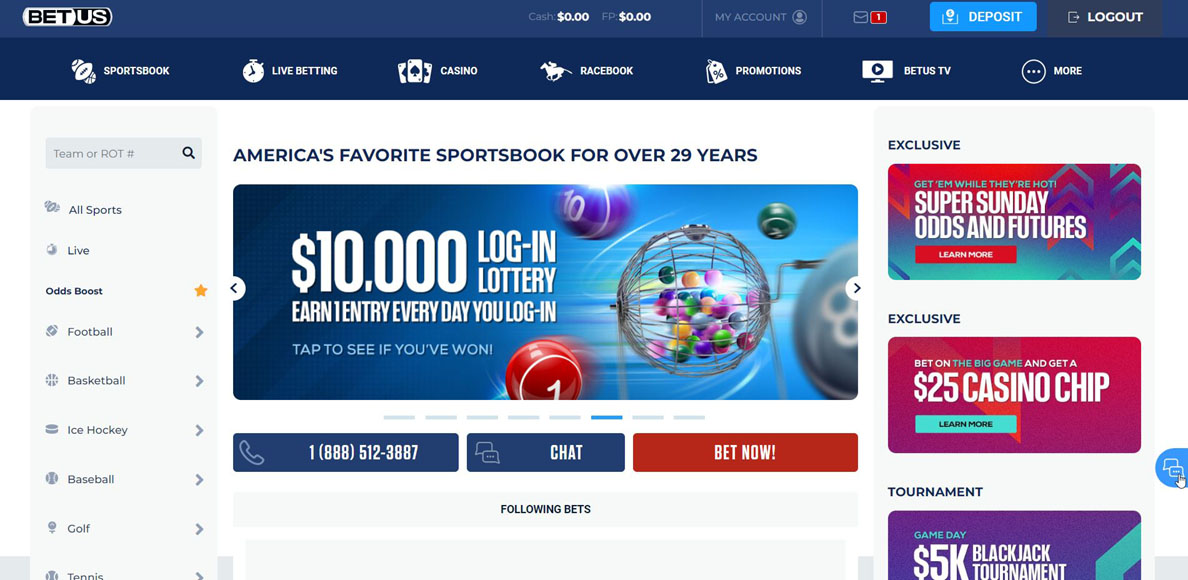

BetUS has offered continuous online betting services to Missouri players since 1994. This site is owned by Firepower Trading Ltd. and licensed by Curacao eGaming Commission.

Top Feature

The BetUS loyalty program is the best feature of this site, as it includes many exclusive benefits for regular players. This six-tier VIP program starts from the Blue tier and goes up to Black. With every real-money sports bet, you will earn points to move to the next tier.

As you climb tiers, you will earn free payouts. In addition, you will qualify for exclusive monthly invitations to the Loyalty Program Tournament of your tier. Any prizes you win in these tournaments will go directly to your BetUS account.

Additionally, the site will provide a dedicated phone number for your tier, allowing you to ask any questions to an account manager around the clock.

Welcome Promotions

BetUS offers a 100% match sports welcome bonus up to $2,500, the best welcome promotion for new Missouri sports bettors. The minimum requirement to claim this bonus is $100.

Use promo code JOIN125 and clear the bonus terms within 14 days. There is a 10x rollover requirement.

Other Promotions

Other promotions at BetUS include a 150% casino bonus up to $3,000 and a 200% crypto bonus up to $5,000, the latter of which divides into 150% for the sports bonus up to $3,750 and 50% for the casino bonus up to $1,250.

Sports Betting Markets

BetUS is fully loaded with extensive sports betting markets, featuring major professional sports teams in football, basketball, baseball, and ice hockey. In addition, every international sport you can imagine is listed on this vast site. You will also find an exciting selection of other betting options, such as esports, darts, politics, and awards.

Banking Methods

Missouri bettors can deposit into their BetUS accounts using 10 different banking methods, including Visa, Mastercard, wire transfer, and various cryptocurrencies. However, withdrawals are only allowed via Bitcoin, Bitcoin Cash, Ethereum, and Litecoin.

The minimum deposit at BetUS is $10, and Missouri players can deposit up to $50,000 on this site using the available cryptocurrencies.

Bovada has been online since 2011, providing premium online betting options to Missouri-based players for more than a decade. This Canada-based site is owned by the Mohawk Morris Gaming Group (MMGG) and is licensed to operate in Missouri by Curacao’s gaming regulator.

Top Feature

Bovada’s prop builder tool for professional football betting is the best thing about this site. Launched in 2020, this unique feature was first introduced to allow players to create their own prop bets.

If you want to bet on something other than the multiple offerings at Bovada, you can form your own for the site’s approval. You can add thousands of wagers over time, increasing your chances of receiving the biggest possible payouts.

Welcome Promotions

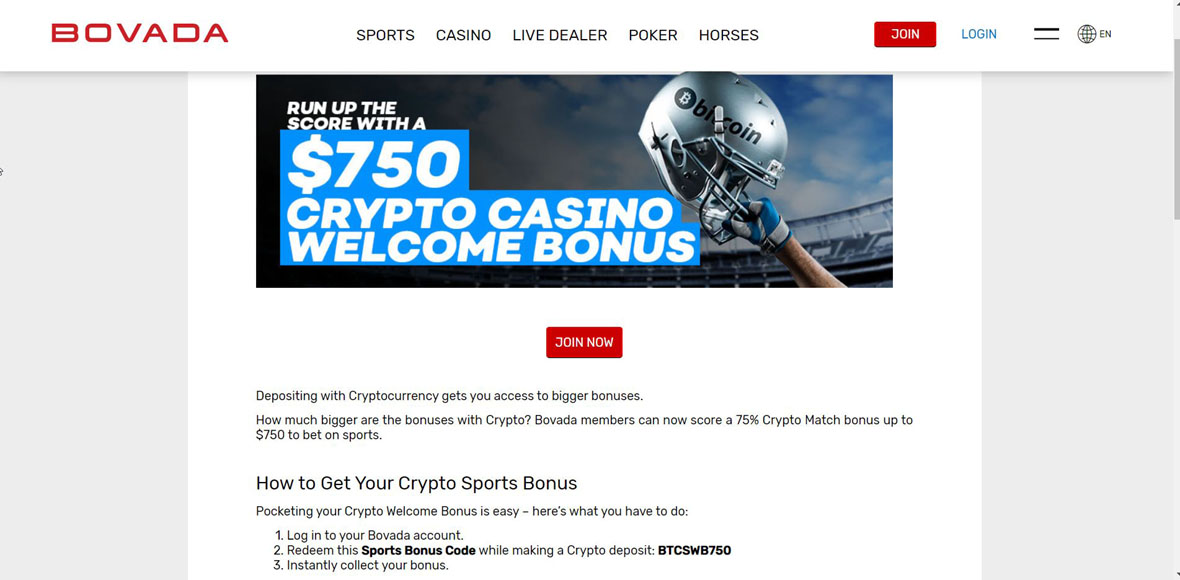

Bovada offers one of the best crypto sports welcome bonuses—a 75% match up to $750. Use the code BTCSWB750 and make a minimum deposit of $20 to qualify for this bonus.

Note that you must deposit using Bitcoin, Bitcoin Cash, Bitcoin SV Deposit, Litecoin, or USDT to cash in on this promotion. The rollover requirement is only 5x, which is quite low in comparison to most bonus terms offered by Bovada’s competition.

Other Promotions

Aside from its sportsbook offerings, Bovada is also among the best Missouri poker platforms and online casinos. Therefore, other exciting promotions at Bovada include a $3,750 Bitcoin casino welcome bonus and a 100% match poker welcome promotion of up to $500.

Sports Betting Markets

Bovada features tons of sports betting options, including offerings in all the major markets. From the Big Four (MLB, NBA, NFL, and NHL) to college sports and from the Canadian Football League (CFL) to the British Premier League, Bovada has you covered.

The site includes an ‘All Sports (A-Z)’ section where you can scroll alphabetically to find the sports of your choice.

Banking Methods

Bovada includes eight deposit and seven withdrawal methods, from traditional options like credit cards and bank wires to modern payment systems like cryptocurrencies and e-wallets.

This top Missouri site requires a minimum deposit of $10 and allows a maximum of $5,000 using cryptocurrencies.

The primary concern about Bovada is its exorbitant 15.9% credit card deposit fee. On the other hand, crypto deposits are free.

MyBookie began its US sports betting journey in 2014. It was when the parent company – Duranbah Limited – acquired a Curacao license to accept bettors from all US states, including Missouri.

Top Feature

MyBookie is notable for its interesting contests, particularly appealing to Missouri players. Currently, it features ‘Squares,’ a competition where players select their squares to win frequent real-money prizes.

Welcome Promotions

This prestigious online bookmaker offers a generous 50% welcome bonus up to $1,000 to kickstart your Missouri sports betting journey. To claim this bonus, use the MYB50 code after making a $50 deposit or more. Remember, you have 30 days to clear a 10x wagering requirement, or the bonus expires.

Other Promotions

At MyBookie, you can enjoy a 25% bonus up to $1,000 in sports reload. You can also get a 200% up to $200 referral bonus every time a friend joins this site upon your recommendation.

Sports Betting Markets

This offshore site offers almost every sport and event under the sun. Whether you like to bet on the NFL, NBA, or college sports, or you like US politics, MyBookie offers competitive odds on these markets. Using this top Missouri site, you can also participate in esports games or horse racing events like the Kentucky Derby.

Banking Methods

MyBookie sportsbook offers a variety of deposit methods for the convenience of its users. It accepts two major credit cards and a wide array of cryptocurrencies, including Bitcoin, Bitcoin Cash, Tether, and Dogecoin. The minimum deposit when using these cryptocurrencies is $20.

Regarding withdrawals, MyBookie offers three options, including wire transfer and e-check. However, Bitcoin is the best option if you want faster withdrawals.

You can take advantage of these promotions when betting online in Missouri:

A risk-free bet is like insurance on your bet, wherein a Missouri betting site will refund your initial stake if you lose your bet. For example, BetUS offers a risk-free (or no-lose) wager on your first qualifying bet up to $500. If you lose, the site will credit back the amount up to $500 as free play.

A deposit match is when, for example, a Missouri sports betting site matches the percentage of your initial deposit amount. You receive rewards in free bets based on the terms of the match bonus. This percentage may be 50% or 100% in traditional deposit matches and can increase to 150% or 200% with crypto deposits.

BetUS, for example, dishes out a 100% deposit match up to $2,500 with its sports welcome bonus. This means you will receive an additional $2,500 in free bets if you make a maximum deposit of $2,500 upon signing up for a new account.

Odds boosts are promotions often available in the form of increased odds on specific wagers. For example, Missouri players taking the odds boost offer can win an increased payout for a moneyline, point spread, or totals bet on specified games.

For example, with normal odds, BetOnline lists +500 odds for Atlanta Braves to win the 2023 World Series. With boosted odds, however, you will receive +800 odds on the same line.

Parlay insurance is a promotion to encourage Missouri players to try their luck with parlay betting. In a standard parlay, you must win each leg (individual wager) to cash. But parlay insurance allows you to receive a refund if one of your legs doesn’t hit.

A referral bonus is a way for your Missouri sportsbook to reward you for promoting its site. For example, you can earn up to $2,000 via the 100% refer-a-friend bonus at BetUS. When your friend makes an initial deposit there, you will receive a reward.

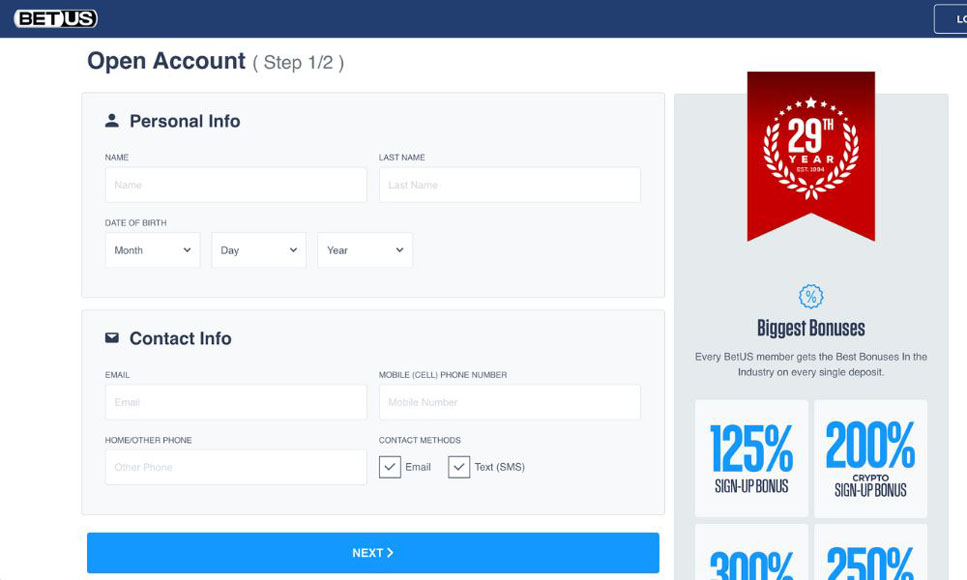

Following this three-step process, you can create an account on one of the best Missouri sports betting sites in no time. We will use BetUS as an example, but you can apply the same process to sign up with any of the top offshore sites for Missouri bettors.

Go to BetUS.com.pa, and click the ‘Join’ icon on the top right. Complete the registration page with your personal information.

You will then see a ‘Deposit’ icon. Click on it to choose from the available deposit methods. Also at that time, enter the bonus code JOIN125 to grab up to $2,500 with the sports welcome bonus.

With money in your account and a bonus in progress, click on the ‘Sportsbook’ icon at the top left of the screen. Then, pick your favorite sport/league, enter the wager amount on the bet slip, and enjoy betting online for real money in Missouri.

Missouri currently has no legal, state-regulated sports betting, but this may change. Several bills are under consideration in the spring of 2023. The previous efforts to legalize sports betting failed in 2022.

No. Online sports betting is not legal in Missouri under current statutes. State lawmakers are trying to legalize and regulate online wagering under state licenses to be issued by the Missouri Gaming Commission. However, it may take months from legalization – if it passes and becomes Missouri law – to the eventual launch.

Luckily, Missouri bettors don’t have to wait for lawmakers to legalize the industry. Instead, they can use offshore sports betting sites to participate in March Madness or any part of the 2023 MLB season.

Two identical sports bills were under consideration in the Missouri legislature early in 2023. This happened just after members returned for the first regular session of the 102nd General Assembly on Jan. 4, 2023.

Missouri State Representatives Dan Houx and Phil Christofanelli presented identical sports betting bills in late February. The most recently-amended proposal aims to legalize sports betting in Missouri. And that bill did clear the House Committee on Emerging Issues within 48 hours.

House Bills 556 and 581 propose legal Missouri sports betting via state casinos and professional sports franchises. Thirteen Missouri casinos and six professional sports teams support the latest push for legal Missouri sports betting, both retail and online.

Rep. Houx expects his bill to hit the House floor for a vote. A similar proposal from Houx made it to the Senate last year before Sen. Denny Hoskins’ filibuster derailed the process.

The Missouri Senate left work without a sports betting deal on the same day as Kansas’ governor signed a sports betting bill into law. The race between Kansas and Missouri to cross the finishing line first was one of the biggest highlights of America’s journey to increased legal sports betting in 2022.

In Missouri, Hoskins’ filibuster killed HB 2502, the sports betting bill cleared by the House. Hoskins wanted to pass a sports betting proposal tied to video lottery game terminals. Though the Republican senator later dropped his VLT-led proposal, it was too late for his amended bill to receive approval in the final days of the last year’s legislative session.

Missouri and Kansas, the two traditional rivals, wanted to outpace each other in sports betting legislation to woo the Kansas City Chiefs, a team based in Kansas City, Missouri.

Kansas lawmakers approved a sports betting proposal that would earmark 80% of the state’s new revenue to lure pro sports teams, particularly the Chiefs, to come to Kansas. Those legislative efforts came amid rumors that the Chiefs considered crossing the state line to become the Kansas City Chiefs of Kansas instead of Missouri.

According to a March 2022 report, the Chiefs considered options in the State of Kansas. An NFL writer spoke to Chiefs President Mark Donovan at a recent NFL owners’ meeting. With regard to potential new stadium options, Donovan said:

“The team has considered options in the State of Kansas. They like Arrowhead and the legacy of Lamar Hunt’s stadium but have been pitched by Kansas developers on a bunch of options. Something to watch.”

However, in an April 2022 hearing in the Missouri Senate, a Chiefs representative said the NFL team is not considering moving to Kansas. Conflicting reports continue to muddy the issue.

House Bills 556 and 581 were first introduced during the opening legislative session of the Missouri legislature in January 2023.

HB 556 is a mirror image of the 2022 online sports betting bill – HB 2502 – which almost passed before the last-minute filibuster.

Houx’s latest proposal creates up to 39 mobile skins and 13 in-person sportsbooks at Missouri riverboat casinos.

The only major difference between the two proposals is that HB 556 seeks to increase the tax revenue to 10% instead of the 8% proposed by HB 2502, and it would ban prop bets on individual player performances by college athletes.

Missouri’s professional sports teams, including the Kansas City Chiefs, expressed support for the latest sports betting proposals in a recent public hearing.

St. Louis Cardinals President Bill DeWitt III said Missouri is learning from other states that already have legalized sports betting. He said:

“We’ve learned how to tweak this to make this more reflective of the market that’s out there, and I believe that the tweaks to this bill do that. So, we’re very supportive.“

Legal sports betting in Missouri may bring $1 billion in potential sports betting revenue in the first four years of wagering. DeWitt said the lawmakers cannot afford to miss the opportunity.

Meanwhile, Hoskins’ VLT-led agenda could kill the bill again in 2023, after his recent measure failed to move out of its committee.

Many state lawmakers want to separate sports betting from the video lottery terminals issue. Proponents fear the additional form of gambling could kill the efforts to legalize sports betting in Missouri again.

Legalized sports betting in Missouri is one of the top priorities for the 2023 legislature. Missouri began its legislative session on January 4, with several lawmakers pre-filing sports betting bills. Sen. Tony Luetkemeyer, whose SB 30 received its first reading on the first day, said in December:

“I feel more optimistic about the chances of the bill getting a floor vote this session.”

Rep. Houx also said that legalized sports gambling is a critical issue with lawmakers, and he is “very optimistic it will get done this year.”

Rep. Christofanelli introduced HB 581 in that opening session. The Republican lawmaker also filed bills to legalize sports betting in each of the last three sessions. Each time, the House cleared his bill, and the Senate failed to do the same.

The Missouri Senate is still as unpredictable as it has been during the past three years. Houx recently told the media that he’s not sure how the upper chamber intends to approach sports betting. Hoskins has already threatened to thwart a standalone sports betting bill as he did last year.

It came after a Senate committee rejected Hoskins’ SB 1, which combines sports betting and video lottery terminals.

Hoskins spoke on the Senate floor for more than an hour on Feb. 23 after a committee rejected his bill for sports betting and VLTs, saying the Senate does not support gaming in the state.

“I’ll be an obstructionist until I get my way.”

According to industry sources, a final agreement is possible between Hoskins, sports teams, and riverboat casinos to include some VLT legalization in the state.

If approved this year, the Missouri sports betting law will take effect in late August. But the actual online sports betting launch may take longer, possibly into 2024.

Missouri sports bettors can enjoy the NFL season in 2023 using the leading offshore sportsbooks. LetsGambleUSA only recommends the safest online sportsbooks that offer statewide mobile wagering in Missouri.

Our recommended offshore sites provide a secure online sports betting experience. You can sign up with those sites to get huge bonuses. You will find competitive odds and fast withdrawals of your winnings.

All the top offshore sites we reviewed above have the best Missouri mobile sports betting apps. They each offer a fully-optimized mobile betting user experience, responsiveness, and a thorough sports betting menu. Bettors with Android and iOS devices consistently share positive reviews of the mobile betting sites.

BetUS, BetOnline, and Bovada are available on Android devices, offering top-notch user experiences. None of the sites offer downloadable Android applications. Instead, you can directly use your favorite Android browser for quick betting action in Missouri.

The top Missouri sports betting sites perform well for iOS users without needing a downloadable iOS app. Every action can be performed on your Apple/iPad devices, from signing up with your phone to finding your favorite betting markets, and from placing mobile bets to withdrawing your winnings.

Our experts have outlined the following advantages of playing at an offshore sportsbook in Missouri:

You can participate in online betting using all of these sports wagers in Missouri:

A moneyline bet is the most straightforward wager type. For example, when two sides are listed on a moneyline bet, you will choose which side will win. A favorite is represented by a negative (-) sign, and an underdog is shown with a (+) sign.

A parlay is a combination of multiple wagers on a single ticket. But players must win all their individual wagers – or legs – to win the parlay payout.

A total or over/under bet is a wager on whether or not the combined goal, score, or points of a single game will be over or under what the oddsmaker had determined. Oddsmakers will set a total before the game starts, and you can bet on either side.

For example, let’s say your Missouri site sets ’47’ as an NFL game total. If you think the combined points score will be more than 47, you will bet the over. If you think the combined total will be less than 47, you will bet the under.

In this type of wager, you bet on the point margin between two teams in a points spread. It is a way that sportsbooks handicap the favored team, requiring the better team to win by a specific number of points or goals.

For example, with a four-point spread, the favorite team must win by more than four points for your bet to win. However, you can still win the bet if the underdogs lose by one, two, or three points.

Futures are bets on an event – a series or election – with an outcome that will settle days, weeks, months, or years after you place the bet. For example, betting on ‘Who will win the Super Bowl 2024?’ is a futures wager.

Props are placed on smaller in-game events that are not directly linked to the game’s final outcome. For example, instead of betting on who would win between the Chiefs and Eagles, an example of a prop bet would be “How many passing yards will Patrick Mahomes have?”

Live or in-game betting allows Missouri players to place wagers as a game is underway. It is different from traditional betting, which is placed before a game begins. Live betting involves constant changes in odds in response to what’s happening during the game.

There are various bets prohibited by licensed sportsbooks in legal sports betting states. For example, no licensed sportsbook in Missouri will offer odds on politics.

Luckily, our top three Missouri betting sites include exciting odds on US elections. Bovada is ideal for betting on the US presidential election in 2024.

Professional football is king in the US, and Missouri’s Kansas City Chiefs have the crown for winning the Super Bowl in 2023. The Chiefs won it by beating the Philadelphia Eagles by a score of 38-35.

Missouri players looking to bet on the Chiefs or any other NFL game should try Bovada. This top Missouri sports betting site has everything you look for on an NFL betting platform.

New Missouri bettors will also find the best odds on moneyline, futures, and props at Bovada. You can also make a crypto deposit to bet online in Missouri. New players will find up to $750 in sign-up bonuses at Bovada.

Missouri residents can enjoy betting on professional and college teams using our top offshore sportsbooks. All these popular sporting events are available for wagering in the Show Me State.

The only major sports league that is lacking in Missouri is the NBA. Since the Kansas City Kings left Missouri in 1985, the Show Me State has been without a major basketball team. The Kings changed their name to the Sacramento Kings and moved to Sacramento, California.

However, professional basketball fans can still bet on any of the NBA teams using the offshore sites mentioned in our reviews. In addition, BetOnline, one of the best NBA betting sites, offers a top welcome bonus for new Missouri players betting on the NBA.

Besides claiming up to $1,000 in sports welcome bonuses, Missouri players can grab up to $250 in risk-free bets.

Missouri is home to two Major League Baseball (MLB) teams – the Kansas City Royals and St. Louis Cardinals.

Both teams have won World Series titles. The Kansas City Royals won twice – in 1985 and 2015. The St. Louis Cardinals, one of MLB’s oldest and most successful teams, was founded in 1882. The team has won 11 World Series titles. The latest came in 2011 when the Cardinals defeated the Texas Rangers.

BetUS offers new Missouri players the best baseball betting welcome bonus in the state, a 100% match up to $2,500. The site also offers early MLB odds and fast payouts.

Before the MLB season begins, BetUS lists the Houston Astros as a 6/1 favorite to win the 2023 World Series. Cardinals fans will get 22/1 odds, and Royals fans will find 200/1 odds on this site.

The St. Louis Blues, originally founded in 1967, has become the team with the most playoffs outside of the Original Six. The team won its first-ever Stanley Cup in 2019.

BetUS is a top-tier NHL sportsbook featuring some of the best odds and moneyline bets in professional hockey. NHL fans in Missouri can grab up to $2,500 in bonuses when they sign up for NHL betting.

The site currently lists the Boston Bruins as a 4/1 favorite to win the NHL Stanley Cup. St. Louis Blues fans will find 200/1 odds on their home team.

Sporting Kansas City is one of Major League Soccer’s original ten clubs. The franchise, formerly known as the Kansas City Wizards, was rebranded in 2010. Sporting KC won two MLS Cups – in 2000 and 2013.

St. Louis City SC is the second MLS franchise in Missouri. The team competes as a member of the Western Conference, which it joined recently, ahead of the 2023 regular season.

The Bovada sportsbook is ranked among the leading MLS betting sites for its promotional offers and competitive odds. You can bet on your favorite MLS team and get into the game directly with live sports betting on this site.

Missouri is home to five D1 basketball programs, including the Kansas City Roos and Missouri Tigers.

College basketball fans in Missouri will find excellent odds on BetOnline, one of the best March Madness betting sites, which offers up to $250,000 in its Bracket Madness promotion. This exclusive March Madness offer could award up to $75,000 for the win. To participate, you have to buy an entry for $25 before March 16, 2023.

The site currently offers NCAAB betting lines. The odds are listed with points spread, moneyline, and total bets options. New Missouri players will find the site highly user-friendly for college basketball betting.

Missouri players can also bet on the Canadian Football League (CFL) – the Canadian counterpart of the NFL. Bovada covers all CFL betting action. The site also offers exciting wagers for the Grey Cup – the championship game of the CFL.

New Missouri bettors can use crypto to grab up to $750 in welcome crypto bonus money to participate in CFL betting. Bovada offers a wide variety of wager types and live betting on CFL games.

Missouri players looking to bet on the Women’s National Basketball Association (WNBA) should try BetOnline. As one of the best WNBA betting sites, BetOnline offers early odds, huge bonuses, secure banking, and responsive customer service.

The Missouri Tigers football team, more commonly known as Mizzou, is the only major college football program in the Show Me State.

Bovada is our top pick for college football betting in Missouri. You can join in NCAAF betting action at this site with crypto. As a new Missouri player, you can get up to $750 in crypto sports welcome bonuses for betting on college football events.

Horse race betting is legal in Missouri. In 1984, state voters approved pari-mutuel wagering at horse tracks. However, as there are no racetracks in the Show Me State, players must travel to neighboring Illinois to watch horse racing and bet in person.

Fortunately, our top three Missouri sites include full-fledged racebooks. You can bet on the Kentucky Derby or any horse racing events in the US via offshore sportsbooks.

Missouri bettors can also bet on politics using reputable offshore sites. Bovada is our top pick for betting on US politics. However, those Missouri players looking to bet on global political events should try BetUS.

Bovada currently lists Joe Biden as a favorite (+245) to win the US presidential election in 2024. Every Missouri bettor putting their money behind Biden’s reelection will get $245 against every $100 wagered on the incumbent president if he wins.

Leading offshore sites have developed innovative ways to increase betting options. You can even bet on religion at sites like XBet. So, if you want to bet on ‘Who will succeed Pope Francis as the next Pope’ and similar questions, you should try XBet.

Missouri has all the major sports teams except a basketball franchise. The state is also home to some of the most popular collegiate programs.

XBet is one of the newest Missouri online sportsbooks. It has garnered positive attention for its unique betting markets and live betting options. The Curacao-licensed site launched in 2013, becoming a valuable addition to the existing list of offshore sportsbooks in the Show Me State.

MyBookie is another new offshore site on our top 10 Missouri sportsbooks list. It launched in 2014. Experienced bettors in Missouri can use their sports betting knowledge to win up to $350,000 in contests at this site.

Finding the best online betting site can be tricky. So, we prepared a checklist for choosing the best Missouri betting site for you:

Reviews: Always do some research before choosing your first Missouri sports betting home. LetsGambleUSA provides in-depth reviews for every leading Missouri sports wagering site. You should also complement the research by reading customer reviews from those who have already tried the sites you’re considering.

Licensing Information: Always verify that the site is properly licensed by a recognized jurisdiction and regulator. For example, if a Missouri sports betting site has an operating license from regulatory authorities like those in Panama and Curacao, you’re safe.

Promotions: Bonuses and offers reflect a site’s overall credibility. Besides offering bonus money to place free bets, bigger promotions show that the site is financially stable.

Accessibility: All the updated sports betting platforms must be accessible 24/7. For example, our top three Missouri sites are 100% mobile-friendly, enabling you to place online bets anywhere in the state at any time of the day or night.

Bets Allowed: More wager types mean more betting fun. For example, moneylines, props, parlays, totals, futures, and live betting options are some of the most popular wager types available at the leading Missouri sites.

Odds Pricing: Always compare two or more betting sites for better odds. For example, a Missouri site listing -110 on a betting line might offer a better bonus than the competitor site featuring -120 on the same line.

Deposit and Withdrawal Methods: Always consider the Missouri site with more expansive banking options before placing your first bet on sports. Your preferred banking options are important for the ease of financial transactions. With 27 deposit and 22 withdrawal methods available, BetOnline provides more banking options than any other MO site.

Customer Support: You must be able to contact your Missouri site if you face any issues. Email, phone number, and live chat are the most popular features for customers. Our top Missouri site, BetUS, even gives loyal bettors a dedicated number for reaching the site’s representatives on a 24/7 basis.

All these deposit and withdrawal methods are available in Missouri:

Credit and Debit Cards

Credit and debit card deposits are available across our top Missouri betting sites. BetUS and Bovada allow Visa, Mastercard, and American Express, while BetOnline includes Discover Card as well.

The minimum deposit with BetOnline credit cards is $25, and you can deposit up to $5,000 using this method. However, credit card deposits can incur fees ranging from 6% to 15.9%, depending on your site choice.

Bitcoin and Cryptocurrencies

Bitcoin is the most popular banking option offered by all our top Missouri sites. However, dozens of other cryptocurrencies are also available for bettors.

BetOnline is one of the best altcoin online sportsbooks, featuring 17 digital coins like Ethereum, Litecoin, Dogecoin, and more. The site allows a minimum deposit of $10 and a maximum of $100,000 with altcoins. However, the maximum deposit limit with Bitcoin is even higher at $500,000.

Wire Transfers

You can deposit and withdraw using wire transfers in Missouri. BetOnline allows a minimum deposit of $1,000 with wire transfers, and there is no maximum deposit amount.

E-Wallets

Bovada is the only online sportsbook allowing e-wallet deposits and withdrawals in Missouri. However, you must create a MatchPay account to link with popular e-wallets like PayPal.

The minimum deposit requirement at MatchPay is $20, but you can deposit up to $1,000 using this method.

Online sports betting remains unregulated in Missouri as of March 2023. However, this can change in the coming days, weeks, or months as state lawmakers work to legalize online sports betting in the Show Me State.

Currently, none of our top Missouri sites offer a no-deposit sports bonus.

Yes, all our top three offshore betting sites accept players from Missouri. Any Missouri resident aged 18 and over can sign up with these sites to bet online on professional and college sports.

Missouri legalized daily fantasy sports (DFS) in 2016. So, residents can participate in daily fantasy sports contests using eight licensed DFS companies.

The BetUS sportsbook is regulated by the Curacao eGaming Authority to operate in the state of Missouri.

DraftKings is legal in Missouri as a daily fantasy sports operator only. Therefore, the Boston-based company cannot offer legal sports betting in the Show Me State.

Bovada Sportsbook has been available to Missouri players since 2011. The site is licensed by the Curacao regulator for betting on sports online in Missouri and 44 other states.

BetOnline is the largest online betting site in Missouri, operating with a Panama license.

FanDuel has been operating as a daily fantasy provider in Missouri since 2016. The New York-based operator has a deal with Boyd Gaming, which owns several casino properties in the state.

MyBookie is one of the top 10 offshore sportsbooks that accept bets from Missouri residents. This site is licensed by the Curacao government to run online betting operations in the state.

Missouri lawmakers have yet to finalize the minimum sports betting age in a legal market. That said, the top three offshore sites accept residents aged 18 and over to bet on sports in Missouri.

Currently, no one does. But the Missouri Gaming Commission, which oversees all gambling in the state, will likely regulate online and retail sports betting in a legal environment.

Missouri has yet to regulate online casino games. However, LetsGambleUSA has reviewed the top Missouri online casinos based offshore. You will find thousands of online casino games, including slots, table games, live dealer games, and more on these sites.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.