475

475 18

18Summary:

Summary:

Bonus:

125% up to $3,125 475

475 18

18

312

312 23

23Summary:

Summary:

Bonus:

50% up to $1,000 312

312 23

23

210

210 18

18Summary:

Summary:

Bonus:

50% up to $1,000 210

210 18

18We selected the best New York sports betting sites based on their outstanding bonuses, competitive odds, extensive market coverage, and diverse banking options.

BetUS, one of the pioneers in US sports betting, launched in New York in 1994. This prestigious platform is owned by Firepower Trading Ltd, which obtained a gambling license from Curacao eGaming Authority.

Top Feature

One of the top-tier features of BetUS is its Loyalty Program. The program consists of six tiers – Blue, Silver, Gold, Platinum, Diamond, and Black – which you can move up through for every real money wager placed on the site.

As you move up the levels, you’ll earn free payouts of up to $500 every time you level up. If you reach one of the top three levels, you’ll qualify for an extra bonus of up to 10% on every deposit.

Additionally, you’ll receive exclusive invitations to monthly tournaments and access to a toll-free number to speak with an account manager at any time to answer your queries.

Welcome Promotions

BetUS Sportsbook offers one of the most impressive welcome bonuses in the industry – a 100% bonus of up to $2,500. To activate this bonus, you’ll need to make a minimum deposit of $100, and it comes with a 10x rollover requirement. However, you’ll need to use the bonus within 14 days, or it will expire.

To claim this bonus, use promo code JOIN125.

Other Promotions

Other promotions at BetUS include a 150% Casino Bonus up to $3,000, a 200% Crypto Bonus (150% Sports + 50% Casino), and a 250% Casino Bonus up to $5,000. Find out more promotional offers on our full BetUS Sportsbook review.

Sports Betting Markets

BetUS covers a wide range of sports, including the NFL, NBA, MLB, NHL, and niche sports. In addition to sports betting, the site also offers early odds on events such as March Madness betting, US politics, the Nobel Literature Prize, and the Academy Awards.

Banking Methods

BetUS offers 10 deposit methods, including Visa, Mastercard, American Express, Google Pay, Apple Pay, and several major cryptocurrencies. However, only Bitcoin, Bitcoin Cash, Ethereum, and Litecoin are available for withdrawals, though you can also contact the site for a cash withdrawal.

With BetUS, you can make a minimum deposit of $10 and a maximum deposit of $50,000 using Bitcoin. The site does not charge any fees on cryptocurrency deposits.

MyBookie is among the best NY sports betting sites due to its live betting, loads of betting markets, and ongoing contests. This Curacao-licensed operator was launched in 2014 and is owned by Duranbah Ltd, which also owns XBet.

Top Feature

MyBookie offers some exciting contests, which are a top-tier feature of this site. You can show off your knowledge and win big prizes through these ongoing contests. As a New York sports bettor, you can participate in the MYBRACKET and SQUARES contests that are currently available on the site. However, make sure to read the terms and conditions before entering any contest to avoid any confusion.

Welcome Promotions

MyBookie offers New York sports bettors a fantastic Sign-Up Bonus of 50% up to $1,000. You need to deposit a minimum of $50 to activate this bonus, and you must use the code MYB50 when depositing to claim this offer.

However, the bonus comes with a 10x rollover requirement, meaning you must wager ten times the bonus amount before you can withdraw your winnings. The bonus expires after 30 days, so make sure to meet the wagering requirements within this time frame to avoid losing the bonus.

Other Promotions

MyBookie features a 150% Casino Bonus up to $750, a 25% Sports Reload up to $1,000, and a 10% Cash Bonus up to $200.

Sports Betting Markets

MyBookie offers a wide variety of sports to bet on, including the major leagues like NFL, NBA, MLB, and NHL. In addition, you can also find excellent odds on niche sports like WNBA, CFL, and Esports on this site.

One of the standout features of MyBookie is its coverage of college sports. It offers early odds on NCAA Football, basketball, and baseball, making it one of the best college sports betting sites available. You can also bet on other college sports like lacrosse and softball.

Banking Methods

MyBookie offers an impressive range of banking options – 13 deposit methods and three withdrawal methods. The deposit methods include two credit cards (Visa and Mastercard) and 10 cryptocurrencies, including Bitcoin, Litecoin, and Ethereum.

Bitcoin, wire transfer, and e-Check are the only available withdrawal methods at this site. However, we would like the site to add more withdrawal methods.

The site allows a minimum deposit of $20, and there is no maximum deposit limit if made via cryptocurrencies. MyBookie does charge a moderate fee on credit card deposits: 4.9% on Mastercard and 6% on Visa.

If you’re a New Yorker who loves sports betting, try XBet Sportsbook. This Duranbah Limited-owned betting giant, launched in 2014, is approved by the Curacao eGaming Authority to accept US-based bettors in all states.

Top Feature

XBet has a one-of-a-kind live betting feature that sets it apart among the top NY sportsbooks. This dynamic platform includes live esports, live basketball, live baseball, and every major league and sport in season, including the NFL.

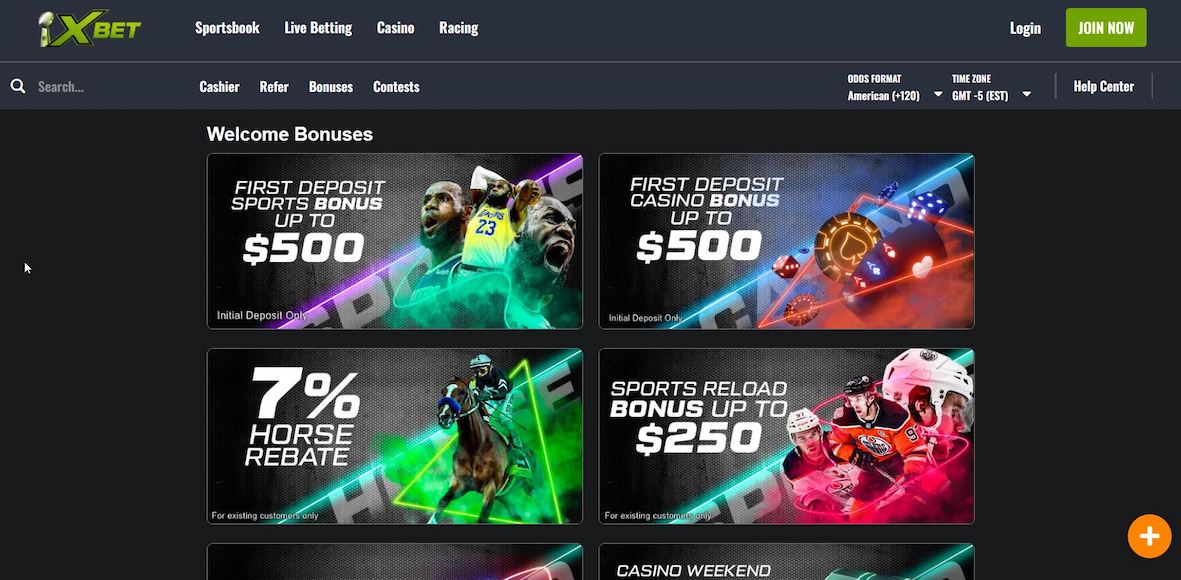

Welcome Promotions

This offshore sportsbook gives a 50% up to $500 welcome deposit bonus to new bettors in the Empire State. Make a minimum deposit of $45 and use the XBET50 code to get this offer. This bonus has a 7x rollover requirement.

Other Promotions

Other exciting promotions at this site include a casino bonus of up to $500 for New York online gamblers joining this site. Additionally, NY bettors can utilize other ongoing reload bonuses of up to $250 on XBet.

Sports Betting Markets

NY bettors will find options to bet on popular sports such as football and basketball, including major leagues like professional football and basketball. Other popular sports like NCAAF and March Madness are also available, ensuring you have tons of betting options throughout the year.

Banking Methods

XBet offers a wide range of deposit methods to suit your preferences. These include conventional methods like credit cards, Person2Person, and plenty of cryptocurrencies.

Deposit as low as $20 using the cryptos and start betting in New York. However, Visa and Mastercard allow a $45 minimum deposit.

You can find all these promotions on our recommended New York sports betting sites:

A risk-free bet is a promotion offered by many sportsbooks, where the site refunds your initial wager if it loses. Most leading New York sportsbooks allow risk-free bets on the first qualifying real money bet only.

For instance, BetUS provides a No-Lose Bet, which is another term for a risk-free bet. With this promotion, BetUS will refund your first qualifying real money bet up to $500 if it loses.

A deposit match bonus is a type of promotion where a sportsbook will match a percentage of your initial deposit up to a certain amount. The percentage and maximum amount vary between different sportsbooks.

For example, BetUS offers a 125% up to $3,125 deposit match bonus. This means that if you deposit $100, you will receive an additional $125 in bonus bets. To claim the maximum bonus of $3,125, you must deposit $2,500 or more. It’s important to read the terms and conditions of the bonus offer before claiming it.

Some New York sportsbooks offer existing customers the opportunity to take advantage of boosted odds on specific wagers. These promotions are designed to provide increased payouts to customers who are already members of the sportsbook.

For instance, BetOnline offers Odds Boosters, where you can receive boosted odds of +800 on the Atlanta Braves winning the World Series, as opposed to the regular odds of +500 on the same futures event.

Parlay insurance is a promotion that provides a partial refund if you lose a parlay by one leg. Some New York sportsbooks offer parlay insurance to encourage customers to try their luck again with this high-risk, high-reward bet type.

A referral bonus is a promotion that rewards you with free bets or bonus funds for referring your friends to a sportsbook. BetUS offers a 300% Referral Bonus up to $6,000, which means that if you refer a friend to the site and they make their first three deposits, you will receive a bonus equivalent to 300% of their deposit, up to a maximum of $6,000.

Online sports betting became legal in New York on Jan. 2022. Currently, there are nine legal online NY sportsbooks taking statewide bets in the Empire State.

However, sports betting has been legal in New York since 2013 when the state legalized retail sports betting at its commercial casinos. The first retail sportsbook opened in 2019, more than a year after the fall of the federal ban on sports betting.

In 2021, then Gov. Andrew Cuomo signed a state budget bill that included a plan to allow the online sports betting market in New York. This was a significant development for NY sports bettors as they can now place bets legally from their homes or anywhere within the state.

The roots of New York sports betting law can be traced back to Senate Bill 5883, which was passed in 2013 and authorized sports wagering at four upstate casinos. This measure led to the creation of the New York State Gaming Commission, which merged the New York State Racing and Wagering Board with the New York State Division of Lottery.

After the repeal of PASPA in May 2018, the commission created a regulatory framework for retail sports betting operations, which became operational in July 2019 at commercial casinos. Online sports betting in New York was legalized in 2021 as part of the state budget bill signed by then-Governor Andrew Cuomo. Nine legal online NY sportsbooks are now taking statewide bets in the Empire State.

Here are the particulars of New York sports betting law:

New York’s licensing procedure for online sports betting is unique in the nation. Instead of opting for an open market, the lawmakers favored a state monopoly over online sports betting.

Under the legislation, the regulators were required to select at least two sports betting platform providers. Each provider would host at least four consumer-facing sportsbook operations.

New York law defines a “sports betting platform” as:

“A sports wagering operator or an entity with whom a sports wagering operator contracts to provide a sports wagering platform, which shall mean the totalisator or other system or method of wagering on sporting events authorized by the commission, including but not limited to mobile sports wagering platforms accessible by any electronic means.”

According to the legislation, the New York State Gaming Commission was tasked with selecting at least two platform providers based on their experiences in other states, their ability to launch quickly, and their ability to manage high volumes of wagers.

The objective of the bidding process was to identify the “best providers who have the ability to do business in New York,” according to Sen. Joseph Addabbo, the chief proponent of mobile sports betting in NY.

Selected platforms were required to pay a $25 million one-time fee for a 10-year license and were expected to make revenue-sharing payments of between 50-55% of their GGR annually. Additionally, the platform provider would pay $5 million to the commercial casino that housed its server for mobile wagering.

Industry analysts believed the strict criteria favored “well-capitalized” companies with a strong presence in New Jersey. During the legislative process in April 2021, Governor Cuomo specifically mentioned FanDuel and DraftKings as the type of companies that could contract directly with the state.

The platform providers were required to offer no fewer than four mobile sportsbooks or licenses statewide.

In November 2021, the New York State Gaming Commission (NYSGC) approved FanDuel and Kambi as platform providers for a 10-year license, with a tax rate of 51% for the bidders and their seven partners. The nine approved operators to run online sports betting in New York are FanDuel, with operators BallyBet, BetMGM, DraftKings, and FanDuel, and Kambi, with operators Caesars Sportsbook, Resorts World, PointsBet, Rush Street (BetRiver), and WynnBET.

Bet365 was also considered for licensing, but the UK-based company failed to get a nod amid concerns that a bigger pool of platforms could drop the tax rate to 50%. Other candidates that lost the bidding race included Penn National, Fanatics, the Score, and Fox Bet.

The NYSGC received six applications for potential licensure in August 2021, including 14 operators in total, but only advanced three of the six as qualified applicants. The Kambi-led consortium submitted a tax rate of 64% and received the highest total score, winning the first bid from the regulators. The committee eliminated Bet365 after determining that the addition of the FanDuel-led group would result in higher aggregate revenue for the state.

If the Kambi-led group had received exclusivity in the NY market, the final tax rate would have been 64%. The NYSGC aimed to launch the online sports betting market before the Super Bowl 2022.

Four mobile sportsbooks, Caesars Sportsbook, FanDuel, DraftKings, and Rush Street Interactive launched NY online sports betting on Jan. 8, 2022, after meeting all regulatory requirements. BetMGM and PointsBet joined in January, while WynnBET and Resorts World Bet launched in February and March, respectively. Bally Bet, the ninth approved NY online sportsbook, started operations in July 2022. Other sportsbooks that failed to secure a license will have to wait until at least 2024 to launch in NY.

Retail sports betting has been available since 2019 at the state’s four licensed upstate casinos: Resorts World Catskills, del Lago Hotel in Finger Lakes, Rivers Casino & Resort Schenectady, and Tioga Downs in the Southern Tier. Many New Yorkers, particularly in the downstate area, traveled to neighboring New Jersey to place mobile wagers until the launch of NY online sports betting.

New York legalized retail sports wagering as part of a referendum in 2013 to allow seven casinos in the state. The proposition received 57% voter approval in a state that already had nine racetracks and five Native American casinos.

The first four casinos were planned to be built upstate and would have exclusivity for seven years. After the first seven years, three more casinos would be built in the New York City area.

In Dec. 2015, the Gaming Commission awarded the casino licenses to the Rivers Casino and Resort at Mohawk Harbor in Schenectady and the casinos in Tyre, Seneca County, and Thompson, Sullivan County. A fourth casino license for Tioga Downs was awarded later in Aug. 2016.

In Jan. 2023, the New York regulators officially launched the bidding process to award the remaining three casino licenses in New York City or nearby suburbs. The Gaming Facility Location Board stated that applicants must invest at least $500 million in their projects and pay a $500 million licensing fee if they are successful with their bids. The license will be valid for 10 years and renewable after that.

In May 2018, the US Supreme Court struck down the Professional and Amateur Sports Protection Act of 1992, which effectively outlawed sports betting nationwide. In July 2019, New York sports bettors were finally able to place their wagers on their favorite teams legally.

The Rivers Casino Resort in downtown Schenectady was the first in the Empire State to accept a legal bet. However, retail sports betting generated only a small fraction of the handles from neighboring states like New Jersey and Pennsylvania, where mobile betting was legal.

The significant revenue potential of mobile betting tempted lawmakers like Assembly Member J. Gary Pretlow and Sen. Joseph Addabbo to push for the legalization of online sports betting in the state.

Former Governor Andrew Cuomo initially resisted the idea of legalizing online sports betting in New York, but in January 2021, he was swayed by the projected revenue it could generate, an estimated $500 million in tax revenues annually. Prior to 2021, Cuomo maintained that the state would require a constitutional amendment to launch mobile betting, and the state’s current 51% revenue-sharing formula was his proposed model.

Cuomo’s proposal came at a time when the state was facing a revenue shortfall of more than $60 billion over the next four years. In January 2021, he said, “We want to do sports betting the way the state runs the lottery, where the state gets the revenues.” Cuomo argued that other legal sports betting states allowed casinos to run their gaming operations, leading to casinos flourishing economically at the expense of the states.

New York’s online sports betting industry has been a success since its launch, with the state breaking sports betting handle and revenue records in the first month. However, some industry analysts believe there is still room for improvement. The state’s two largest sportsbooks in 2023 have warned that New Yorkers could get worse odds if the tax rate remains high.

During a joint hearing of the New York Assembly and Senate gambling committees in January 2023, FanDuel Group President Christian Genetski stated that the company did not believe that the economic success of NY online sports betting is sustainable with the current tax rate of 51%. Genetski cited a study suggesting that New York’s sports betting handle could drop 10% to 20% on a year-to-year basis. As legal operators struggle to make the numbers work, they may be forced to adjust odds pricing in the Empire State, Genetski told the committee members.

He added that the New York sports betting market has already peaked in its first year of operation, whereas other states continue on a solid upward trajectory. Therefore, the state may need to adjust the tax rate to maintain a competitive market and encourage growth in the industry.

In Jan. 2023, Senator Addabbo proposed Senate Bill 1962, aiming to increase the number of mobile sports betting apps in New York and decrease the tax rate.

The bill proposes up to 14 online sportsbooks in the state by Jan. 31, 2024, and up to 16 operators by Jan. 31, 2025.

Additionally, the bill seeks to reduce the tax rate on gross gaming revenue (GGR) from 51% to 35% with 14 operators and 25% with 15 or more. The proposal also allows sportsbook operators to deduct promo bets from the GGR they report to the state for tax purposes.

However, the license fee under the new proposal would increase to $50 million, twice the amount of the original bill that created nine mobile licenses for $25 million.

Senator Addabbo believes there is still room for improvement in the New York sports betting market, stating in the bill summary, “This legislation would direct the gaming commission to issue additional licenses so that we can continue to grow and improve the market.”

New York generated $909 million in sports betting revenue in its first full year of legal mobile wagering. So, it would be challenging for Addabbo to convince lawmakers to decrease the 51% tax rate.

Last year, Pretlow filed a similar bill to increase the number of legal mobile sportsbooks to 14 by Jan. 23 and 16 by Jan. 2024. But the effort failed. Pretlow’s proposal to sought to decrease the revenue by a 25% tax rate.

Using an offshore sportsbook comes with risks, including potential legal issues and a lack of consumer protection. However, if you choose to use an offshore sportsbook, it’s essential to stick to reputable and trustworthy sites.

The top offshore New York sportsbooks we have reviewed use advanced SSL encryption to ensure the security of your online betting experience. They also provide huge bonuses and competitive odds.

Furthermore, offshore sportsbooks offer a variety of ways to deposit and withdraw funds, including the fastest crypto withdrawals. It’s important to do your research and choose a reliable offshore sportsbook before placing any bets.

Our recommended offshore sportsbooks support every mobile device, including Android and iOS.

Our top five recommended NY sportsbooks are optimized for Android sports betting, providing a hassle-free experience for users. Rather than downloading an app, users can easily place bets directly through their Android phone or tablet’s browser.

Leading sites such as BetUS and BetOnline are known for their user-friendly mobile betting experience in New York. From signing up to placing bets and withdrawing winnings, everything can be done with just a few taps on your device.

For Apple users, mobile betting is more convenient with the top NY sportsbooks like BetOnline and MyBookie. Instead of offering downloadable applications, these leading operators have optimized their sites for iOS sports betting.

This approach eliminates the need for recurring software updates, making it easy to sign up and play directly on your mobile browser.

New York has 11 retail sportsbooks at the state’s four casinos and tribal locations.

If you play at an offshore sportsbook in New York, you will have the following advantages:

You can engage in all these types of bets in New York using the top NY online sportsbooks:

The Moneyline is the most straightforward type of bet, where you select which team or athlete will win a game and place your wager accordingly. The favored team or athlete will be indicated by a minus (-) sign, while the underdog will be indicated by a plus (+) sign.

Parlays are a combination of multiple wagers into a single bet, making it a high-risk, high-reward bet type. Your parlay will be a win only if you win every leg of the bet. However, if you lose any leg of the parlay, then the NY sportsbook will consider it a loss. Once all the events included in your parlay are over, your site will settle your multi-leg parlay.

A total or over-under is a type of bet where you predict the total number of points that will be scored by both teams in a game. For example, if BetOnline sets the over/under for the New York Giants vs. Kansas City Chiefs NFL game at 52, you can bet on whether the total points in the game will be over or under 52.

If the final score of the game is 35-24, for a total of 59 points, and you bet the over, you would win your bet. Conversely, if the total points scored are less than 52, and you bet the under, you would win.

In a point spread, your NY sportsbook will effectively handicap one team by giving the opponent a head start. Spread betting usually aims to even the odds between two unequal teams.

For example, the Kansas City Chiefs are a -3 point favorite against the New York Giants. The -3 points are the spread. Therefore, if you want to bet on the Chiefs on the spread, it will mean the Chiefs must win by at least three points for you to win your bet. If the Chiefs win by two points, you will lose the bet as the favorite failed to “cover the spread.”

The odds are usually set at -110 on both sides in a point spread bet. It means whether you bet on the Chiefs -3 or the Giants +3, you will win the same percentage of money ($100 for every $110 wagered) if you win the bet.

NY sportsbooks offer the option to bet on future events, which may take some time to be decided. For instance, if you want to wager on the New York Yankees to win the 2023 World Series, you’ll have to wait until November to see the result.

Another popular example of future betting is predicting the winner of the 2024 US Presidential Election. If you think that Joe Biden will be reelected, you’ll have to wait until November 2024 to settle the result of your future bet. Future betting allows you to place bets on events that are yet to happen, and it can offer higher payouts, but it also involves higher risk.

Proposition or prop bets are wagers placed on specific in-game events that are not directly related to the game’s overall outcome. Instead of betting on which NFL team will win, you’re betting on the proposition of something within the game.

Player props are a common type of prop bet and are usually shown in over/under odds. For example, during the 2023 Wild Card round game between the New York Giants and the Minnesota Vikings, you may see player prop bets such as:

Live or in-game betting is a popular option among NY online sports bettors as it allows them to place sports bets while the game is underway. Unlike pre-game bets that are processed before a game starts, live bets occur throughout the action. As a result, the odds change throughout the game in response to what is happening on the field, court, or rink.

With live betting, you can wager on a range of outcomes such as the next team to score, the player to score the next goal, or even whether a particular penalty will be called. The constantly changing odds and the ability to place bets as the game unfolds adds an extra layer of excitement to sports betting.

Bets that are not allowed by law are known as prohibited bets. In New York, prohibited bets include wagering on politics, entertainment awards, and betting on in-state college teams.

However, if you want to bet on these prohibited events, you can do so by using offshore gambling sites like BetOnline and BetUS, which are not subject to New York laws and regulations. Keep in mind that there may be legal and financial risks associated with using offshore sportsbooks, so be sure to research thoroughly before placing any bets.

Professional football is a beloved sport in the United States, and New York is no exception. The city is home to two NFL teams: the New York Giants and the New York Jets. Since 1984, both teams have shared the MetLife Stadium as their home field.

The Giants-Jets rivalry has a long history and has divided fans in the state between the two teams. However, regardless of which team you support, you can find attractive odds on your team at top NFL betting sites in New York.

BetOnline is one of the best NFL betting sites in New York. It offers early NFL odds, covers all the markets, and features a wide range of ongoing promotions throughout the NFL season. At BetOnline, you can bet on live NFL odds, lines, props, and futures using various payment methods, including cryptocurrencies and credit cards.

New York is home to many professional leagues and college teams. The top offshore sportsbooks offer odds on all the leagues and sports in New York. Besides professional leagues, you can also bet on NY colleges.

The New York Knicks and the Brooklyn Nets are the two NBA teams based in New York City. The Knicks play in the NBA as a member of the Atlantic Division of the Eastern Conference and play their home games at Madison Square Garden. The Nets, on the other hand, joined the American Basketball Association (ABA) in 1967 as the New Jersey Americans and moved to Brooklyn in 2012 after the NBA formally approved the move.

BetOnline is our top pick for NBA betting in New York, offering the best NBA basketball betting odds and lines. You can take advantage of tons of futures betting and prop betting options for devoted basketball fans. Additionally, new bettors can get a head start of up to $1,000 in a welcome bonus to start wagering on the 2023 NBA Playoffs and the NBA Finals, scheduled to begin on June 1, 2023.

The New York Yankees and the New York Mets are two of the most popular professional baseball teams in the United States.

The Yankees have the most successful history in MLB, with 27 World Series titles and 40 American League pennants. The team last won the championship in 2009.

The New York Mets were one of the first expansion teams in baseball, founded in 1962. While the Mets have won two World Series titles in 1969 and 1986, they continue to have a massive following among New York sports fans.

The 2023 MLB season kicked off on March 30 and will conclude with a potential World Series Game 7 in November. With 162 games per season and non-stop action six days a week, MLB betting provides plenty of opportunities to place wagers.

BetUS is an excellent online sports betting site for betting on MLB games in New York. The site offers the latest MLB odds and betting lines on the Yankees, Mets, and all other MLB teams playing in the league. Additionally, new users can get up to $2,500 in sign-up bonuses to start betting on their favorite sport.

National Hockey League comprises 32 teams. Three of those are based in New York— California is the only other state with three NHL teams in California.

New York Rangers in Manhattan, the New York Islanders on Long Island, and the Buffalo Sabres in Buffalo are the local pride.

The Rangers are one of the Original Six teams and the first US franchise to win the Stanley Cup in 1928. The Blueshirts won two more titles in 1933 and 1940 before entering a 54-year draught. Since the 1994 title, the team has not won any title. They reached the Stanley Cup Finals in 2014 but lost to the Los Angeles Kings.

The New York Islanders are no less interesting NHL team, with four back-to-back Stanley Cups between 1980 and 1983. The Montreal Canadiens are the only other team to win four or more consecutive titles, between 1956 and 1960 and then again between 1976 and 1979.

The Buffalo Sabres, established in 1970, have yet to earn their maiden Stanley Cup title.

You can bet on any of these three NY-based NHL teams online with BetUS. The site offers the latest NHL odds and betting lines, allowing you to bet dozens of different ways to bet on your favorite game. The site offers exciting odds on NHL props, NHL Division Futures, NHL Conference Futures, NHL Stanley Cup Futures, and more.

New York is home to two professional soccer teams – New York Red Bulls and New York City FC. The Red Bulls were established in 1994 and participated in the league’s inaugural season in 1996. The Bulls reached the MLS Cup final in 2008 but lost to the Columbus Crew.

New York City FC joined the league in 2015 as an expansion team. The franchise won its first-ever MLS Cup title in 2021, defeating the Portland Timbers in penalty kicks.

Sportsbetting.ag offers excellent soccer odds, game lines, spreads, and player prop bets for MLS games, as well as other soccer leagues around the world. The top MLS betting site also allows you to bet on games as they are in progress, with live betting action. In addition, the site offers an excellent crypto welcome bonus to start betting on MLS games in New York.

You can bet on National Collegiate Athletic Association Basketball (NCAAB) in New York using top offshore betting sites. New York is home to 22 Division I college basketball teams, including the Syracuse Orange, Cornell Big Red, Siena Saints, Iona Gaels, St. John’s Red Storms, and Buffalo Bulls.

BetOnline is an excellent option for New York bettors who want a wide selection of college basketball bets. The site features the latest betting odds and lines for NCAA basketball and offers a fantastic sign-up bonus of up to $1,000. Additionally, BetOnline provides ongoing promotions and contests for March Madness betting in New York.

New York sports bettors can also get in on the action of the Canadian Football League (CFL). Played north of the border, the CFL closely resembles the NFL and is the highest level of competition in Canadian football.

MyBookie is an excellent choice for New Yorkers who want to bet on the CFL. The site offers great odds on game lines, props, and futures. It’s also perfect for those who enjoy live betting and a wide selection of CFL markets. Additionally, MyBookie offers competitive odds to win the 2023 Grey Cup, the championship game of the CFL held annually.

Basketball fans in New York can find plenty of wagering opportunities throughout the year. After March Madness ends in April and the NBA finals in June, they can turn to the Women’s National Basketball Association (WNBA) for their basketball fix. The WNBA comprises twelve teams, including the New York Liberty, who compete in the NBA’s Eastern Conference. The Liberty was one of the eight original franchises of the league, founded in 1996.

BetOnline is an excellent option for New York bettors who want to bet on the WNBA. The site covers the regular season, which begins on May 19th and runs through September, as well as the playoffs, which begin on September 13th and conclude in late October. BetOnline offers a variety of betting options, including the latest odds and lines for WNBA basketball, and awards a significant sign-up bonus to new New York bettors to start wagering on their favorite sport.

New York is home to three Football Bowl Subdivision (FBS) teams: Army Black Knights, Buffalo Bulls, and Syracuse Orange. The state is also home to many Football Championship Subdivision (FCS) teams, such as Albany Great Danes, Colgate Raiders, Columbia Lions, and Cornell Big Red.

Offshore betting sites like MyBookie offer a variety of betting options for college football enthusiasts in New York. The site provides extensive NCAAF action on any given week during the season, allowing you to bet on college football spreads, moneylines, totals, parlays, props, or futures. With MyBookie, you’ll have plenty of options to bet on your favorite college football teams in New York.

XBet is a reputable offshore online sportsbook that offers New York sports bettors one of the best live betting experiences. This Curacao-licensed sportsbook was launched in 2013 and has quickly gained popularity for its excellent odds, wide range of sports markets, and speedy withdrawals. XBet is also known for offering unique betting options such as religion and weather, which make it stand out from other sportsbooks.

When choosing the best online sportsbook in New York, it’s important to consider the following:

The New York State Gaming Commission reported record-breaking adjusted sports betting gross revenue of $163.6 million for March 2023, setting a new monthly high for the state in its 14 months of legal online wagering. This revenue figure surpassed the previous record of $149.4 million set in January. The surge in revenue was primarily due to the record mobile revenue numbers in March, which amounted to $162.8 million. This resulted in $83.1 million in tax receipts for the Empire State, bringing New York’s lifetime tax revenue from sports betting to over $900 million.

Since the launch of online sportsbooks in January 2022 until March 2023, New York has generated over $1.8 billion in sportsbook revenue from more than $21.2 billion in total mobile wagers. During this time, the state collected more than $800 million in sports betting receipts.

New York State has a 51% tax rate for mobile sports betting and a 10% tax rate for retail sports betting. In January 2023, Governor Kathy Hochul announced that the first full year of NY mobile betting generated $909 million in revenue for the state, including a record $709 million in NY mobile sports betting tax revenue. More than 98% of that revenue went to educational funding.

All these banking methods are available on our recommended NY online sportsbooks.

Our recommended NY online sportsbooks accept Visa, Mastercard, American Express, and Discover for credit and debit card deposits. BetUS accepts the first three cards, while MyBookie accepts the first two. BetOnline, on the other hand, allows all four credit card deposits. You can deposit a minimum of $25 and a maximum of $5,000 using credit cards on BetOnline, but there is a 9.75% fee on credit card deposits. Meanwhile, MyBookie charges a lower fee on credit card deposits: 4.9% for Mastercard and 6% for Visa.

All the top NY betting sites we recommend allow Bitcoin and other cryptocurrencies for deposits and withdrawals. BetOnline is the best Bitcoin online sportsbook in New York, with a $20 minimum deposit limit and a $500,000 maximum deposit limit. The site also allows 17 other cryptocurrencies for deposits and withdrawals, making it the best altcoin online sportsbook in NY. You can deposit a minimum of $20 for all altcoins except Ethereum, which requires a minimum deposit of $50. The maximum deposit limit for all altcoins at BetOnline is $100,000. The available altcoins in New York include Bitcoin Cash, Ethereum, Ria, Ripple, Litecoin, Dogecoin, Polygon, ApeCoin, Avalanche, Binance Coin, Cardano, ChainLink, Shiba Inu, Solana, Steller, Tether, and USDCoin. Crypto deposits are free across all our recommended NY sportsbooks, including BetOnline.

Wire transfers are also available across the leading NY online sports betting sites we recommend. BetUS offers it for deposit, while MyBookie allows it for withdrawal only. BetOnline and Sportsbetting.ag, however, offer wire transfers for both deposits and withdrawals. The minimum deposit range for wire transfers at BetOnline is $500, and you can deposit up to $25,000 using this method. The site charges $45 on wire transfer withdrawals between $500 and $1,500, $60 on withdrawals between $1,000 and $5,000, and a flat 3% fee on withdrawals between $5,000 and $25,000.

Unfortunately, e-wallets are not currently available for deposits and withdrawals in New York. Bovada, the only top offshore site offering popular e-wallets like PayPal, does not operate in the Empire State.

New York is bordered by Pennsylvania, New Jersey, Connecticut, Massachusetts, and Vermont. Except for Vermont, all are legal sports betting states.

The State of New Jersey was instrumental in bringing down the PASPA in 2018. The Garden State launched sports gambling in June 2018. In April 2023, New Jersey sportsbooks reported $93 million in revenue on more than $1 billion in wagers for March.

From June 2018 to March 2023, the NJ sportsbooks have generated over $2.59 billion in sportsbook revenue on more than $36.6 billion in lifetime sports betting handle. In addition, the Garden State has generated more than $325 million in tax revenue from legal wagering.

New Jersey laws set a competitive tax rate – 13% for online and 8.5% for retail wagering.

Pennsylvania legalized sports betting in 2017 and launched online sportsbooks in May 2019, months after its retail industry. PA gambling laws impose a one-time $10 million licensing fee and a 36% tax rate on all sportsbook operators.

Because of these high rates, Pennsylvania has generated over $393.2 million in tax revenue from legal wagering, more than any other state. From its launch to March 2023, the PA sportsbooks have generated over $1.67 billion in gross gaming revenue (GGR) on nearly $21 billion in lifetime wagers.

Connecticut sports betting has been legal and operational since Oct. 2021. Until March 2023, the Nutmeg State has generated more than $2.3 billion in lifetime sports betting handle. In addition, the CT sportsbooks have generated nearly $208 million in GGR, allowing the state to collect more than $22.6 million in tax revenue.

Massachusetts launched legal online sports betting on March 10 with six mobile sportsbook applications. Retail wagering became operational in the state on Jan. 31, 2023, less than six months after Gov. Charlie Baker signed a sports betting bill into law in Aug. 2022.

According to regulators, the Massachusetts sports betting industry totaled $568 million in March, with 96% coming from online wagering. As a result, the state collected more than $9.3 million in tax revenue. Massachusetts online sports betting is taxed at 20%, and retail wagering is taxed at 15%.

In late 2019, the Oneida Indian Nation struck a deal with Caesars Sportsbook to operate in-house sportsbooks at three of their tribal casinos: Turning Stone Resort Casino, Yellow Brick Road Casino, and Point Place Casino. These were the first retail sportsbooks to open in New York.

Soon after, the Seneca Nation of Indians launched three retail sportsbooks at their Allegany, Buffalo, and Niagara Falls casinos.

The Akwesasne Mohawk Casino Resort joined the list of tribal casinos offering sports betting with the opening of ‘Sticks Sports Bar & Grill’ in January 2020.

Yes. Online sports betting in New York has been legal since April 2021 after then-Gov. Cuomo signed a budget bill that contained a provision for legal mobile wagering. NY online sports betting kicked off on Jan. 8, 2022.

Unfortunately, none of our top 10 NY mobile sportsbooks offer any no-deposit sports bonus. However, some online sportsbooks award a no-deposit bonus for just signing up with that site, even if you don’t make any initial deposit.

New York online sports betting was legalized after former Gov. Cuomo signed budget legislation for the 2022 fiscal year on April 19, 2021. That legislation contained a plan to allow statewide online sports betting.

Yes, leading offshore sportsbooks like BetUS and BetOnline accept New Yorkers aged 18 and above to place statewide mobile bets on professional sports. Unlike legal NY betting sites, the offshore operators allow residents to bet on New York college sports teams.

Daily fantasy sports is legal in New York. You can participate in DFS contests using the operators like DraftKings, FanDuel, Yahoo, and Fantasy Draft.

BetUS is licensed by Curacao eGaming Authority to operate in New York and the rest of the US. It is one of the earliest online sportsbooks in the Empire State. New Yorkers can also enjoy online slots and other real-money online casinos games on its platform.

DraftKings is legal in New York as a licensed sportsbook and daily fantasy sports operator. The Boston-based site was among the first four mobile betting sites that kickstarted NY online sports betting on Jan. 8, 2022.

Bovada operates in 45 US states. Unfortunately, New York is one of the five states where this mobile sportsbook does not operate. The Bovada online casino is also unavailable in New York.

BetOnline obtained a regulatory license from Panama Gambling Authority to run online gambling operations in New York. This all-purpose site has the largest online sports betting platform in the Empire State.

FanDuel Sportsbook is legal in New York and also runs DFS operations in the state. The New York-based operator led one of the two successful bids winning 10-year contracts to run legal NY online sports betting in November 2021.

MyBookie is one of the top five NY sports betting sites based offshore. The site is approved by the Curacao government to run a legit gaming business in the Empire State.

You must be at least 21 to place a legal sports bet in New York. However, the reputed offshore sites accept New Yorkers aged 18 and above to place online bets in the state. You can learn more about minimum gambling ages here.

The New York State Gaming Commission regulates all sports betting functions, including mobile sportsbooks. The commission also makes rules to govern mobile wagering in New York.

Online casinos are not currently legal in New York. However, you can still participate in online casino gaming in the Empire State. LetsGambleUSA has reviewed the top New York online casinos for real money based offshore. You can check them out to play thousands of real money casino games from the comforts of your home in New York.

Are you ready to take your online gambling experience to the next level? Sign up for the LetsGambleUSA newsletter and get the latest news, exclusive offers, and expert tips delivered straight to your inbox.